Divergent Views

$SPY$

Theoretically, the market should consolidate sideways this week, then correct after positive news from the CES conference is digested.

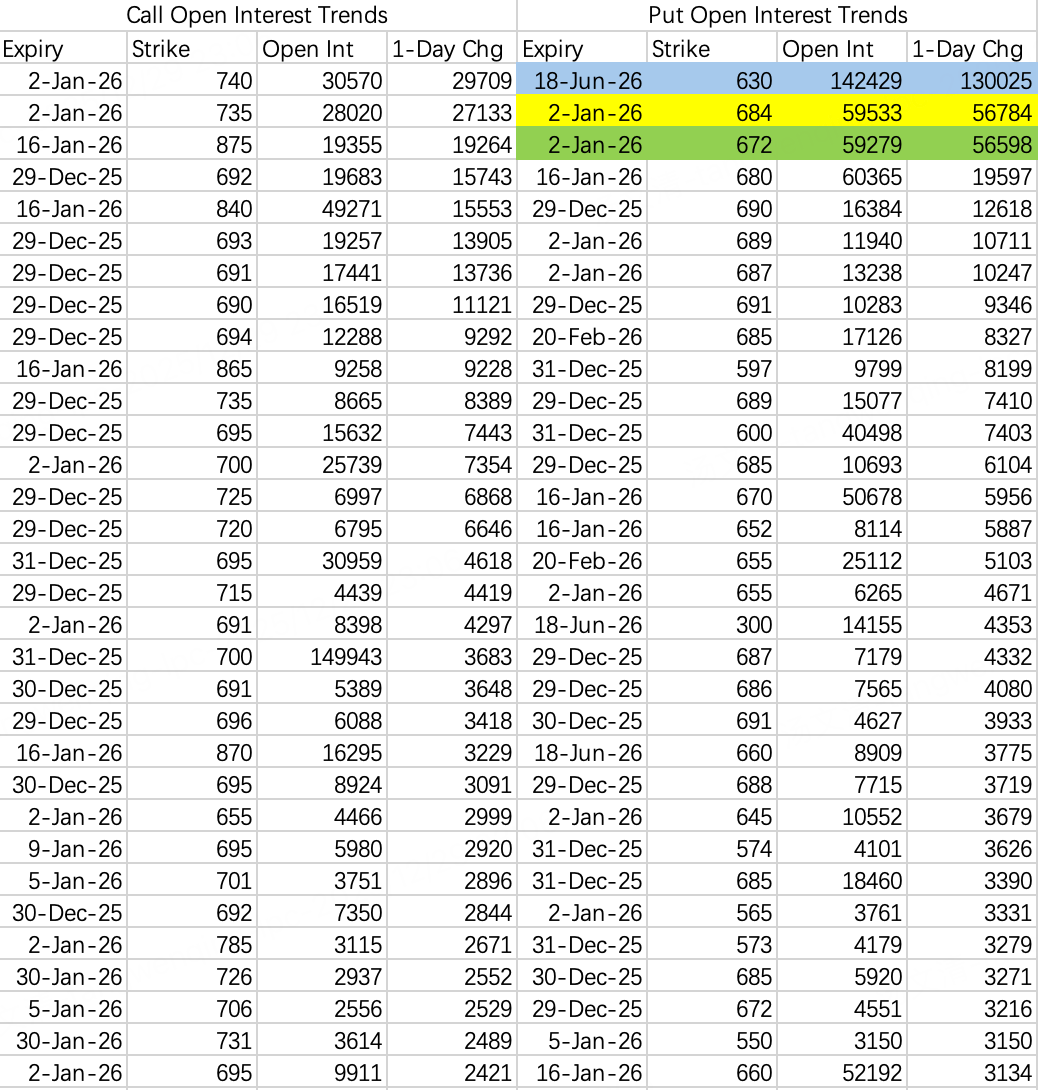

However, a large bearish spread order was opened on SPY: buying the 684 put and selling the 672 put $SPY 20260102 684.0 PUT$ $SPY 20260102 672.0 PUT$ . This implies a potential pullback to around 680 this week.

Currently, the source disrupting market rhythm could potentially be precious metals.

$SLV$

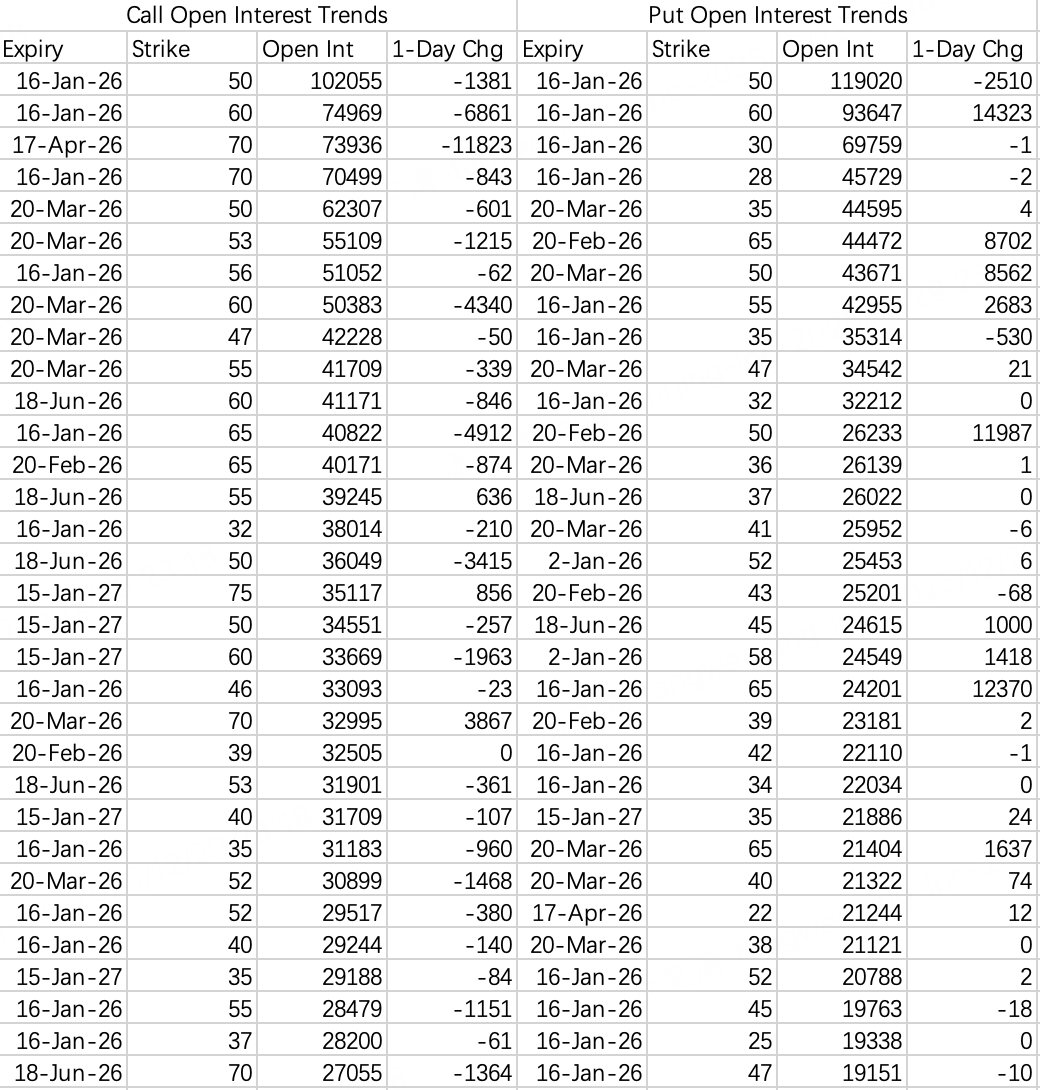

Options activity on the Silver ETF suggests a clear short squeeze scenario. Front-month call options are being closed continuously, while front-month put options are seeing significant additions. However, a squeeze-driven rally is difficult to sustain.

First pullback target: $60 $SLV 20260116 60.0 PUT$

$NVDA$

If the broader market is preparing for a pullback, will NVIDIA follow suit?

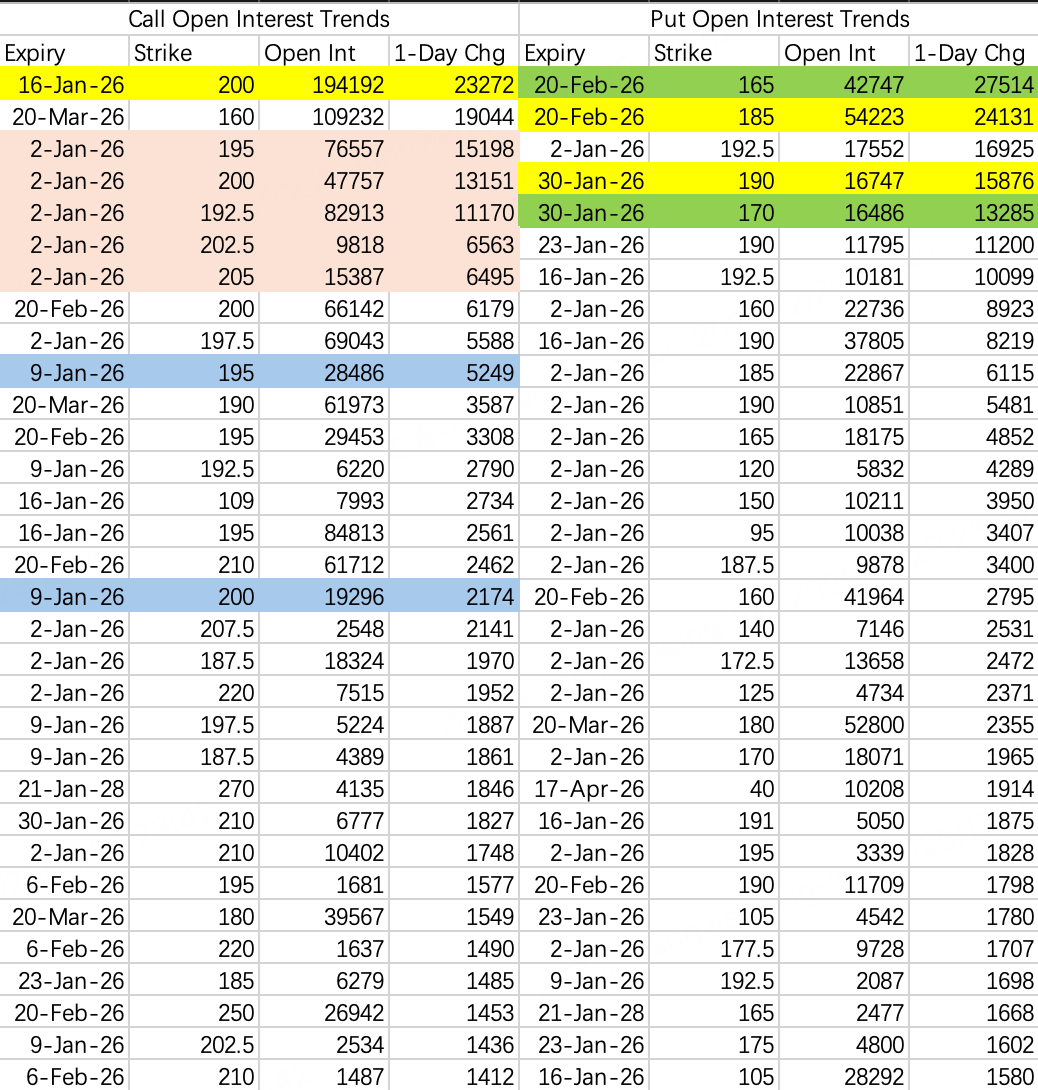

Yet, NVIDIA's call option openings are similar to last week's: sequential, sizeable single-leg openings from the 192.5 to 205 strikes. Another short squeeze similar to last Tuesday's cannot be ruled out.

However, put options indicate large bets on another pullback within the next 1-2 months: down to the lower boundary of the consolidation range at 165.

Thus, market views this week are unprecedentedly split. Considering all factors, I've decided to proceed with a sell put strategy. $NVDA 20260102 185.0 PUT$

$TSLA$

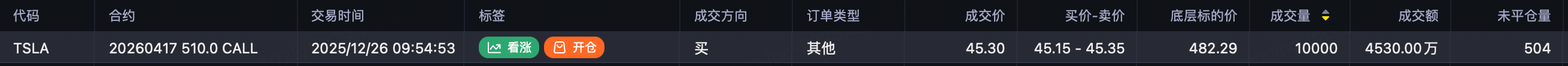

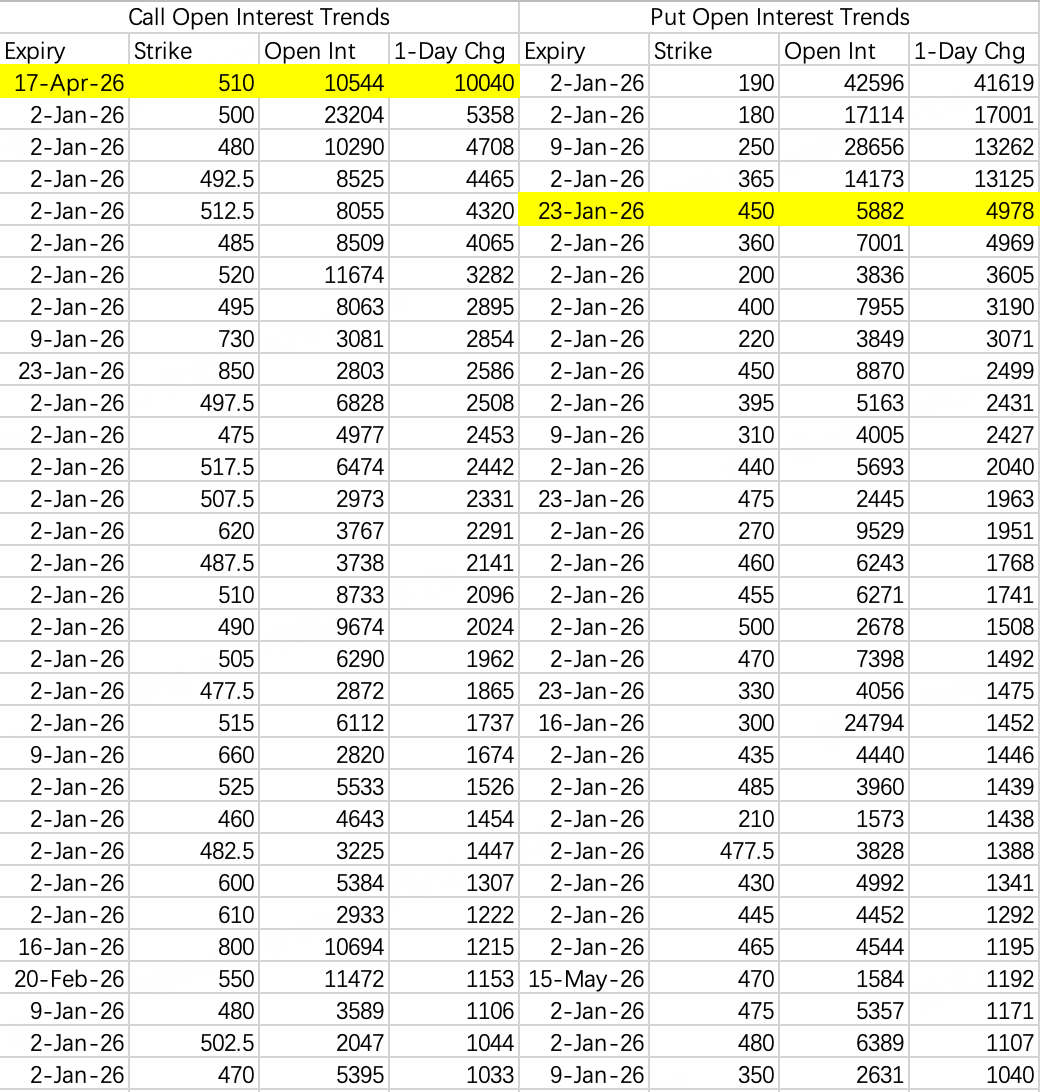

Tesla's recent price action has shown both strength and weakness. This is reflected in options activity with both large bullish orders $TSLA 20260417 510.0 CALL$ and large bearish orders $TSLA 20260123 450.0 PUT$ .

The large bullish 510 call order saw 10,000 contracts traded, totaling $45.3 million. A positive for bulls is that the large bearish put order was just closed out, not waiting for the price to hit 450.

However, I believe the probability of breaking above 500 in January is low, as the open interest on the January 16th 500 call is excessively high.

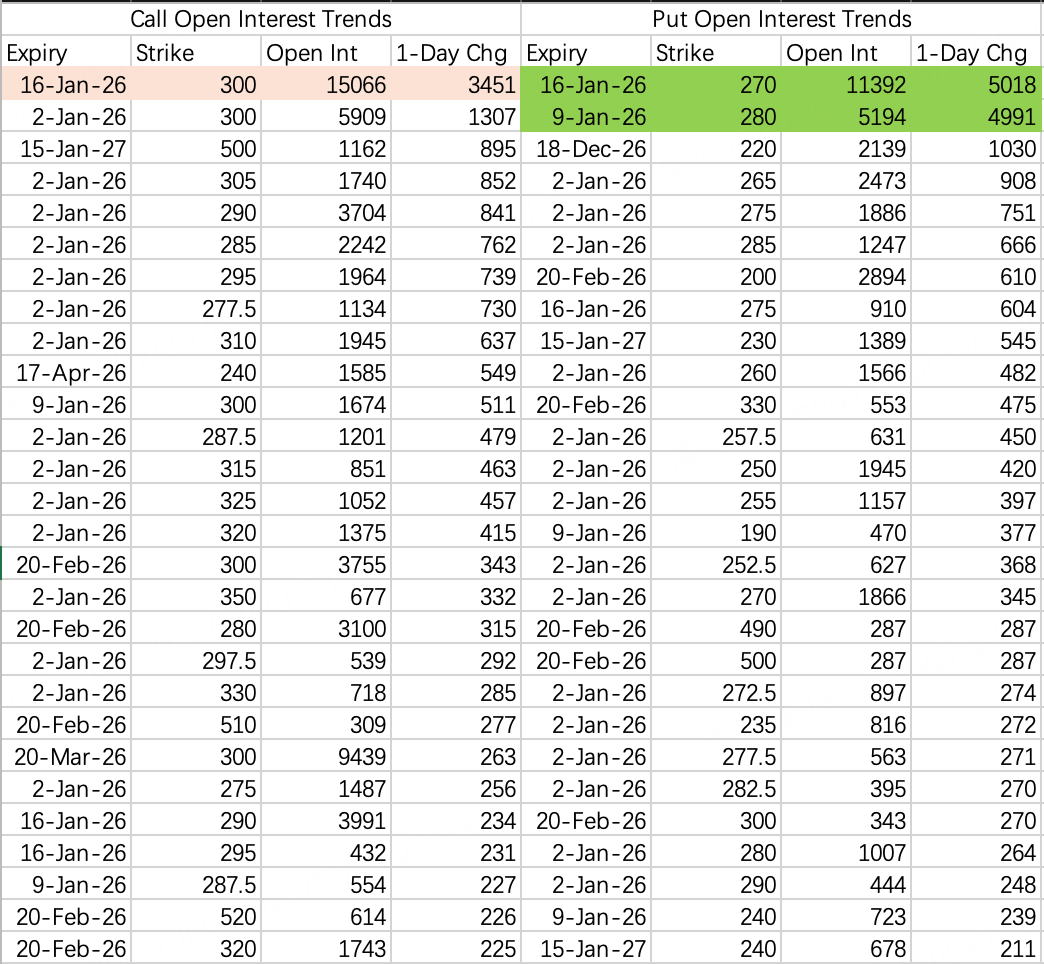

$MU$

Micron is at elevated levels, but there are many large sell put orders, indicating a straightforward momentum-following strategy: $MU 20260116 270.0 PUT$ $MU 20260109 280.0 PUT$

It's difficult for the price to exceed 300 before January monthly options expire. However, selling single-leg calls is not recommended.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- GiG123·12-30 03:52spot on, thanks.LikeReport