$NVDA$

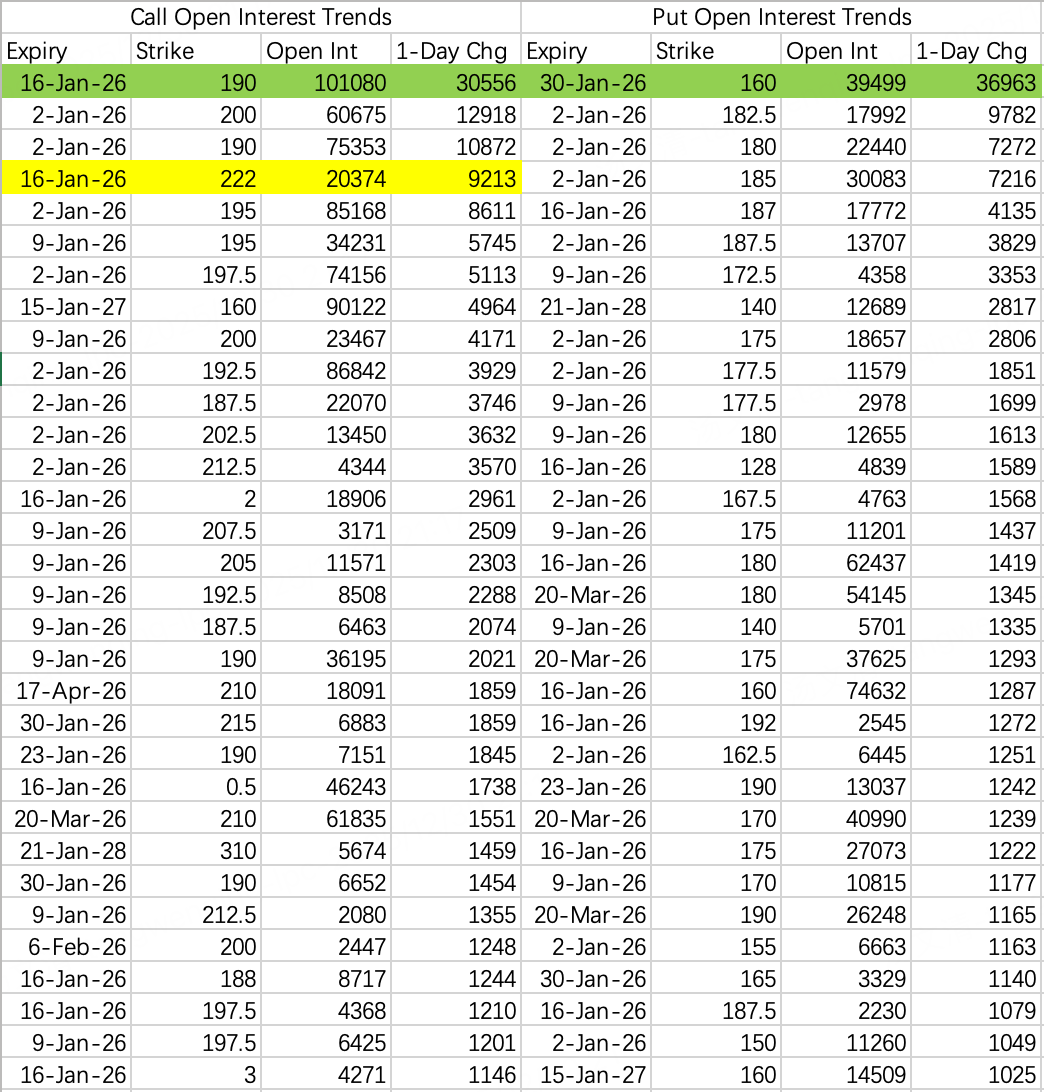

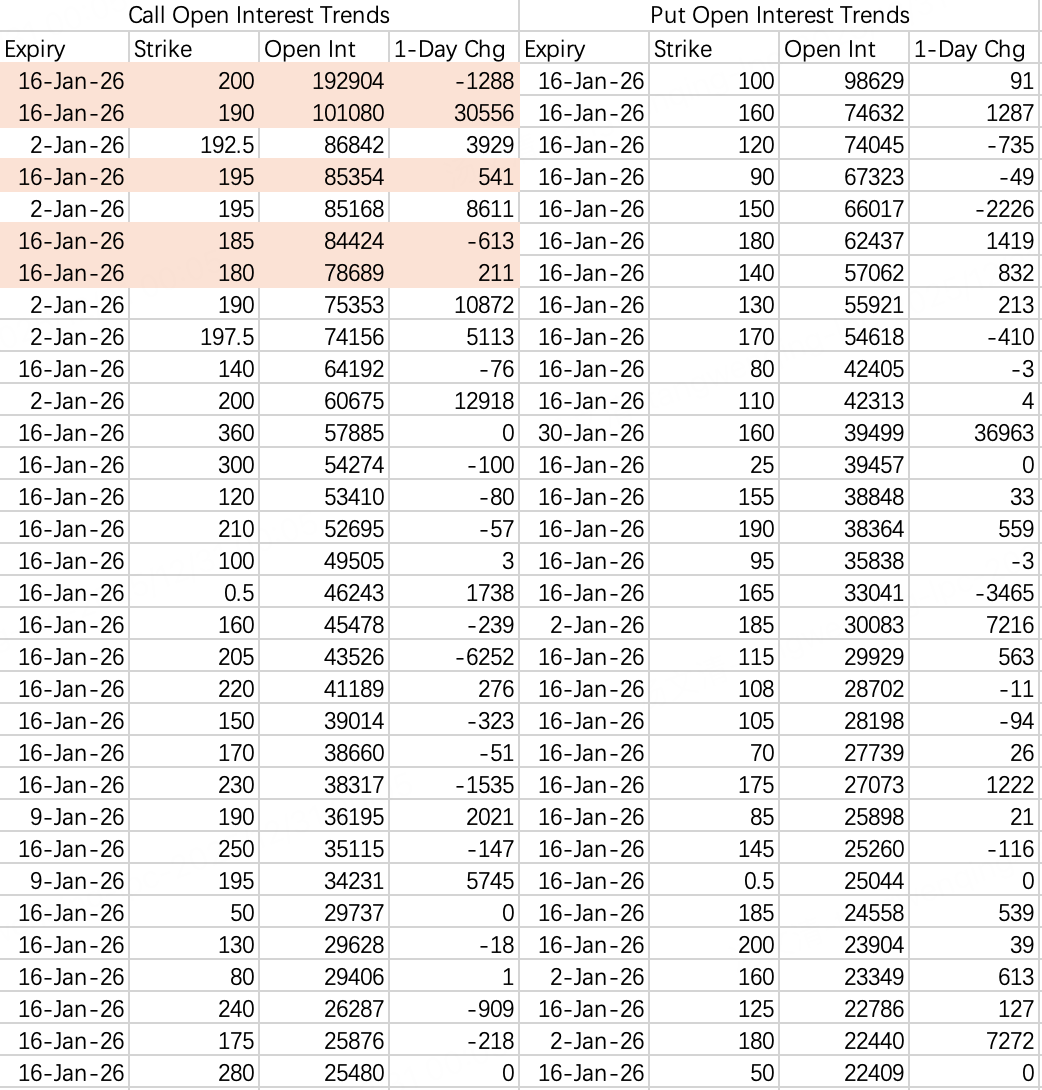

For January, the most reliable sell put strike is undoubtedly still 160. A large block trade opened, selling the January 30th 160 put $NVDA 20260130 160.0 PUT$ , with 36.9k contracts opened.

On the call side, the January 16th 190 call $NVDA 20260116 190.0 CALL$ saw 30k contracts added in new opens, leaning towards the sell side, bringing total open interest to 100k contracts. The market message is that it will be difficult for the price to break above 190 before January 16th.

However, referencing last January's price action, if the broader market does not correct after the New Year but maintains its current consolidation, given the scale of open interest expiring on the 16th, there is a small probability NVIDIA could experience another minor short squeeze pushing towards 200.

$TSLA$

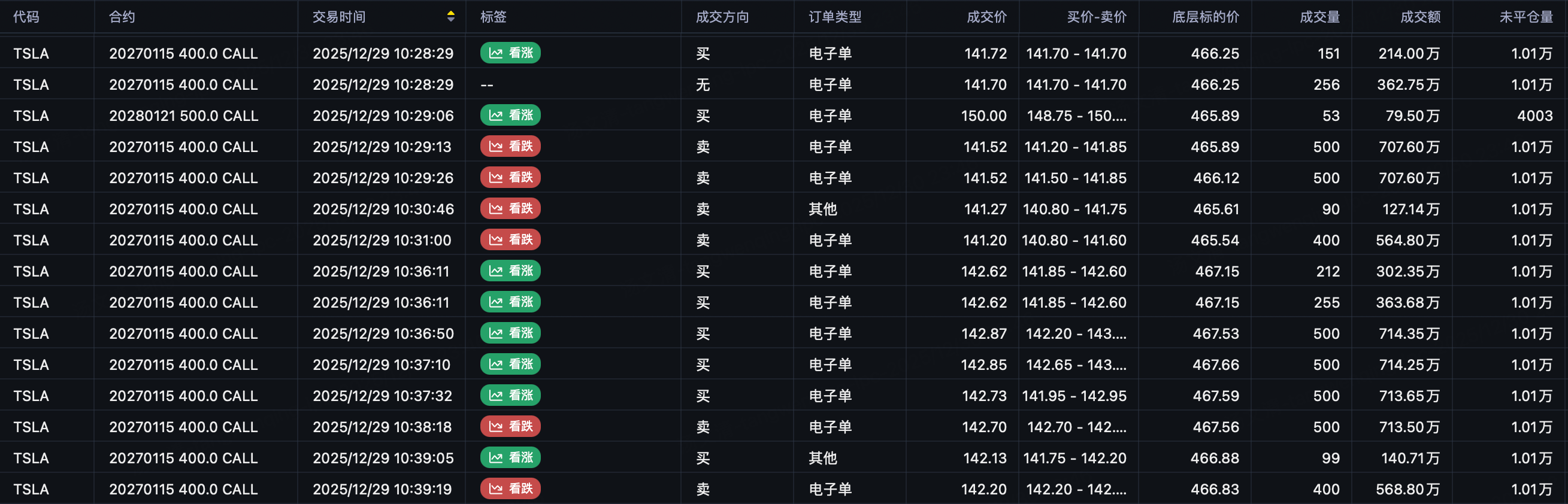

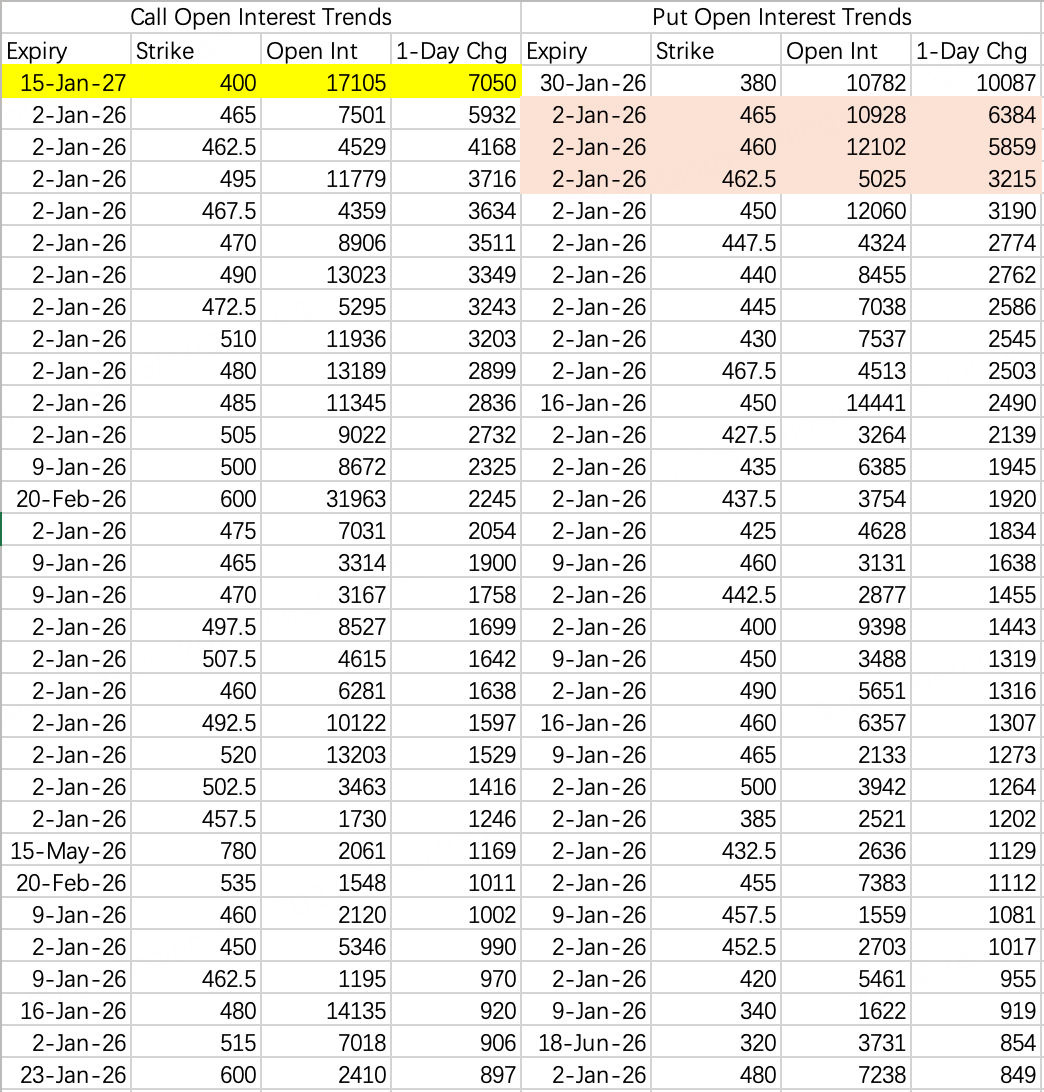

I consider Tesla a benchmark stock for the 'AI Hardware' theme and theoretically, it should see a hype wave in 2026. However, recent unusual large bullish orders $TSLA 20270115 400.0 CALL$ make me think Q1 might not be so calm.

$TSLA 20270115 400.0 CALL$ is a large, deep in-the-money, long-dated order with a total notional value around $100 million.

In reality, there are negative catalysts: Q4 delivery numbers declined, and the stock price is expected to test the $450 - $460 range.

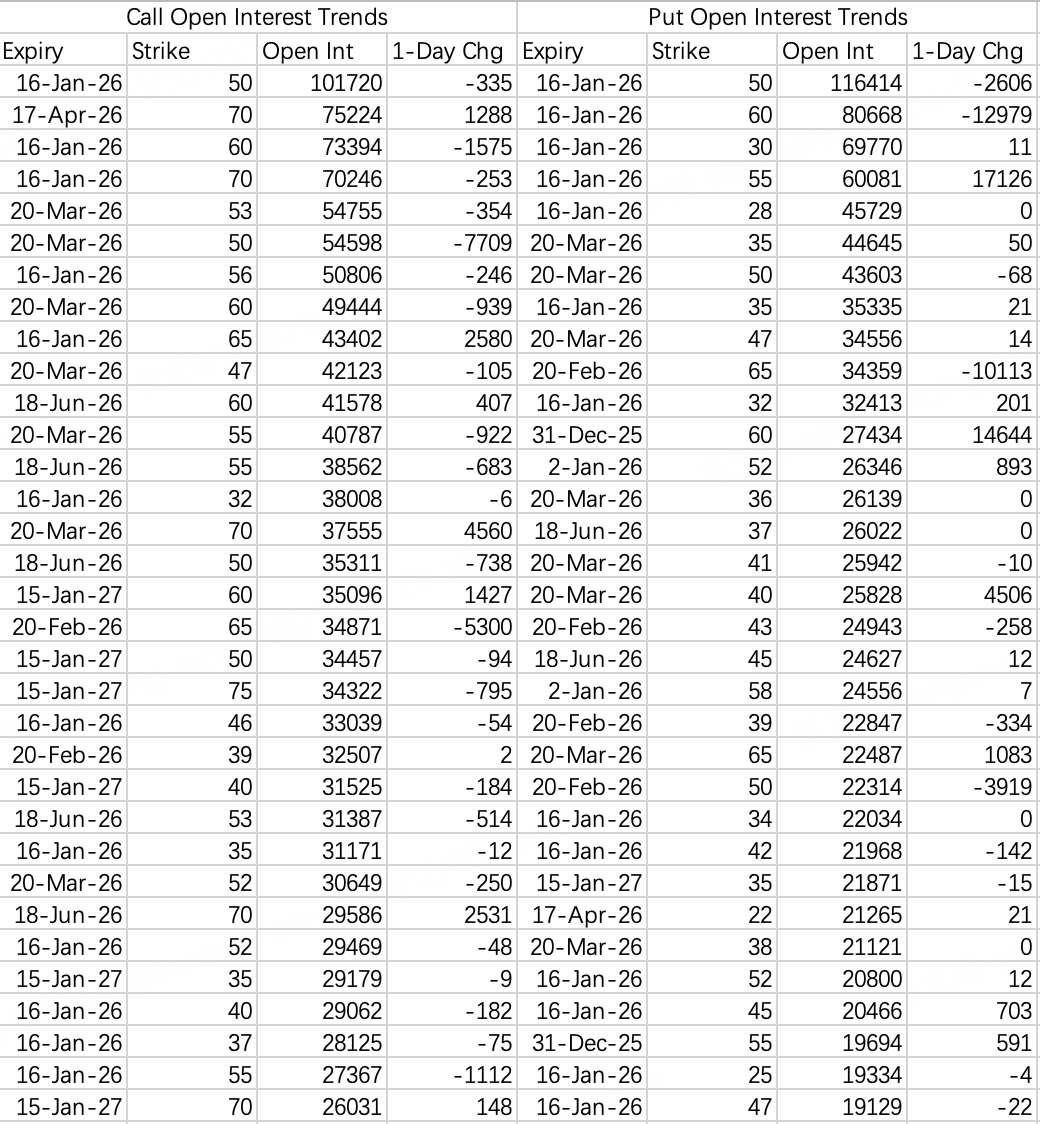

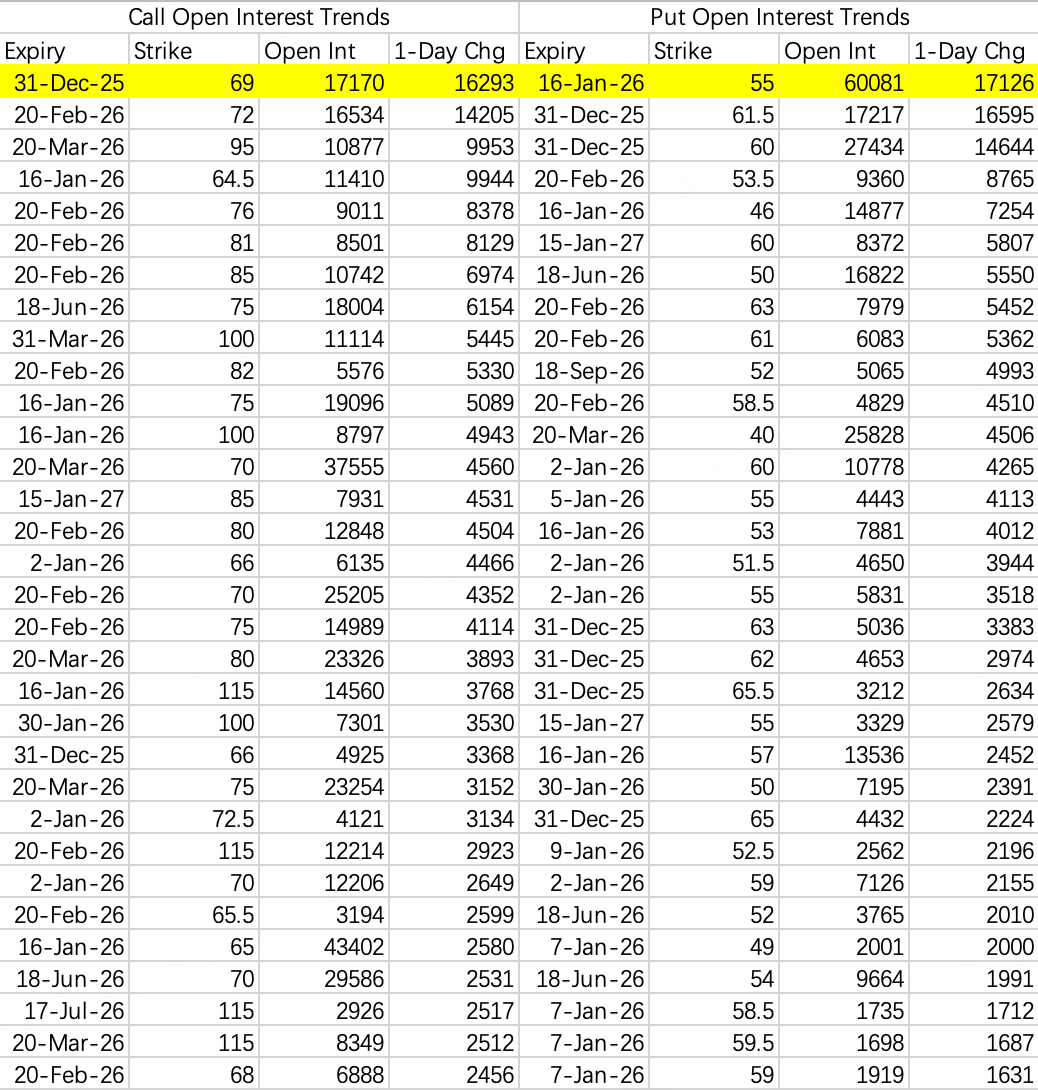

$SLV$

The largest bullish positions continue to reduce, while the largest bearish positions are rolling. As a target with massive options open interest, it's likely similar to other instruments—no clear trend will develop before January 16th because both bullish and bearish open interest is too heavy and needs to be shaken out.

Although SLV is an ETF, the underlying product it tracks can mirror futures market sentiment.

Short-term call openings constitute a very small portion of new activity, perhaps due to high market uncertainty, leading both buyers and sellers to focus on 0DTE trades. In contrast, significant short-term bearish openings are occurring for outright shorting or hedging purposes.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.