Massive 300k Contract VIX Order Opened, Guard Against Sudden Plunge

$VIX$

Another massive bullish volatility order has appeared. The March 18th expiry 35 call $VIX 20260318 35.0 CALL$ traded 300,000 contracts for a total notional value of over $20 million.

Opened around the same time was the February 18th expiry 35 call $VIX 20260218 35.0 CALL$ , trading 250,000 contracts.

Based on SPY's option activity, the probability of a major decline this week seems low. However, historical patterns suggest a non-negligible chance of a correction starting in late February.

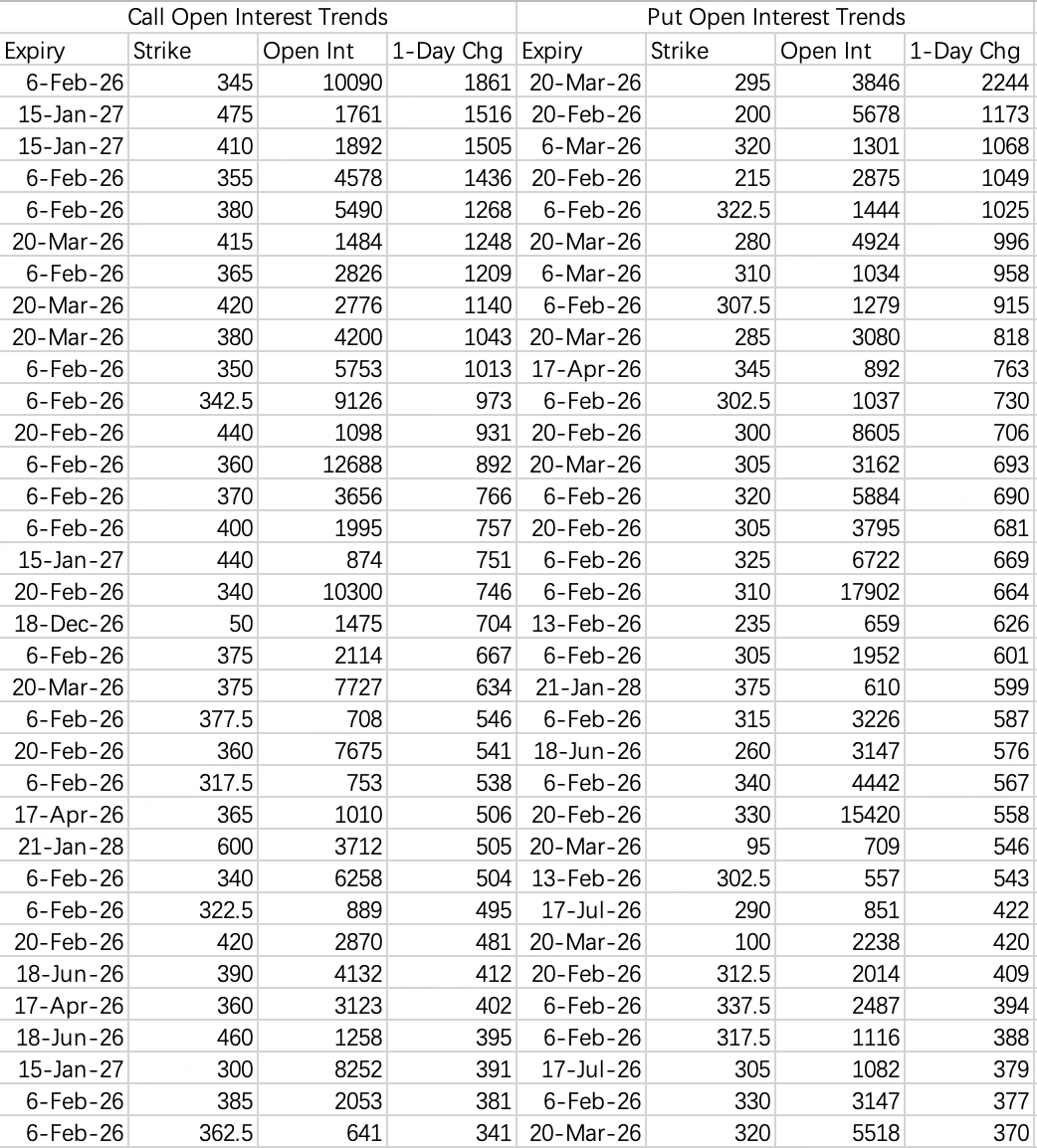

$GOOGL$

Google now enjoys the privilege of Monday & Wednesday weekly expiry options, though none expire on its actual earnings day. As the current undisputed leader in AI, its bullish option positioning clearly sets this year's price target above 400.

Earnings are expected to be strong. A conservative strategy is to sell the put: $GOOGL 20260206 320.0 PUT$

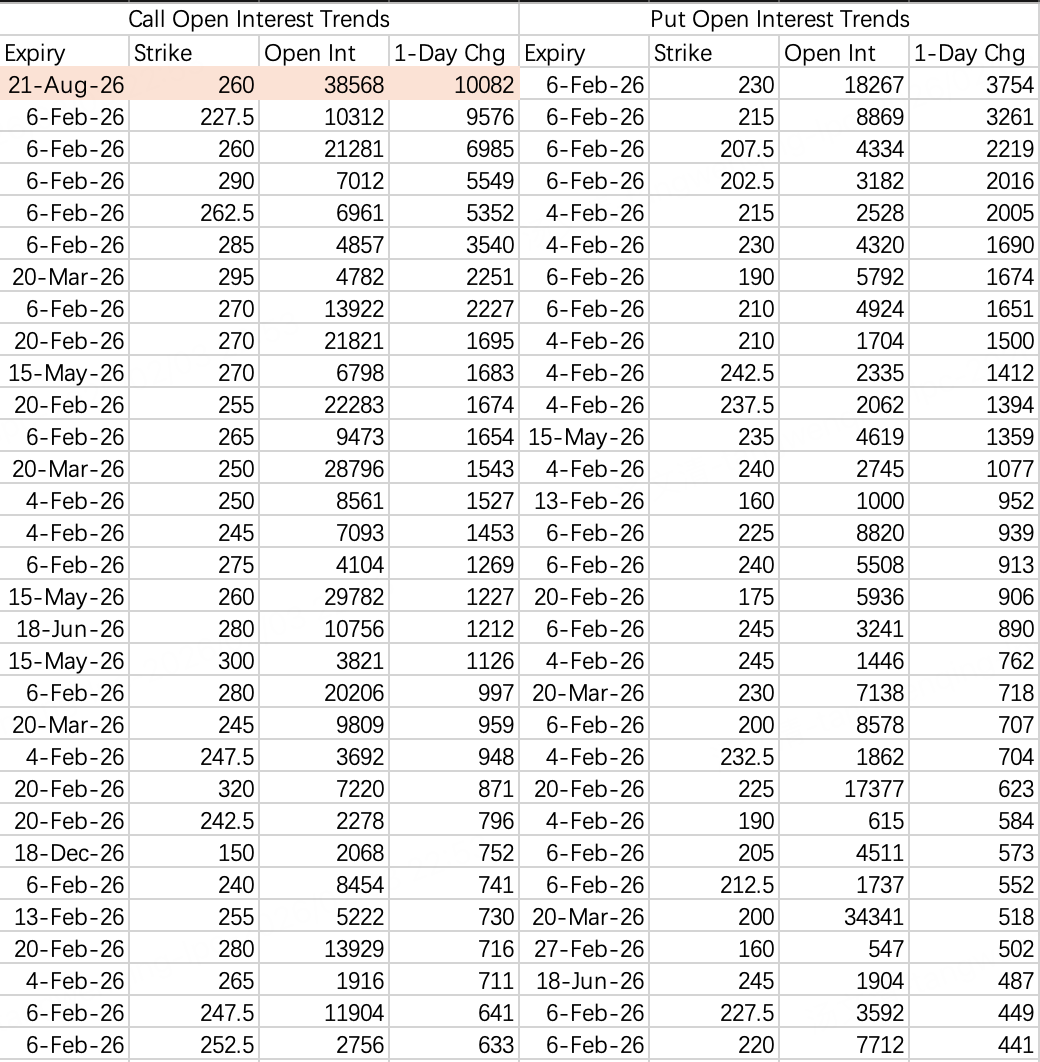

$AMZN$

Earnings expectations are positive, with AWS growth anticipated to accelerate and the Fresh grocery delivery business also strong. The expected move is to the downside below 260, though a breakout above resistance cannot be ruled out.

However, we've all experienced Amazon management's tendency for conservative guidance. Therefore, the prudent choice remains selling the put: $AMZN 20260206 215.0 PUT$

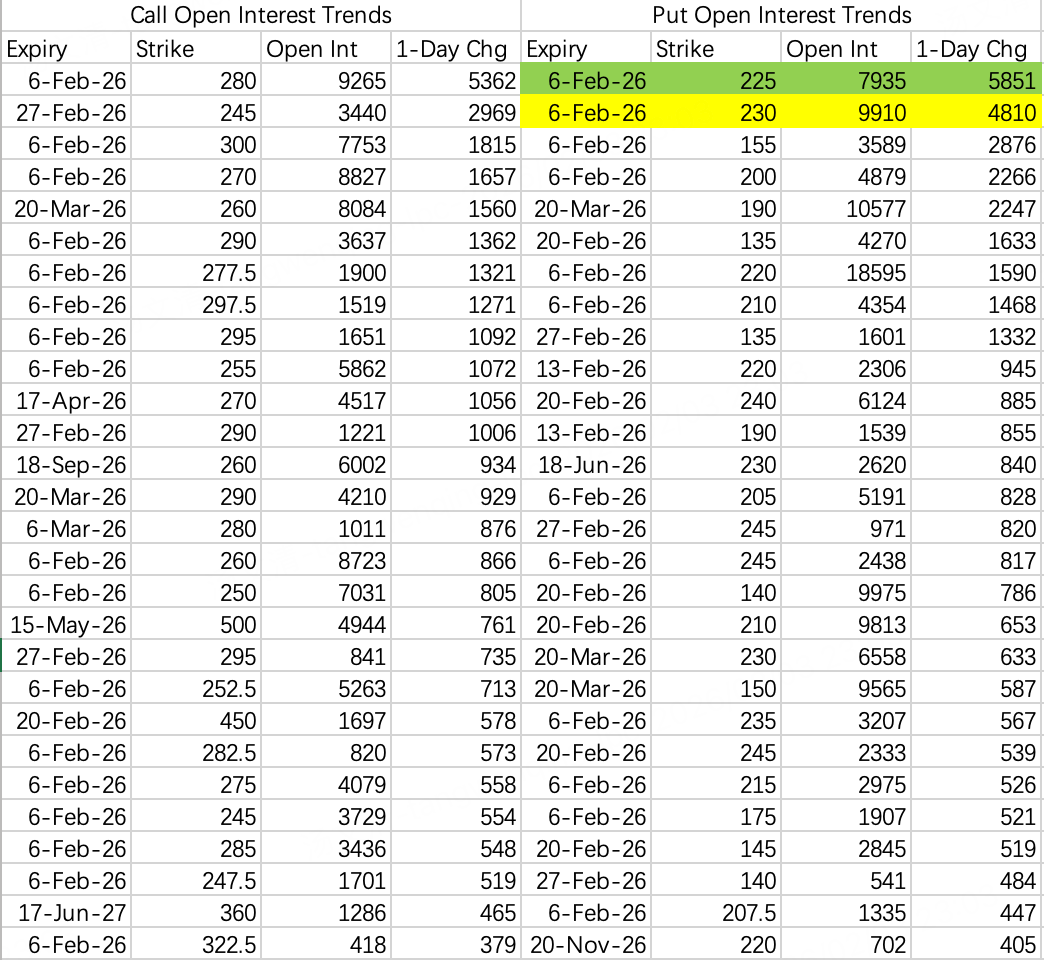

$AMD$

Earnings focus will be on CPU business growth, which should also be good, but a post-earnings pullback to 225 is possible.

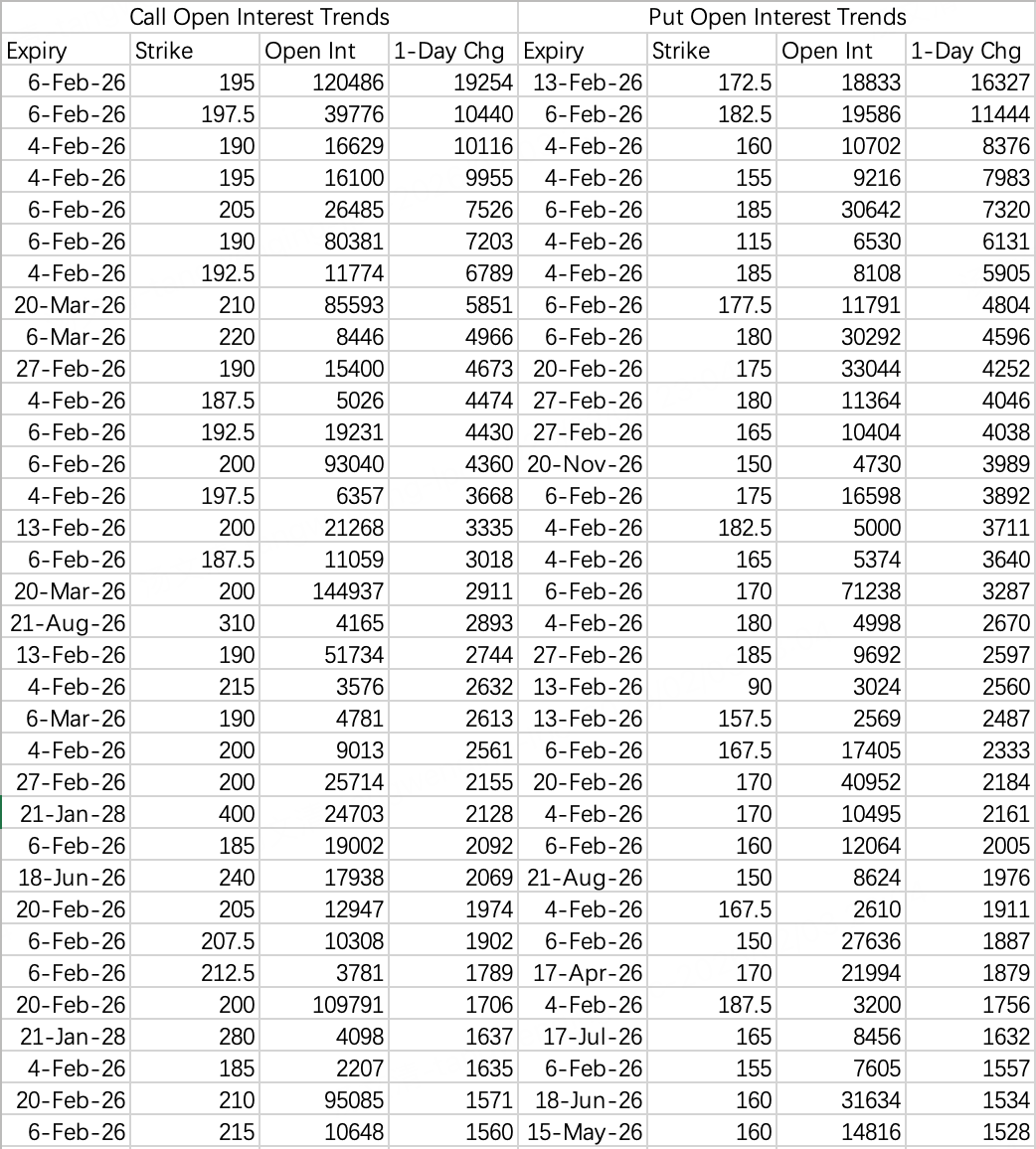

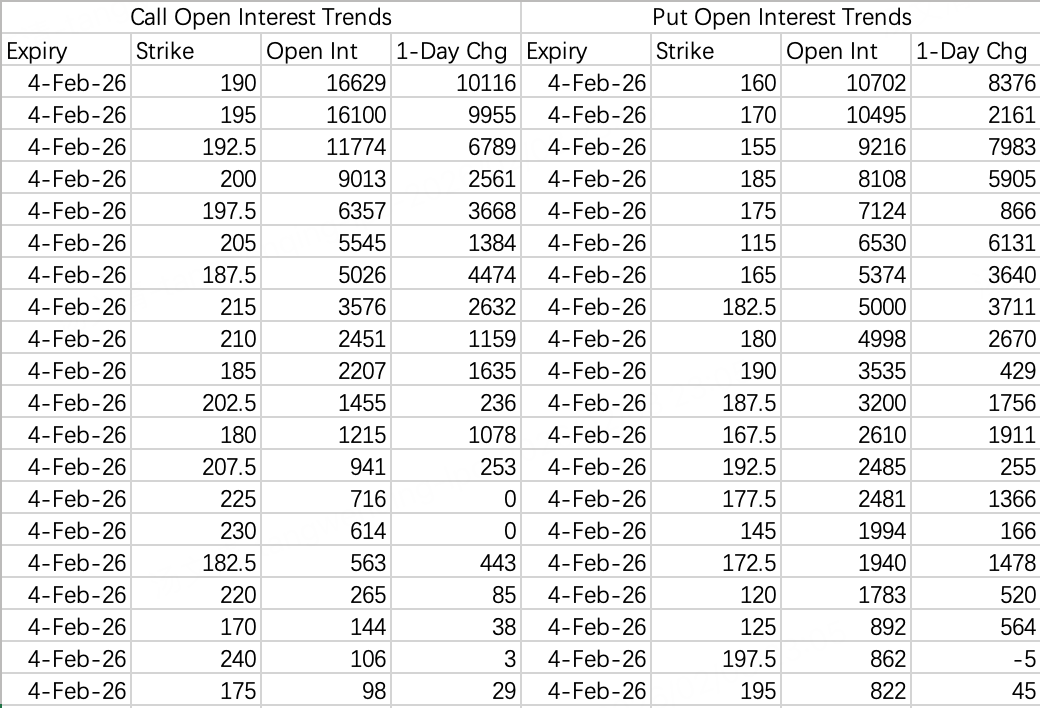

$NVDA$

The market has a very strong consensus on NVDA's price ceiling: the 190-195 range, which is proving very difficult to break above.

The lower bound, however, is less clear. A pullback to 170 remains a possibility.

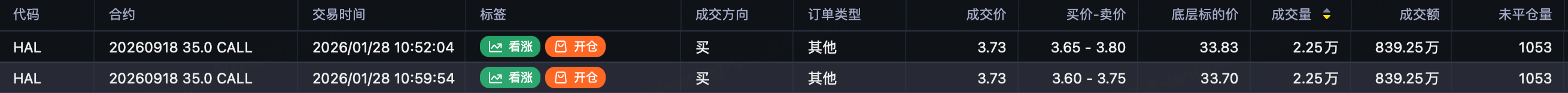

$HAL$

I believe it's time to shift focus from precious metals to crude oil. Halliburton, the largest US oilfield services company, saw a large bullish call order: the September 18th expiry 35 call $HAL 20260918 35.0 CALL$ , with 46,000 contracts traded for a total notional value of approximately $16 million.

Considering the recent sharp rally, a pullback is possible. A conservative approach would be to sell the put: $HAL 20260213 31.5 PUT$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.