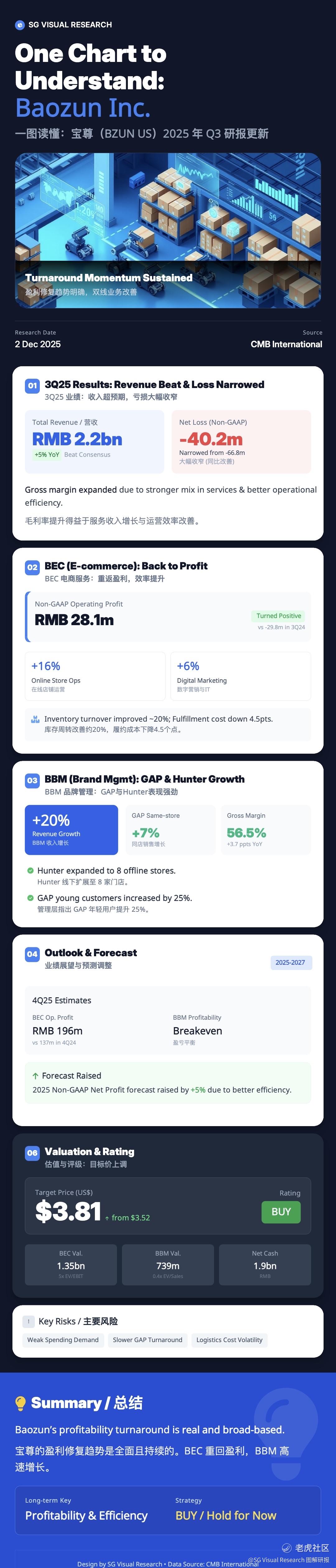

Baozun 3Q25: Real Profit Turnaround Underway — Can BZUN Sustain the Momentum?

Baozun just posted one of its most encouraging quarters in years.

🔥 Non-GAAP net loss narrowed sharply to RMB –40m

🔥 BEC (e-commerce services) returned to profit with RMB 28m OP

🔥 BBM (brand management) revenue jumped 20%, driven by GAP and Hunter

🔥 GAP’s young customer base up 25% thanks to targeted campaigns

Operational efficiency is clearly improving:

Fulfilment cost ratio dropped –4.5pts YoY

Inventory turnover improved ~20%

Service revenue mix continues to rise

CMBI now expects:

✔ BEC profit to surge in 4Q25

✔ BBM to break even by 4Q25

✔ Target price raised to US$3.81, BUY maintained

Key question for investors:

Is Baozun entering a multi-quarter recovery cycle?

Or will category volatility still hold back margins?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.