$NVDA$

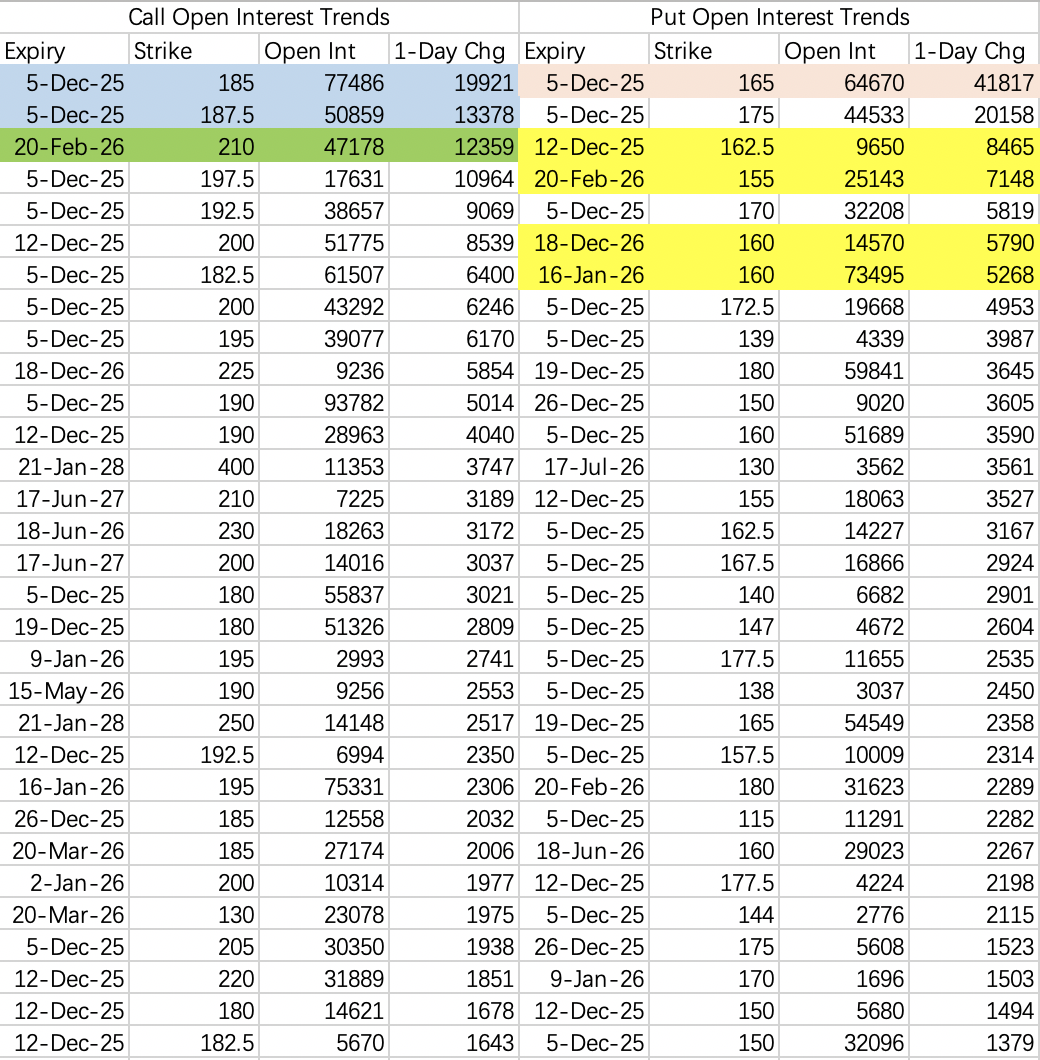

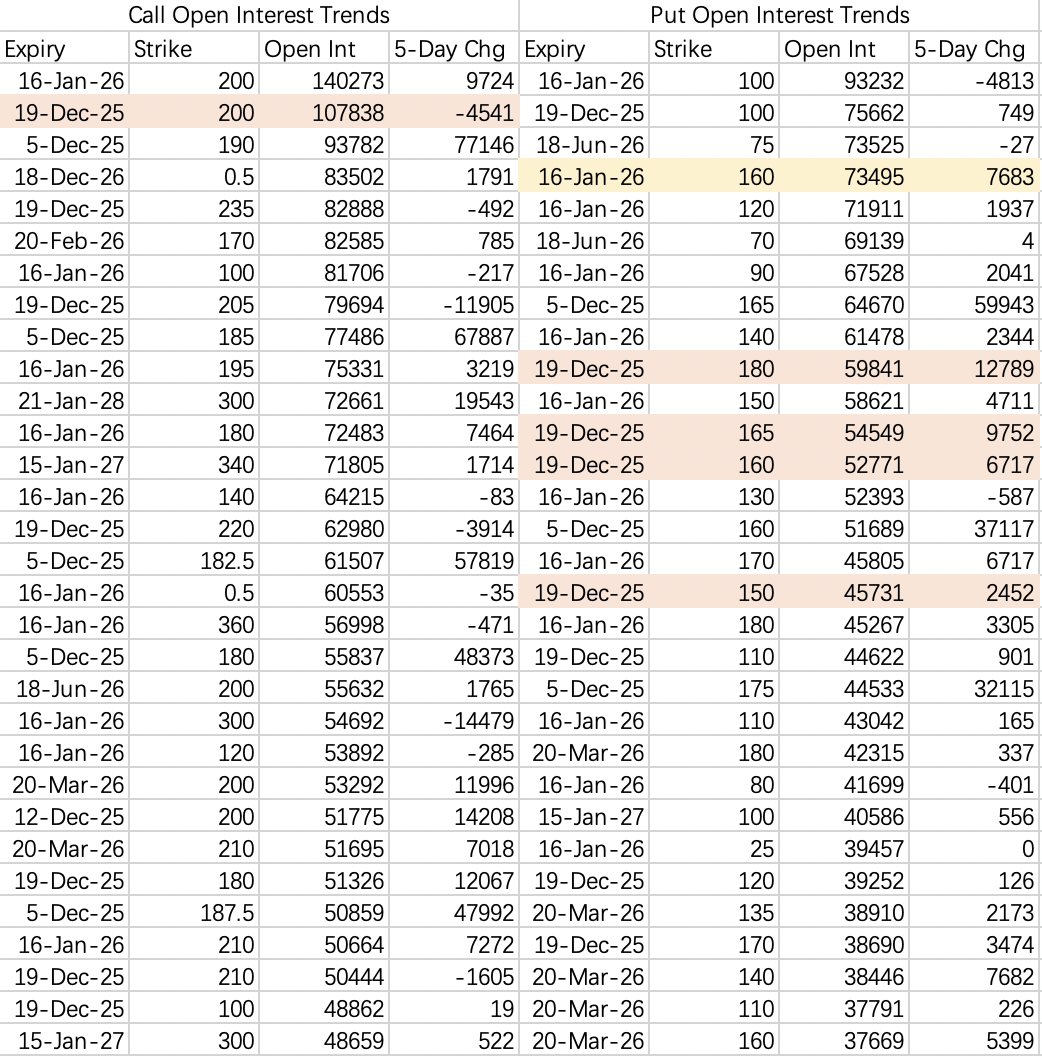

Selling calls into strength remains suitable for the current setup, with strikes preferably above 190.

Based on Monday's options flow, the probability of a pullback to 160 within the next month is quite high. The Dec 5th 165 put $NVDA 20251205 165.0 PUT$ saw 41k contracts opened. The overall delta was positive, indicating seller dominance, but such heavy open interest also creates downward pressure.

A retest of 170 is possible this week. If considering selling puts, it's advisable to add a protective put leg or wait for an actual pullback before entering.

Looking at the broader open interest, it will likely be difficult for NVDA to break above 200 before the Jan 16 monthly expiration. The two calls with the highest open interest are precisely the Jan 200 call and the Dec 200 call.

As for put activity, my gut feeling is a move toward 160 is quite possible. Therefore, implement protection on rallies.

$SPY$

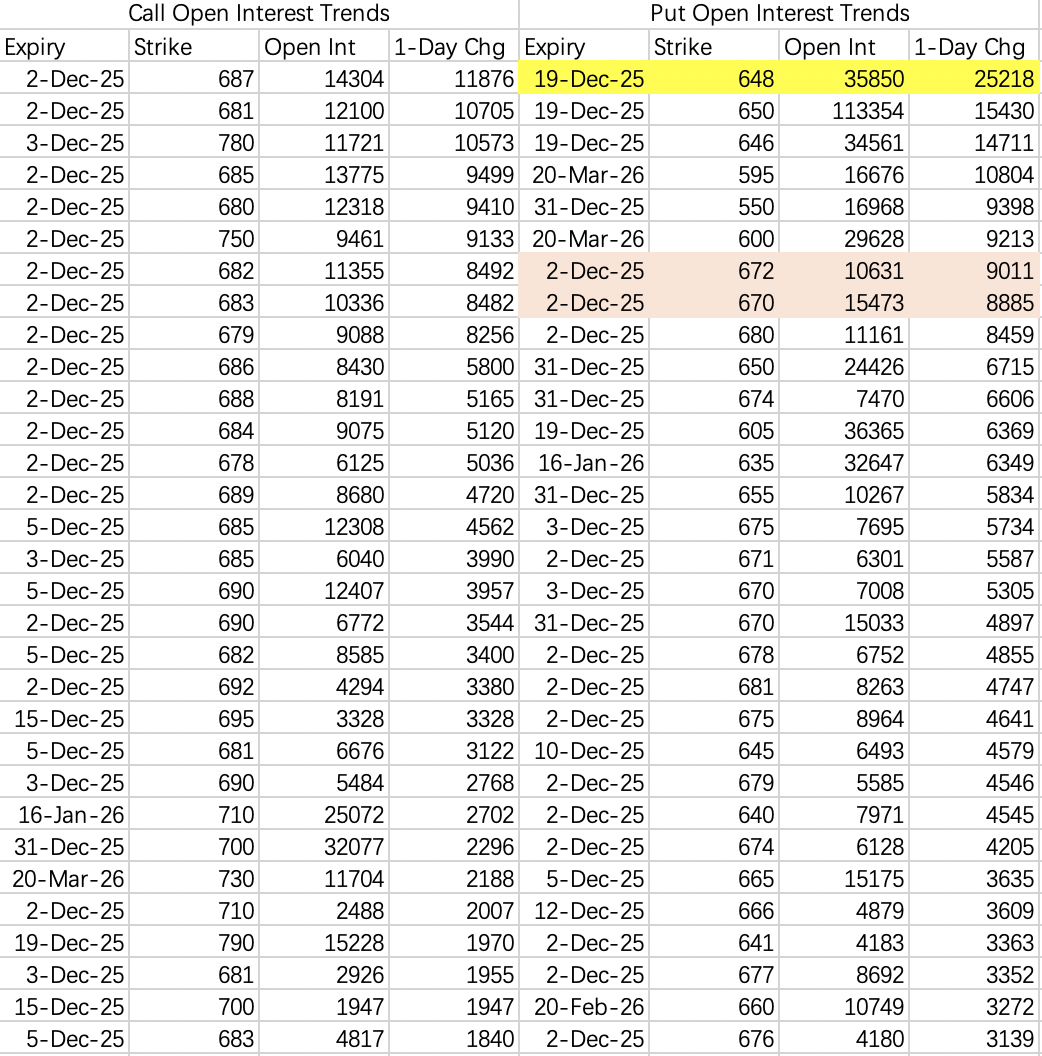

The market attempted another breakout above 687 today, but the outlook beyond this week is less clear. There remains a risk of a pullback toward 650 over the next month.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.