Despite broader market correction pressure, bulls won this pullback battle, and barring unexpected events, NVIDIA should head above 160 before earnings.

Though it's only the first week of January, celebrating halfway might seem premature, but these champagne bottles were brought in truckloads by the bulls:

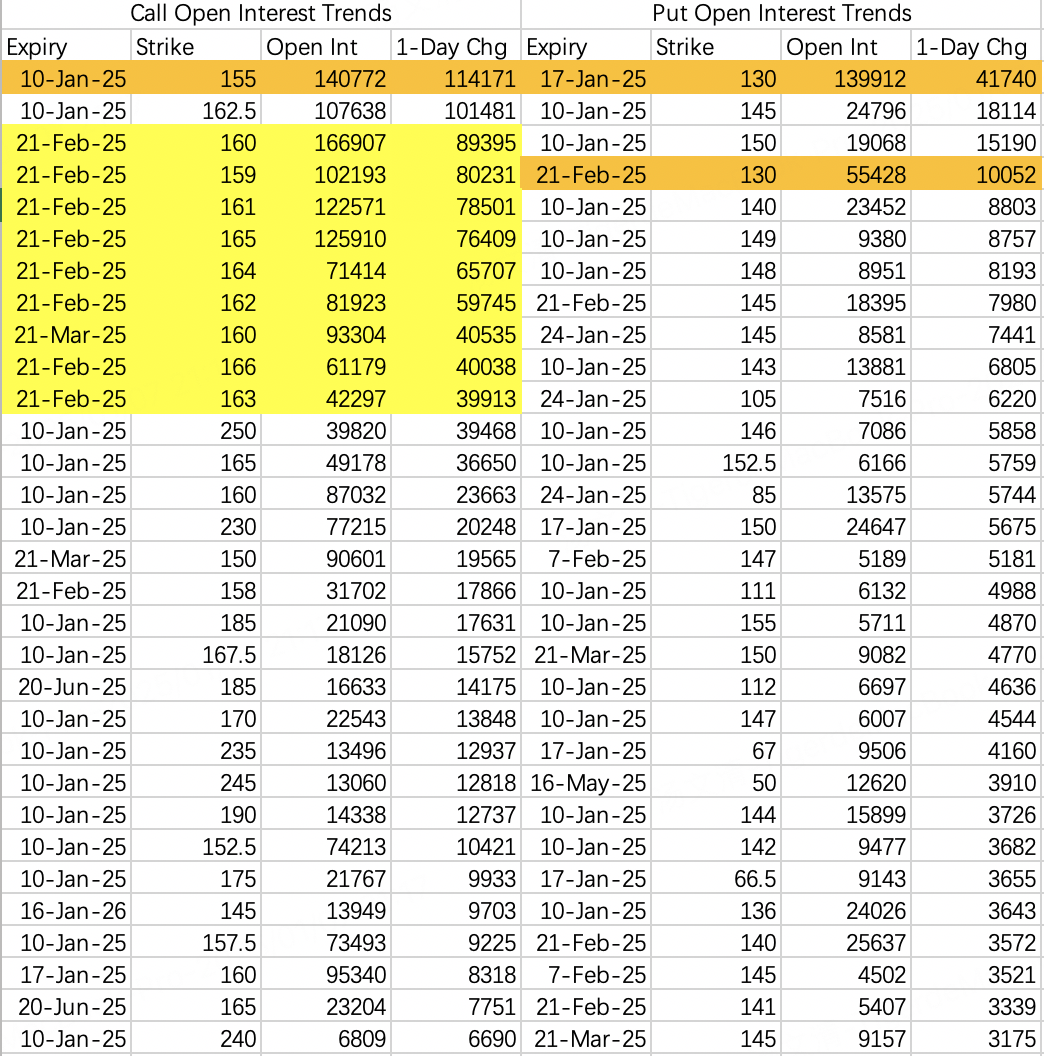

Monday's options open interest details show surging call option positions at the top. Excluding spread strategy positions in 155 and 162.5 calls, February expiry calls with strikes 158-166 saw massive increases in open interest, ranging from 40,000 to 89,000 new contracts.

Put strike prices rose accordingly, anchoring in the 130-140 range.

Friday's short squeeze, combined with Jensen's vision-casting speech, produced remarkable price gains.

Previously, I assessed NVIDIA's January movement as either stable or significantly down. Now, while broader market correction pressure remains, it's largely decoupled from NVIDIA.

Reaching 160 this week is possible but unlikely.

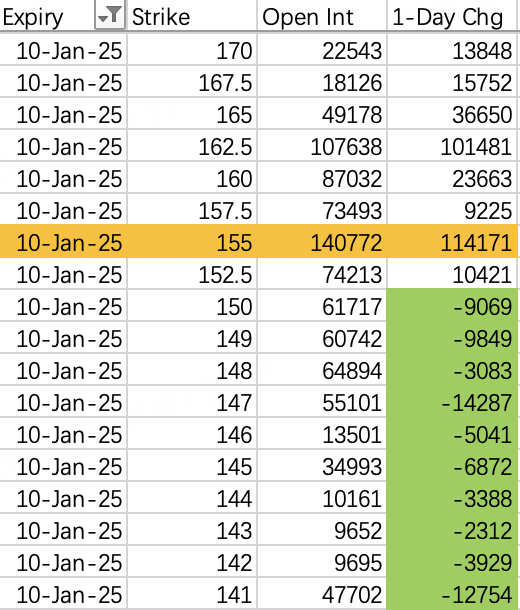

Below are this week's call option opening details. Calls below 150 saw massive position closures, while 155 gained 114,000 new open interest, becoming the highest open interest call. This suggests price likely stays below 155 this week, with a small chance of breaking through to 160.

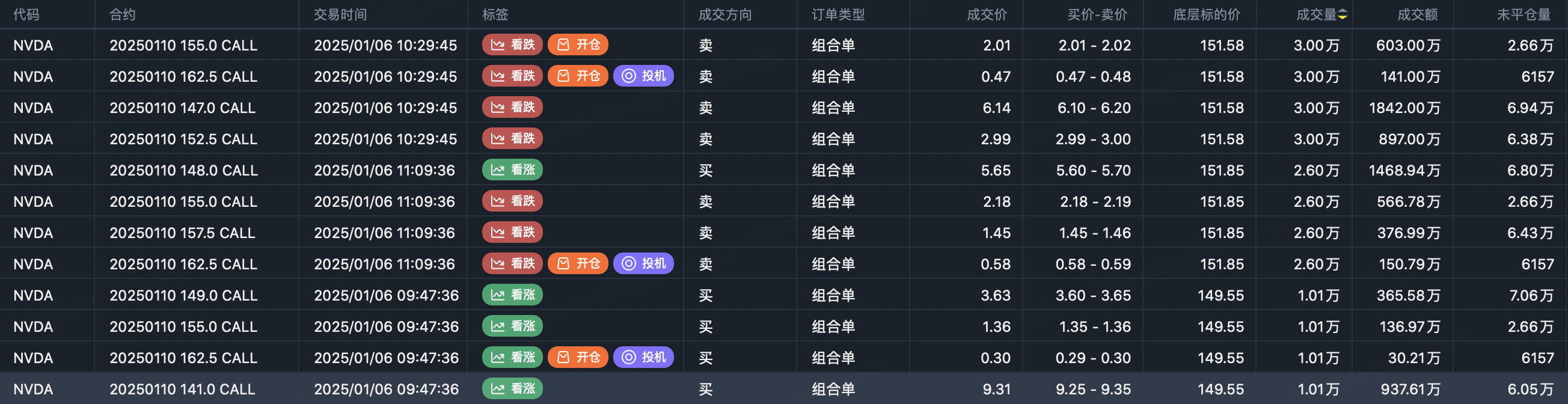

We know besides retail traders, the main weekly options players are institutions running bearish call spreads. They expected NVIDIA to follow market correction below 141, but Monday's move likely triggered stops, leading them to close spreads below 150 and open new positions:

Sell $NVDA 20250110 155.0 CALL$

Buy $NVDA 20250110 162.5 CALL$

Honestly, watching these past months, I wonder if some fund managers are inside agents, often blowing up their own sell calls to boost stock price. Or perhaps they're being targeted - without Friday's squeeze, selling this week's 141 calls might have been profitable.

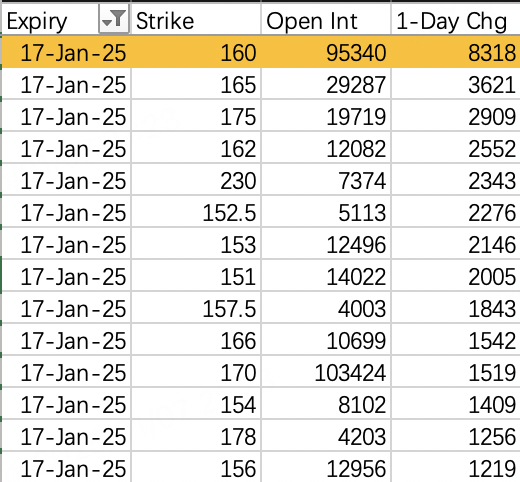

Next week's highest new call position remains $NVDA 20250117 160.0 CALL$ , with similar 160 strike positioning visible in later expiries, typically indicating clear market direction.

Bullish strategies:

Many options: holding shares, selling puts, buying calls, call spreads, all work.

Simplest is selling puts, either ITM or OTM. I'm closing my 140 sold puts and selling next week's $NVDA 20250117 150.0 PUT$ . Also adding a call spread: buying $NVDA 20250620 160.0 CALL$ and selling $NVDA 20250117 170.0 CALL$ .

Comments