Massive 230k Contract Deep Out-of-the-Money China ETF Put Order

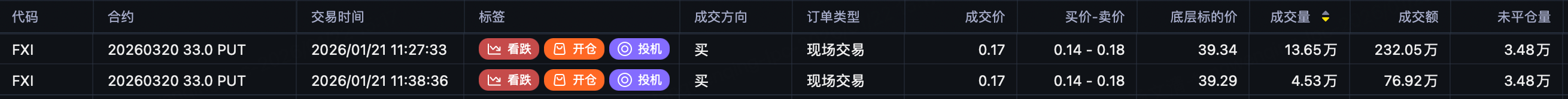

$FXI$

The March 20th expiry 33 put saw a massive purchase of 230,000 contracts over Tuesday and Wednesday. Although the trade price was only around $0.17, the sheer volume resulted in a total notional value exceeding $3 million.

The current FXI price is $39. The delta for the 33 strike is only 0.069. Trades at this level are typically bets on a "black swan" event, with notional values in the tens of thousands. Spending millions on this is essentially throwing money away. Therefore, the trader either has genuine insider knowledge of a major impending negative event or holds an enormous long portfolio and needs to hedge against a potential flash crash.

In either case, it signals expectations of a significant volatility spike. The profit mechanism for such deep OTM options isn't just the price dropping to the strike; a flash crash causing implied volatility to skyrocket can also make them profitable. I think the probability of Chinese stocks dropping to 33 is relatively low. This could be a hedge against a potential negative macro event in the near term.

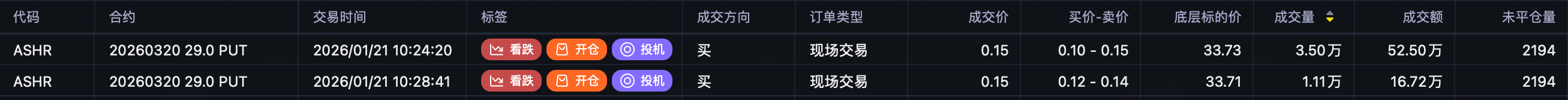

$ASHR$

ASHR also saw a large bearish order. The March 20th 29 put $ASHR 20260320 29.0 PUT$ had 46,000 contracts bought, with a notional value of approximately $700k. The rationale is likely similar to above—hedging against a flash crash.

To gauge the probability of a sharp decline in Chinese stocks, observe the previously mentioned 100k contract long call order $KWEB 20260821 40.0 CALL$ . If that position is closed, it might indicate genuine perceived risk.

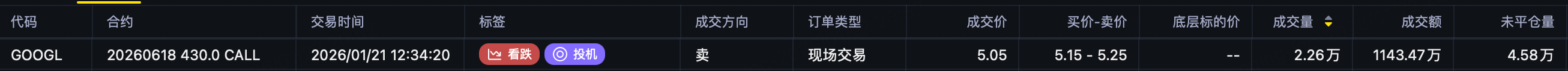

$GOOGL$

For example, the OTM long call position in Google was scared off. The recent macro uncertainty causing sharp market swings is what OTM calls fear most—decay during consolidation. The 430 call $GOOGL 20260618 430.0 CALL$ was largely closed on Wednesday.

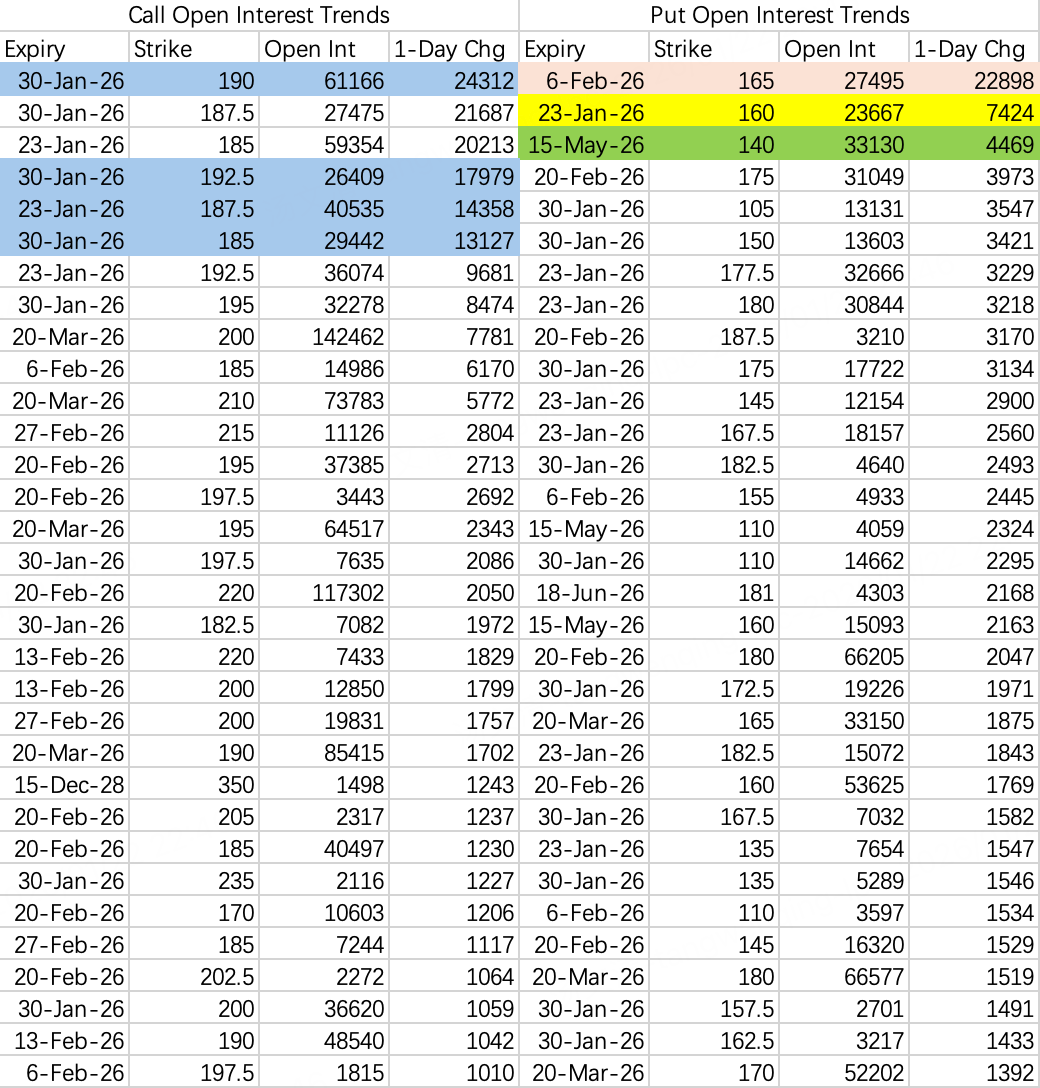

$NVDA$

As shown in the chart (referencing implied chart), bearish positioning remains pessimistic. Selling puts is not advisable.

Institutions opened a bullish call spread expiring next week: sell 187.5 $NVDA 20260130 187.5 CALL$ , buy 192.5 $NVDA 20260130 192.5 CALL$ . I think selling calls above 190 could be considered.

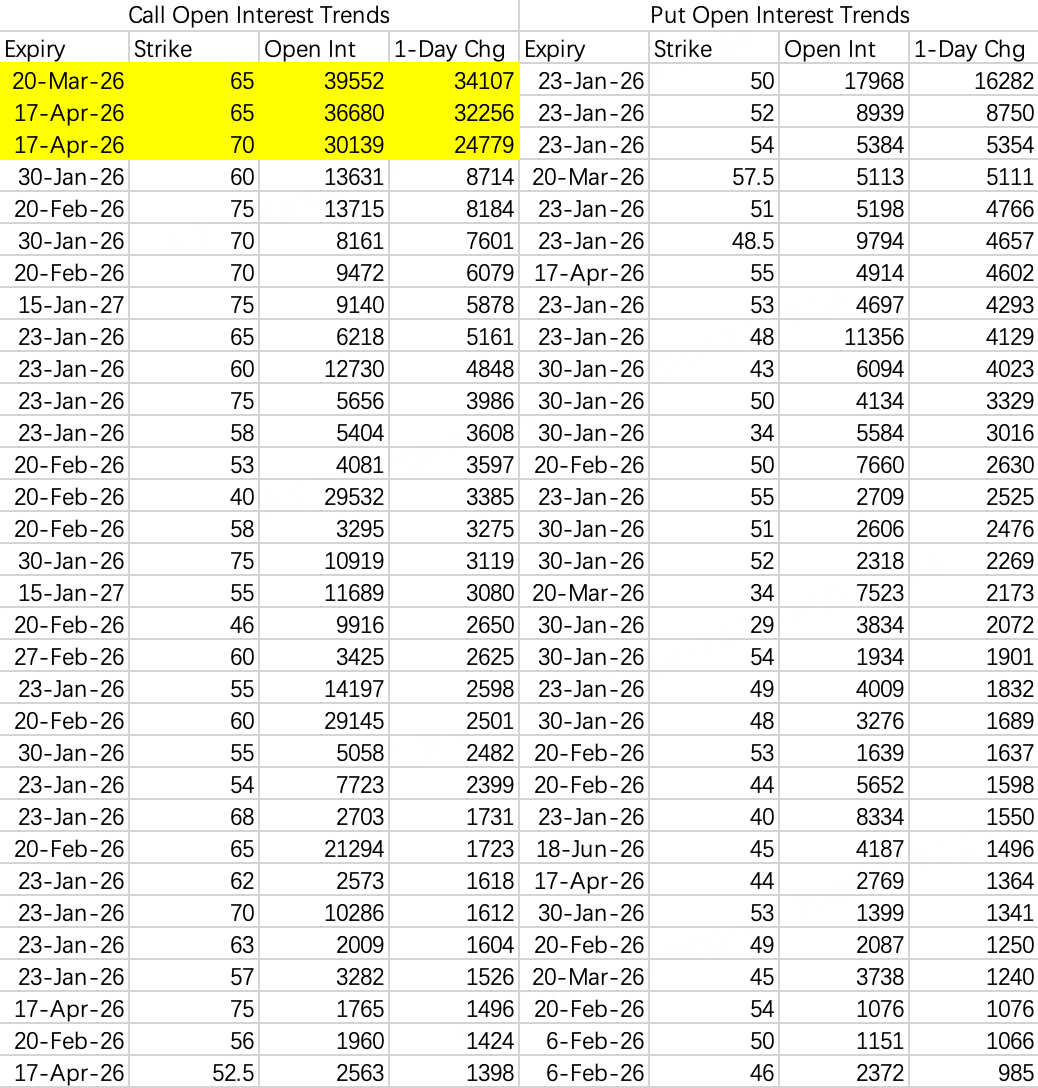

$INTC$

After Wednesday's 11% surge, many call positions were closed or rolled—for example, rolling from the 60 strike to 65 $INTC 20260320 65.0 CALL$ . There was also significant new bullish buying in calls like the 65 and 70 strikes $INTC 20260417 70.0 CALL$ $INTC 20260417 65.0 CALL$ , with notional values in the millions.

Frankly, why don't we just set this year's target at 100 and be done with it?

If chasing the rally seems risky, continuing to sell puts or simply buying the stock are viable alternatives.

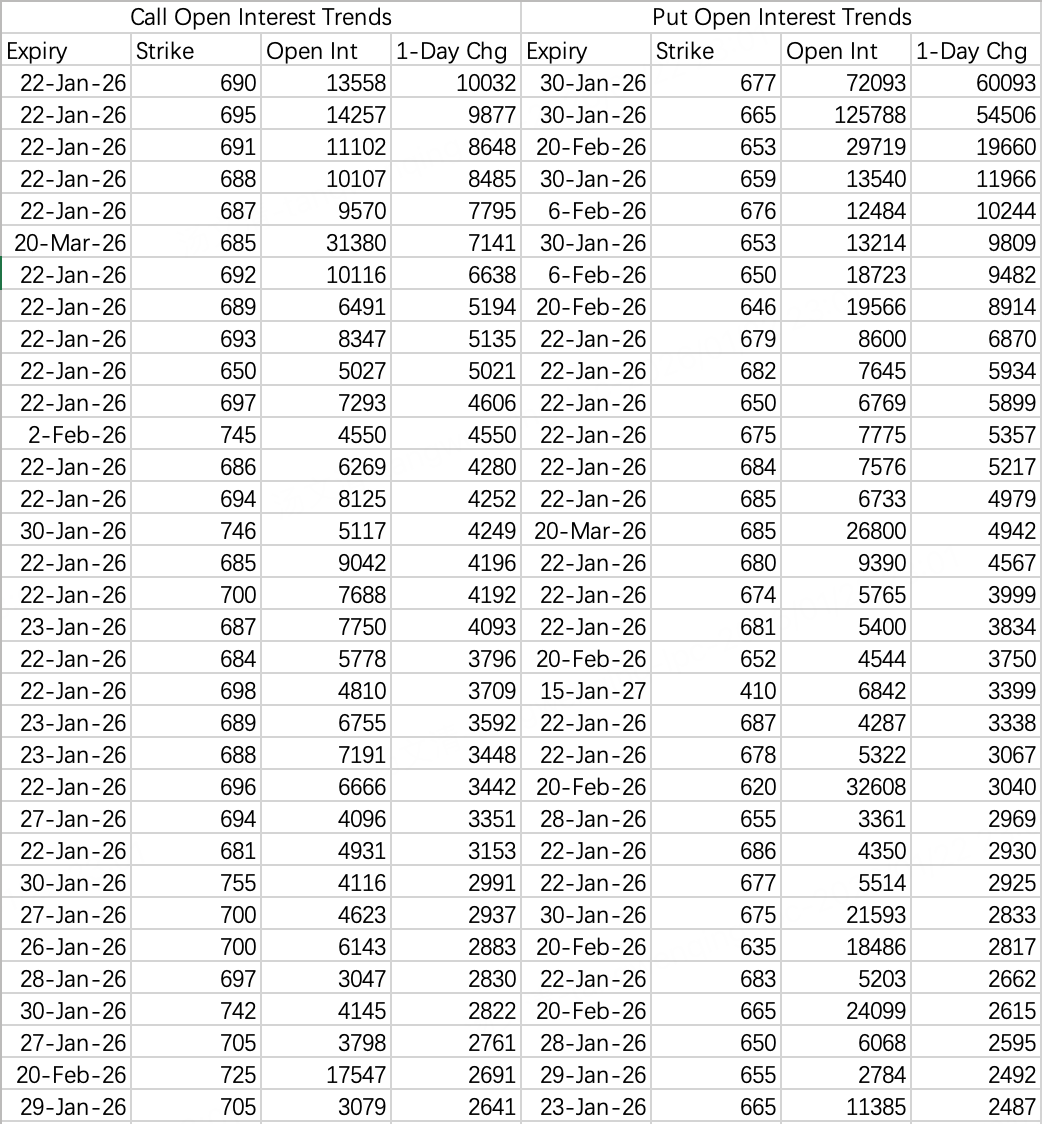

$SPY$

A Danish pension fund reportedly "in anger" sold off US Treasuries and stocks (though it was likely a calculated decision). I'm curious what they bought instead.

The timing of the sell-off does make some sense. Currently, SPY looks set to continue probing the 670 support level.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.