$NVDA$

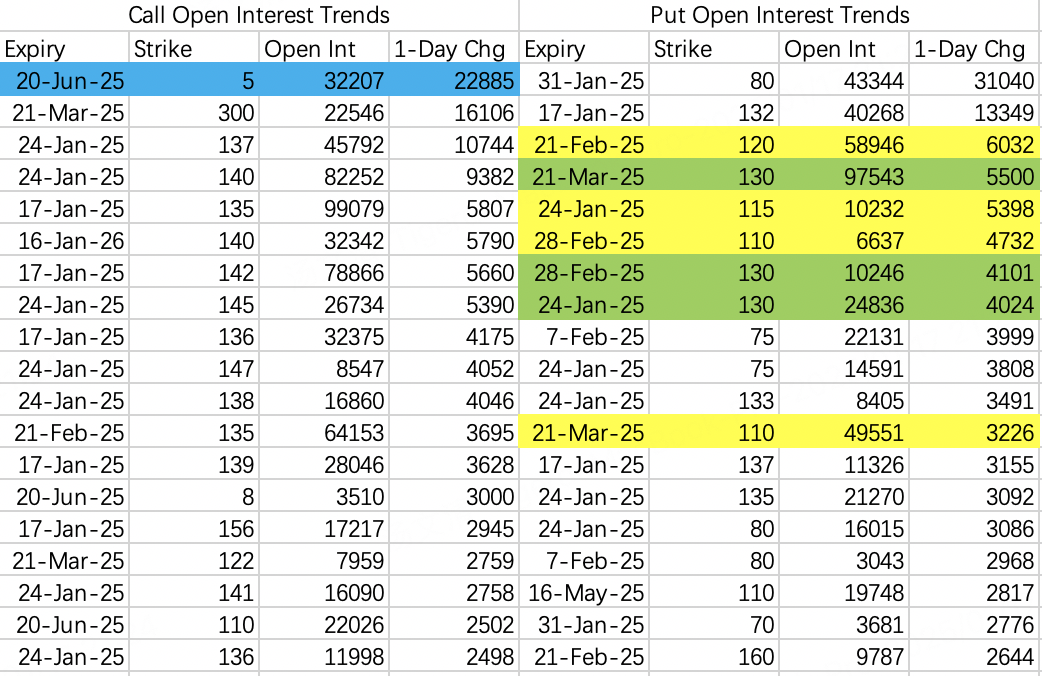

After TSM's earnings report on Thursday showing long-term AI benefits, I expected to see large bullish options positions in NVIDIA. I was stunned to see 22,800 new June contracts with a $5 strike price! $NVDA 20250620 5.0 CALL$

With NVIDIA trading around $135, a $5 strike means deep in-the-money options, with prices approximately equal to stock price minus strike price. Each contract cost around $13,000, making the 22,800 contracts worth about $296 million.

Deep in-the-money options have poor liquidity, and since this large order wasn't executed on-exchange, it took considerable time to fill.

While the strike price may not provide much directional guidance, a $300 million purchase representing 2.28 million shares upon exercise is definitely bullish.

As for why they chose $5 instead of $50, $30, or $20, that remains unknown. Caution is never wrong, especially for someone spending $300 million on call options.

TSM's Earnings Report Major Positive Guidance

I briefly mentioned TSM's earnings highlights on Thursday, but missed the most important point, likely what the $300 million options bet is based on:

$TSM$ raised its 5-year long-term revenue CAGR target to nearly 20% and extended the timeframe to 2024-2029 (previous guidance was 15-20% for 2021-2026)

This statement needs no explanation, right?

I recall last year's second-half speculation about AI demand verification this year, with market skepticism about AI's practical applications. However, after TSM's statement, any bearish expectations and positions need reconsideration.

20% growth rate for the next five years - consider the magnitude of that!

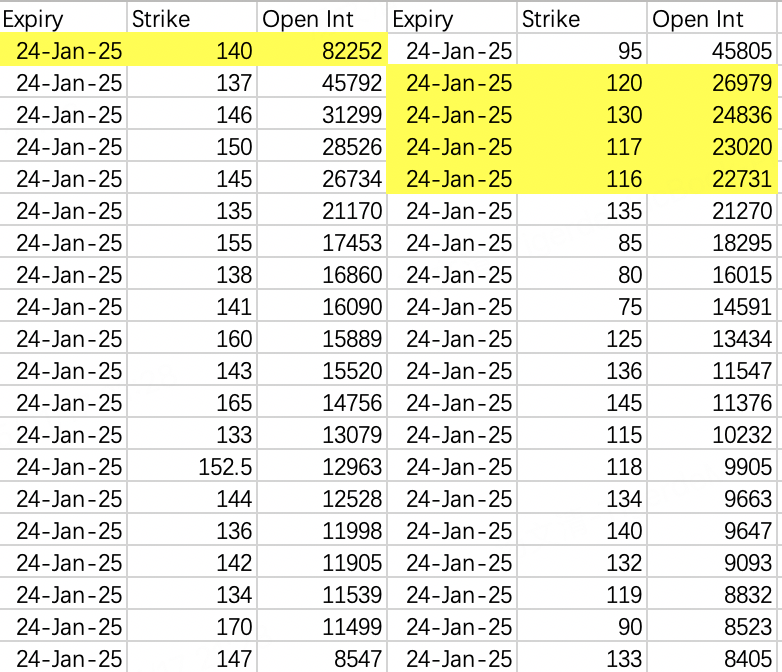

Reviewing the position details again, put options are split into two camps - one still targeting a pullback to 110, the other seeing 130 as the bottom.

I think 130 is wise - who would benefit from a pullback to 110?

Based on next week's open interest data, price range appears to be 120-140, though like this week, it might not reach 120, staying within 130-140.

Comments