East Rising, West Falling?

$NVDA$

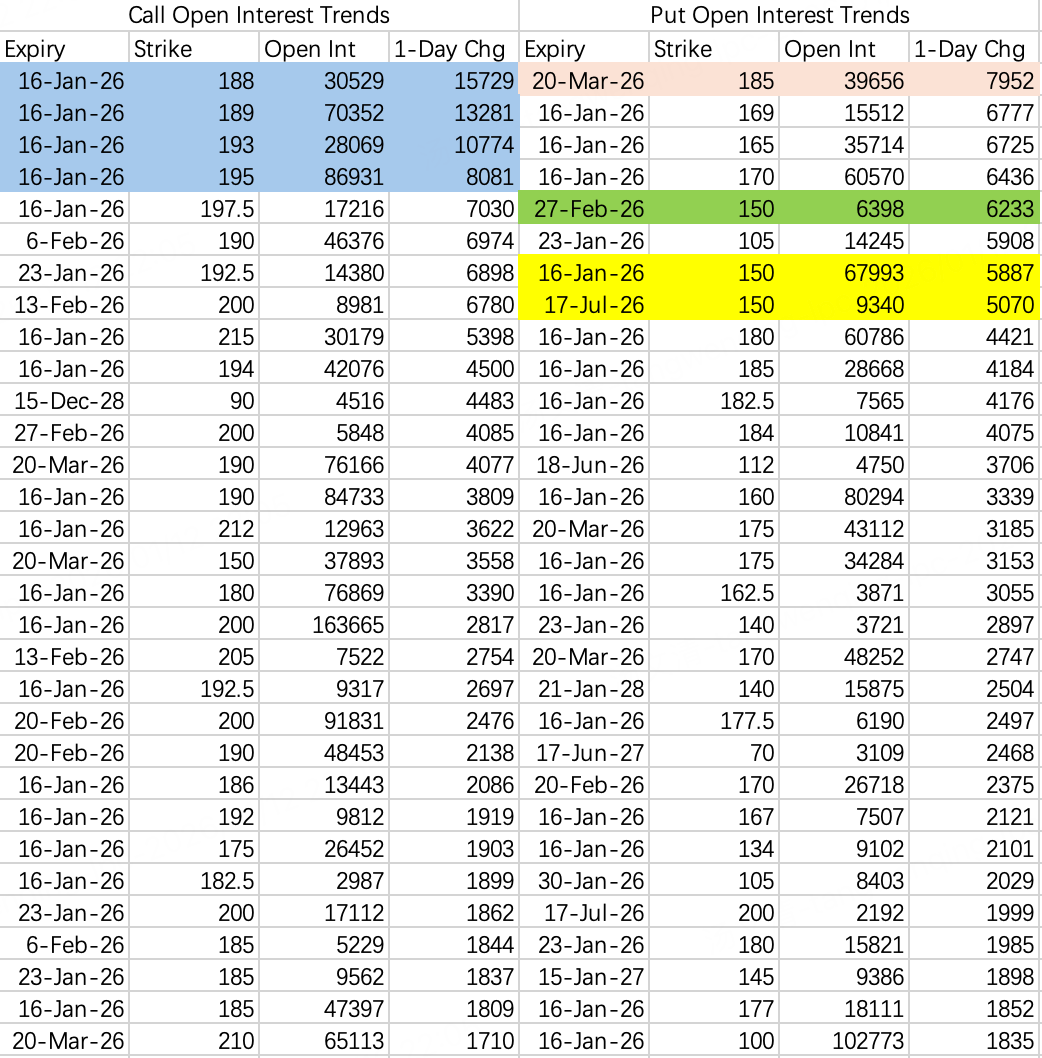

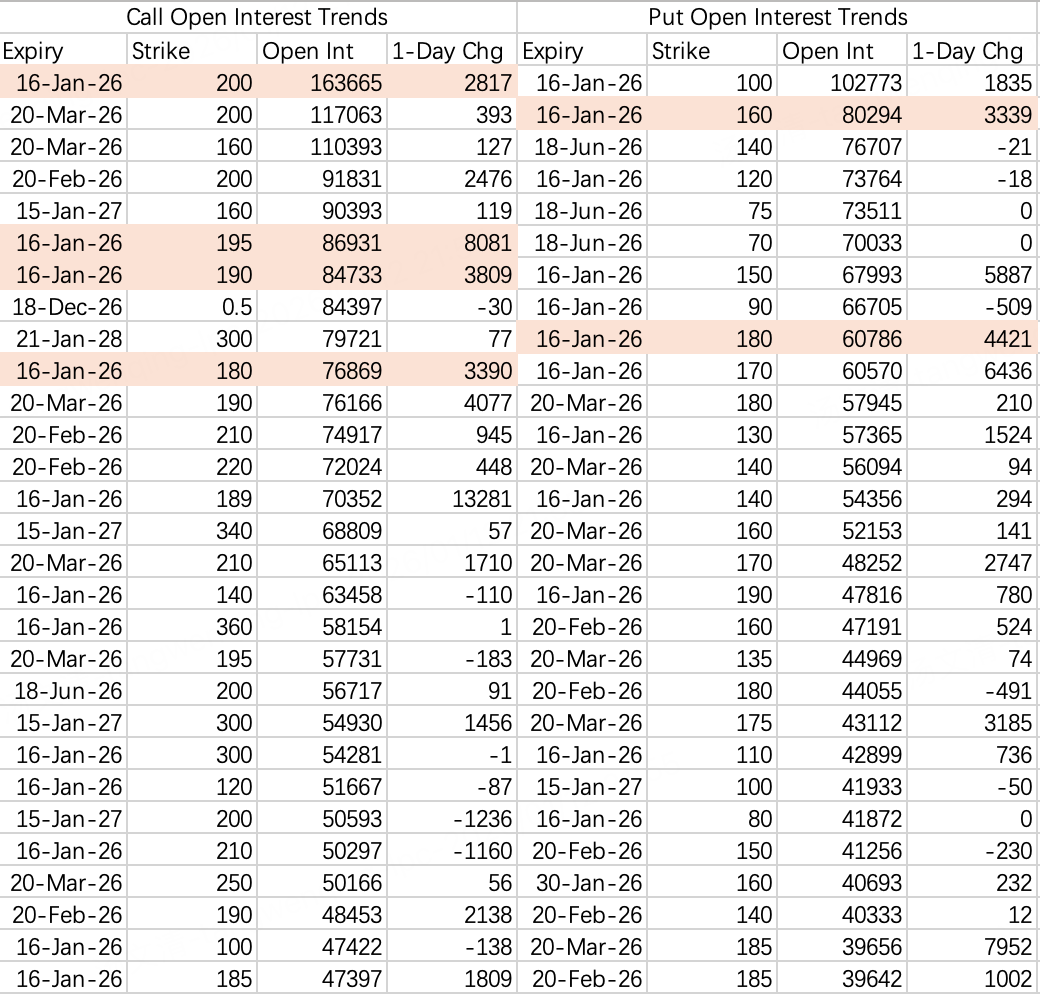

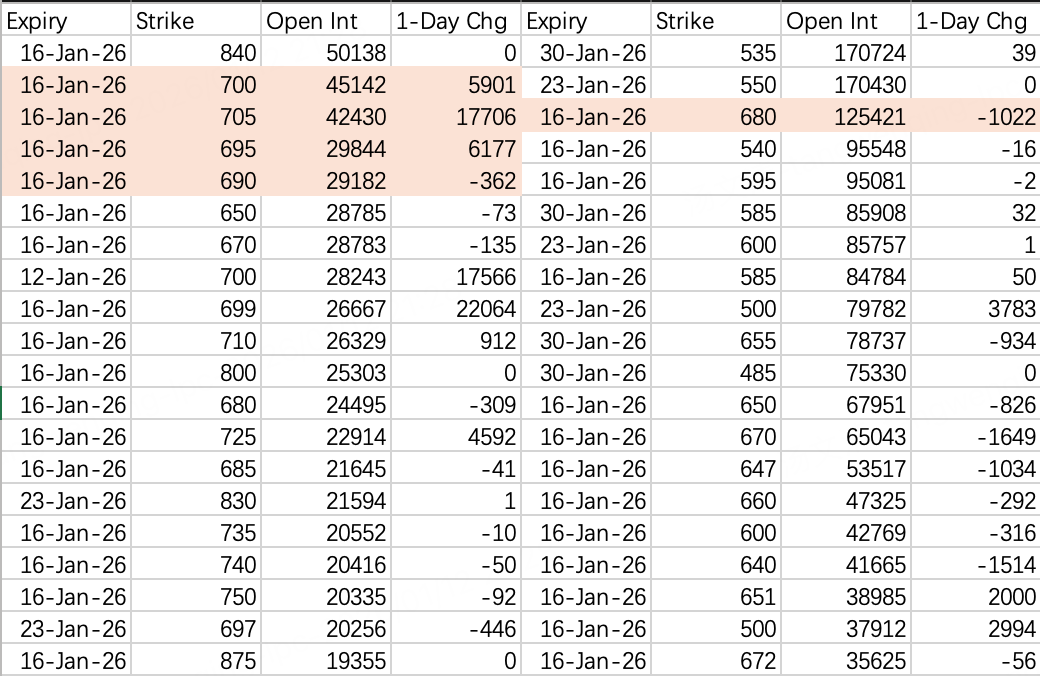

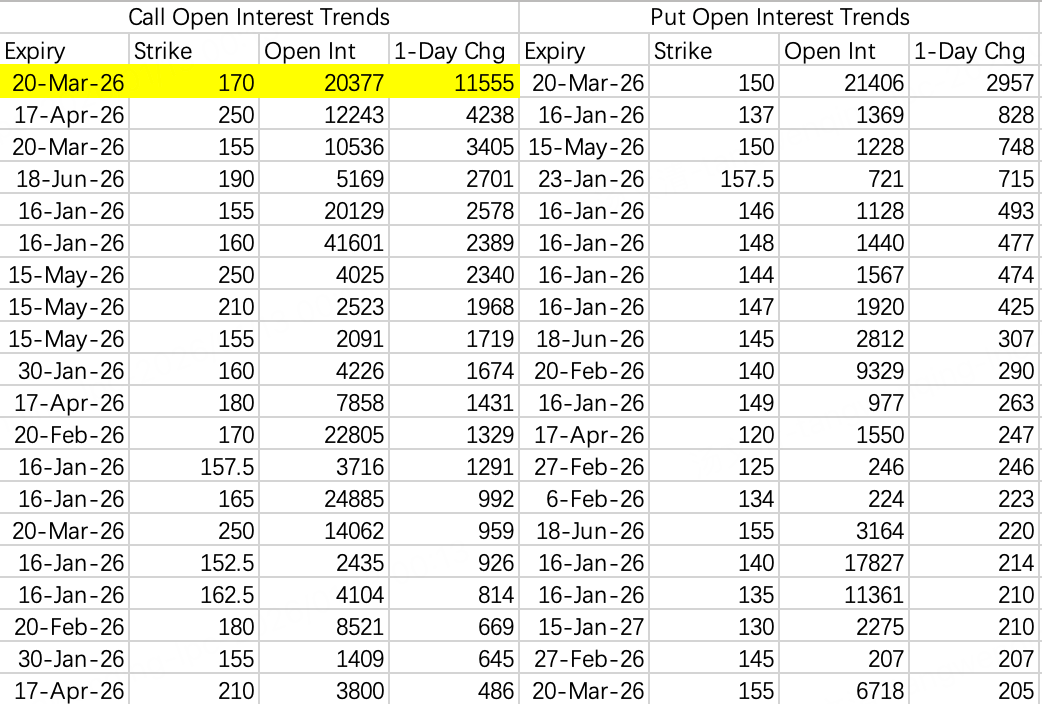

This Friday, January 16th, is the monthly options expiration, with a massive number of contracts expiring. Following the principle of "pinning to max pain" based on the largest open interest concentrations for calls and puts, NVIDIA's stock price is expected to gravitate towards a pullback, currently targeting around 170.

Institutions' arbitrage strategy this week involves selling the 188 call $NVDA 20260116 188.0 CALL$ and hedging by buying the 193 call $NVDA 20260116 193.0 CALL$ .

The lowest expected pullback price is seen around 150. I've considered this; it might be due to DeepSeek potentially releasing its V4 version around the Chinese New Year. However, I don't believe this release will cause a severe impact on NVIDIA's stock price.

Based on open interest ranking for this week's expiry, the 200 call leads with 160k contracts, followed by the 160 put with 80k contracts.

$TSLA$

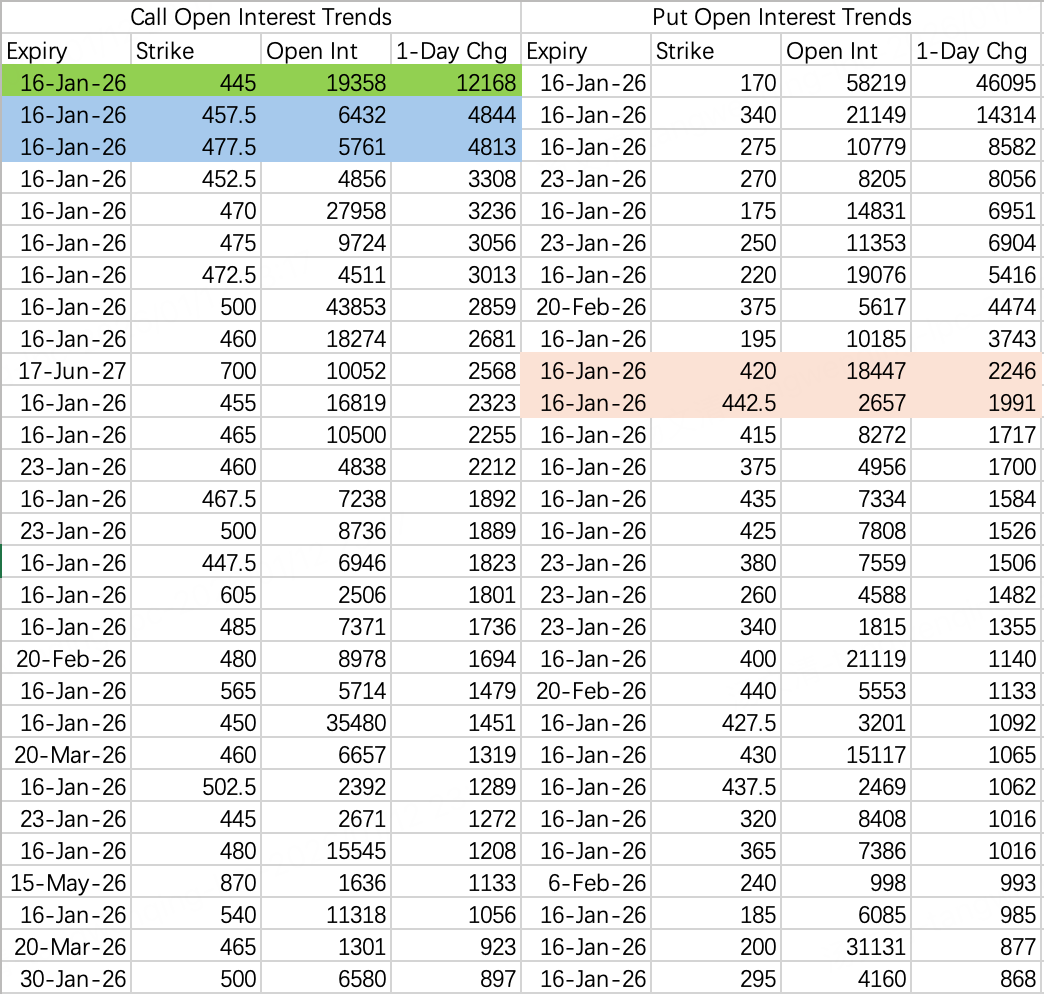

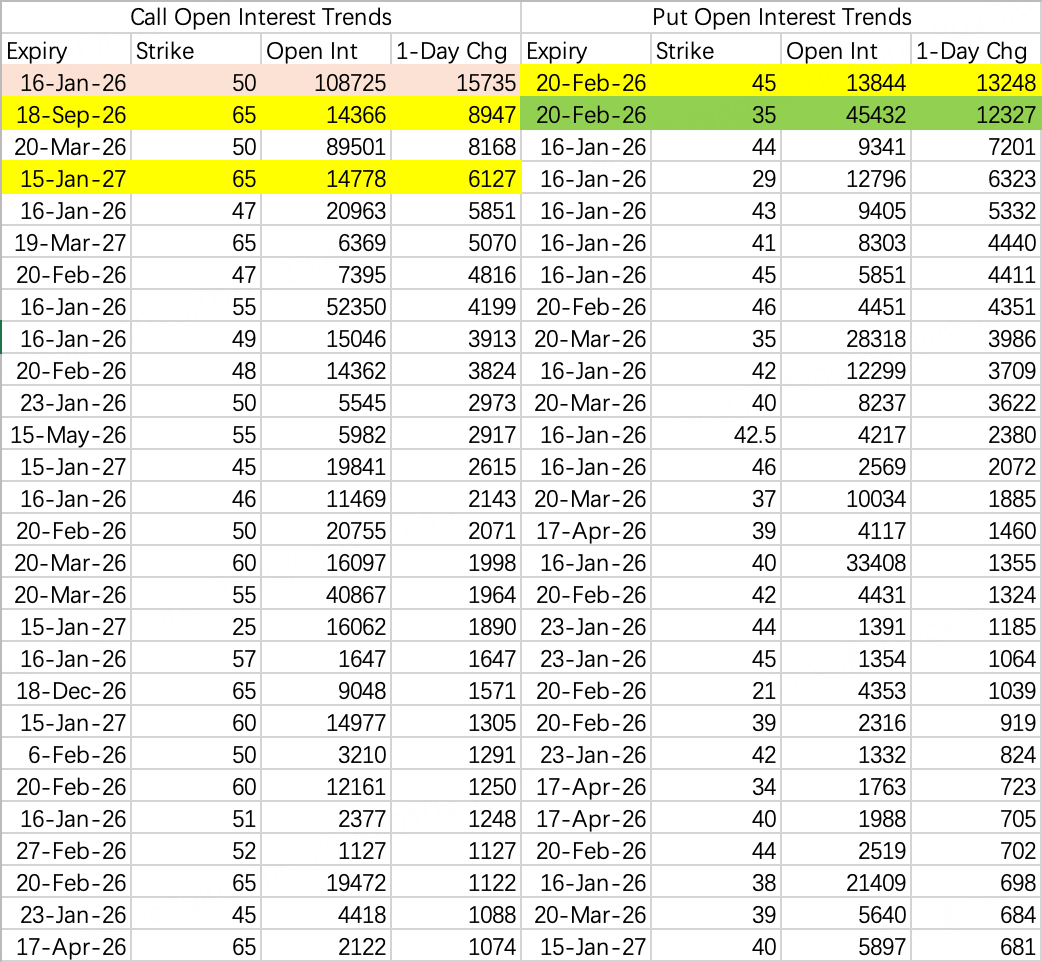

An awkward situation: someone sold a large block of at-the-money 445 calls $TSLA 20260116 445.0 CALL$ on Friday (12,000 contracts opened), and then got caught in a short squeeze.

Institutions took a more cautious approach by selling the 457.5 call $TSLA 20260116 457.5 CALL$ and hedging with the 477.5 call $TSLA 20260116 477.5 CALL$ .

This week, the price is likely to oscillate between 420 and 470. The 450 level seems like a potential short from either side, but currently, I lean towards selling the 420 put.

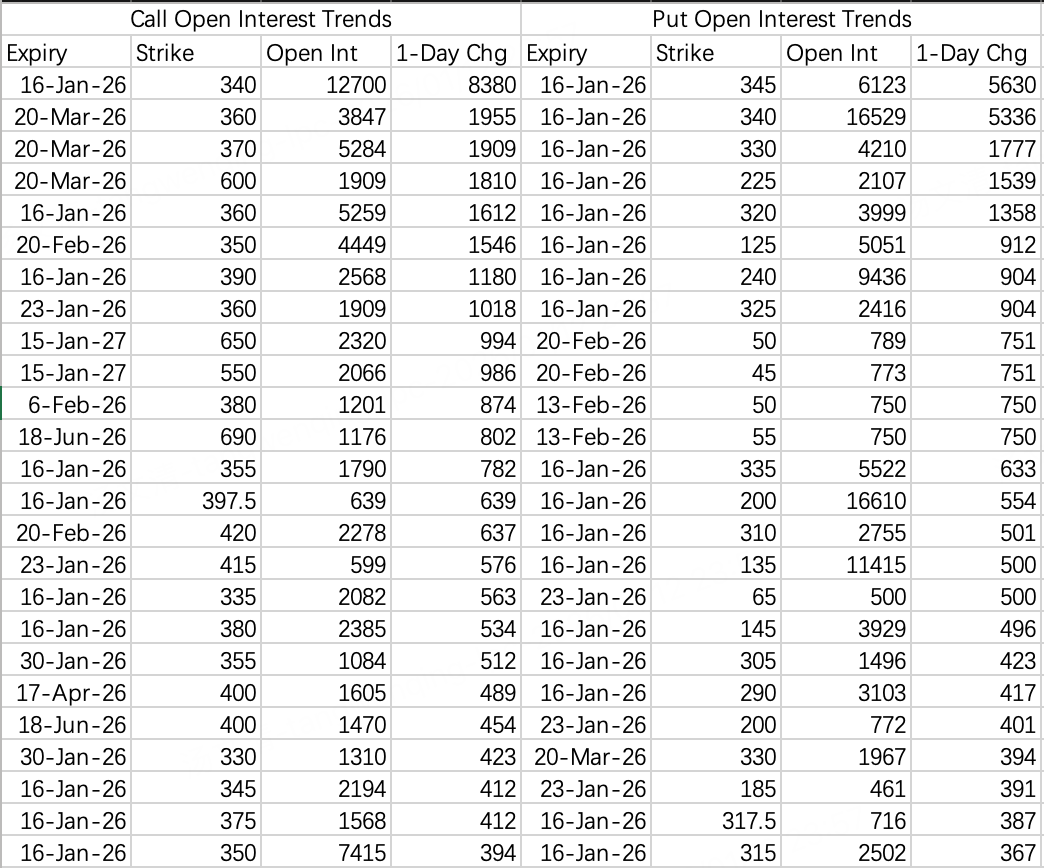

$SPY$

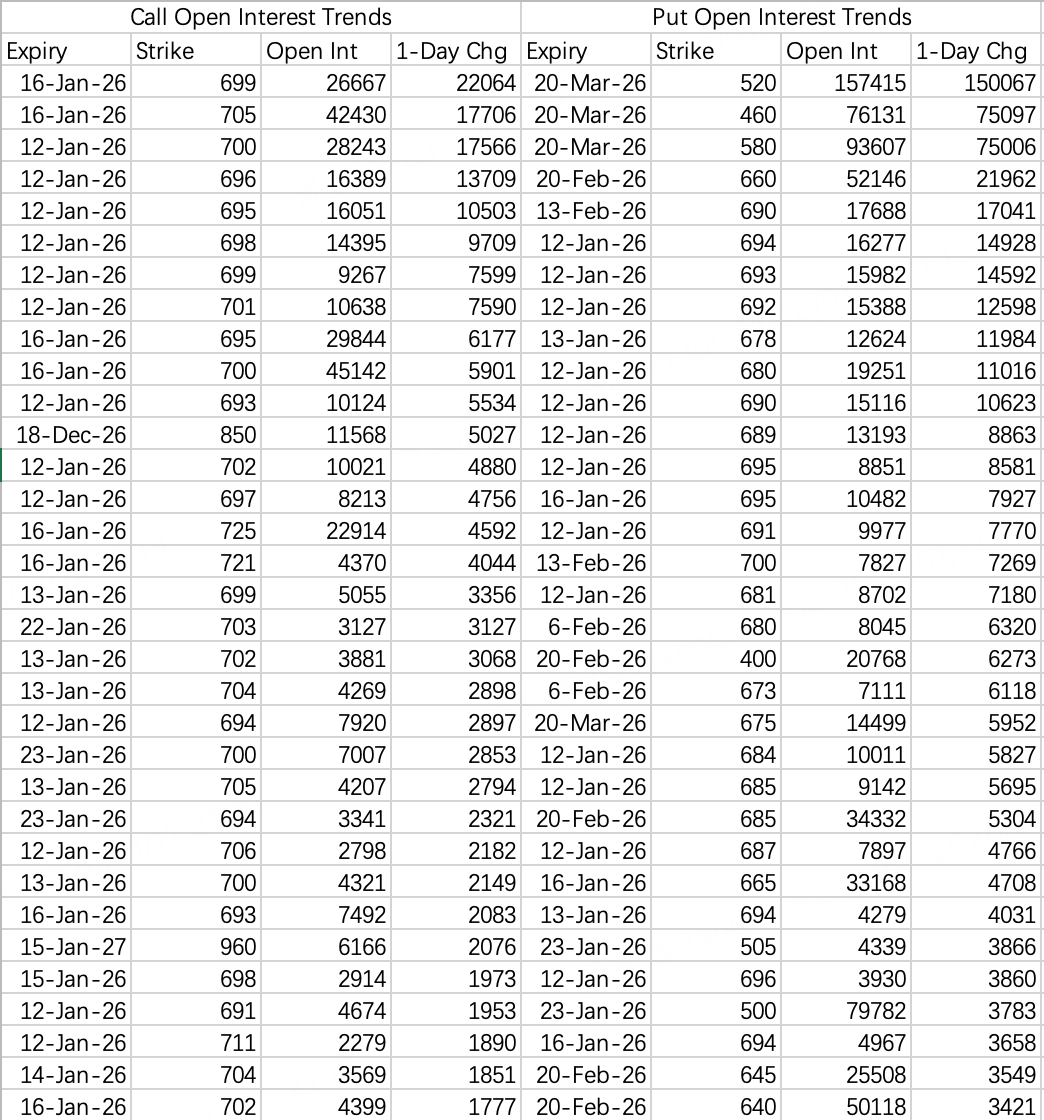

Originally, a minor correction was expected in January, but for some reason, it hasn't materialized. The uptrend continues, replaced instead by increased bets on a potential flash crash. This could be due to fears that Trump's geopolitical hardline stance might backfire.

Based on open interest, it was supposed to be difficult for SPY to rise above 700 this week. But if the A-share market surges this week while the US market falls, wouldn't Wall Street lose face?

$INTC$

Significant divergence has emerged around the 45 level. Many call options have been closed, but this doesn't necessarily signal an imminent pullback. Many of these closed positions were January expiries—traders simply took profits/exited during the surge. It's rare to see such "benevolent" major players.

The large bullish 60 call order opened last week $INTC 20260618 60.0 CALL$ remains open.

However, even with the positive trend, breaking above 50 this week is unlikely, as there are 108k contracts of open interest in the January 50 calls.

$MU$

For Micron, open interest data cannot constrain the stock price. Both bullish and bearish stances are very clear. While the bullish view remains, significant new bullish bets are unlikely at this level. Focus on pullback opportunities.

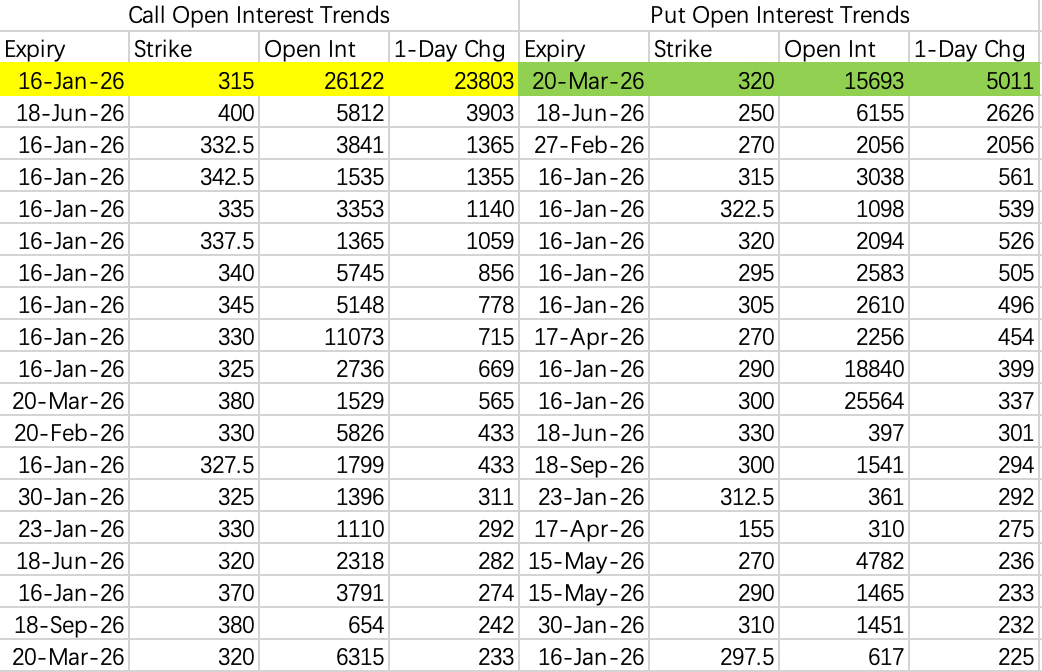

$TSM$

A good target for selling volatility this week! It's expected to be difficult to make new highs, but also hard to fall significantly.

Call buying activity includes purchasing deep in-the-money 315 calls $TSM 20260116 315.0 CALL$ expiring this week—everyone knows deep ITM calls don't easily drive the price up. A large sell put order is the 320 put $TSM 20260320 320.0 PUT$ —the same large sell put from last time has seen additional size added. Overall, the price is expected to oscillate around 320.

For the bold, consider selling the 310 put $TSM 20260116 310.0 PUT$ . Selling puts below 300 is also an option.

$BABA$

There is a large buy call order for the 170 strike $BABA 20260320 170.0 CALL$ . This makes sense, as KWEB is bullish towards 40, and Alibaba should see corresponding gains.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.