$Goldman Sachs (GS)$ has been publishing its views a bit more intensively lately, and it has also generated discussion

But to summarize, several big banks $ Bank of America (BAC)$ $ JPMorgan Chase (JPM)$ $ Morgan Stanley (MS)$ and others have similar views recently:

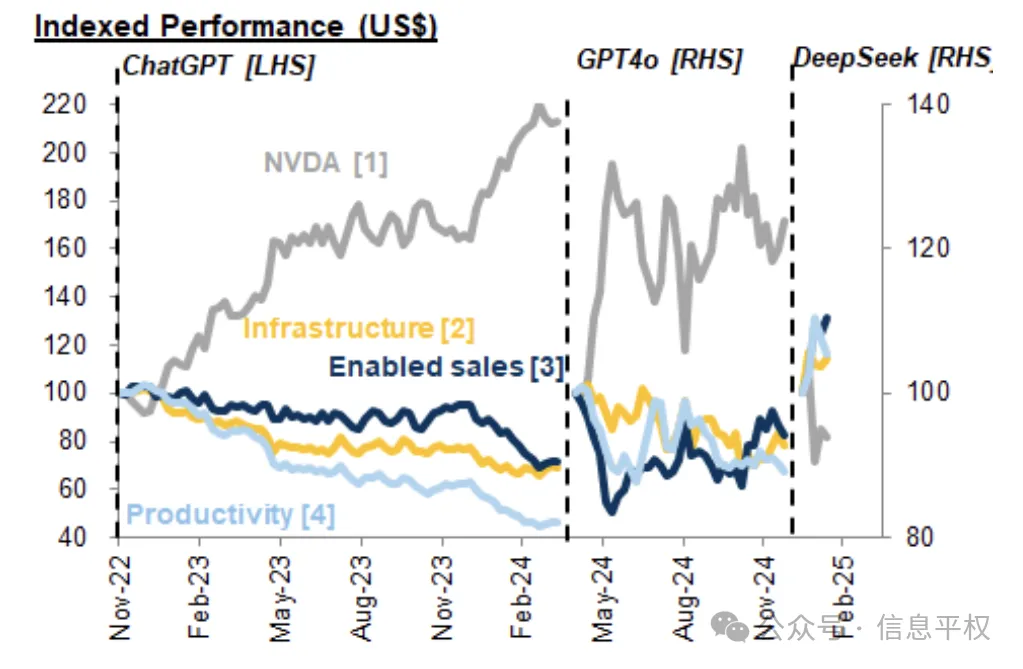

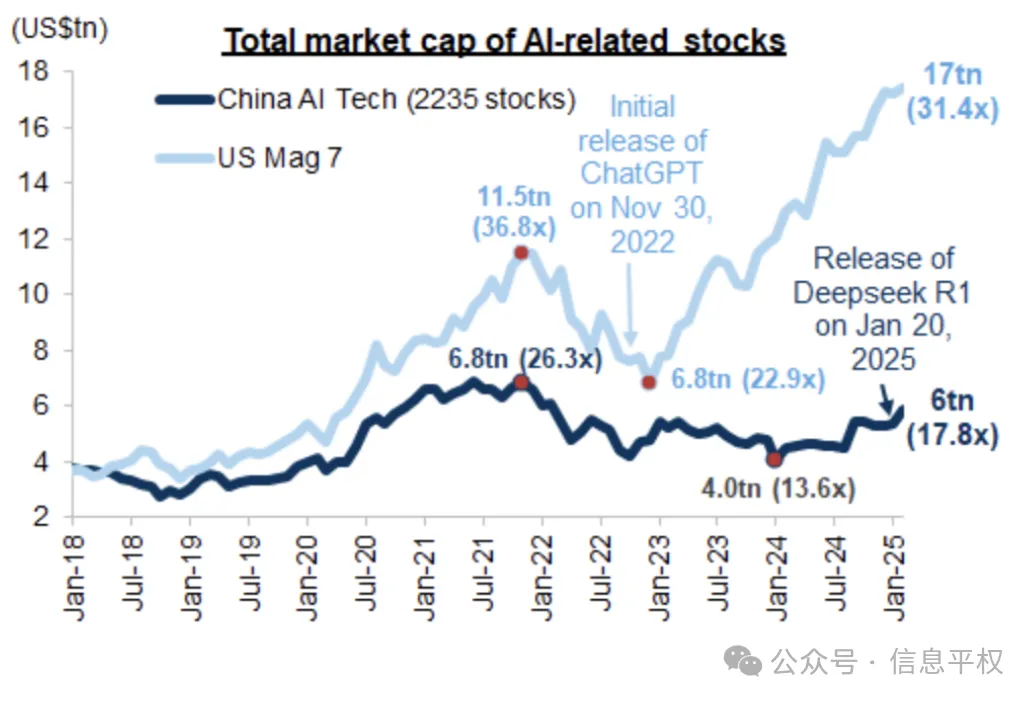

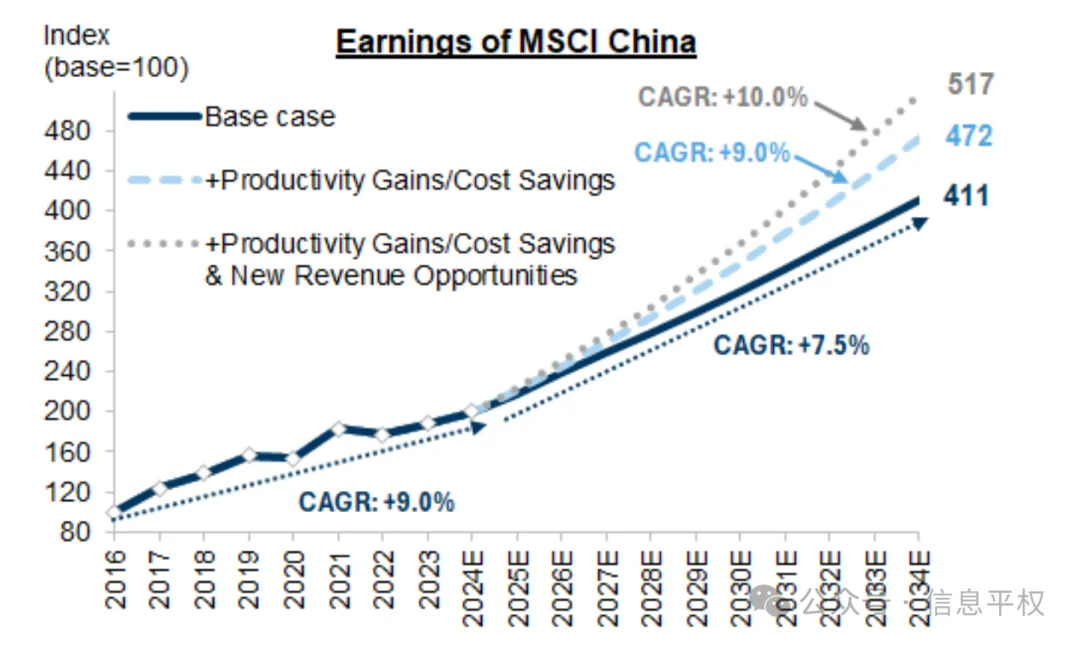

Bullish on this wave of China asset revaluation brought about by Deepseek, with AI-related assets shifting from negative to positive valuations

May encounter retracement resistance in the short term, but not a bad buying opportunity;

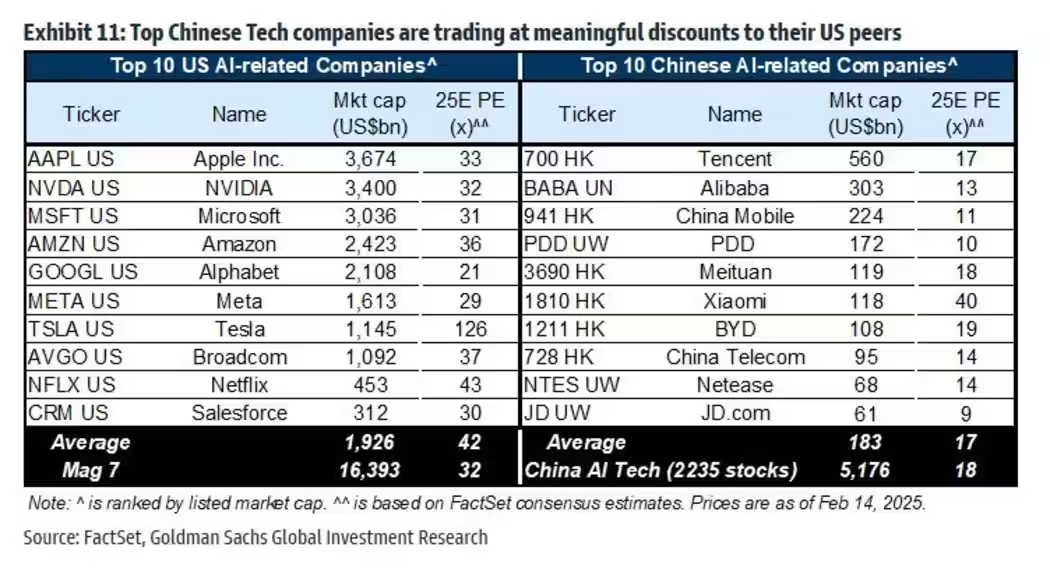

Hong Kong and A are not progressing in the same way, A-share valuation is relatively a bit higher, and Hong Kong stocks and Chinese companies are more resilient (because of liquidity, shorting mechanism, etc.)

Stimulus from the two sessions may favor other sectors and help the overall upside.

GS Target Position:

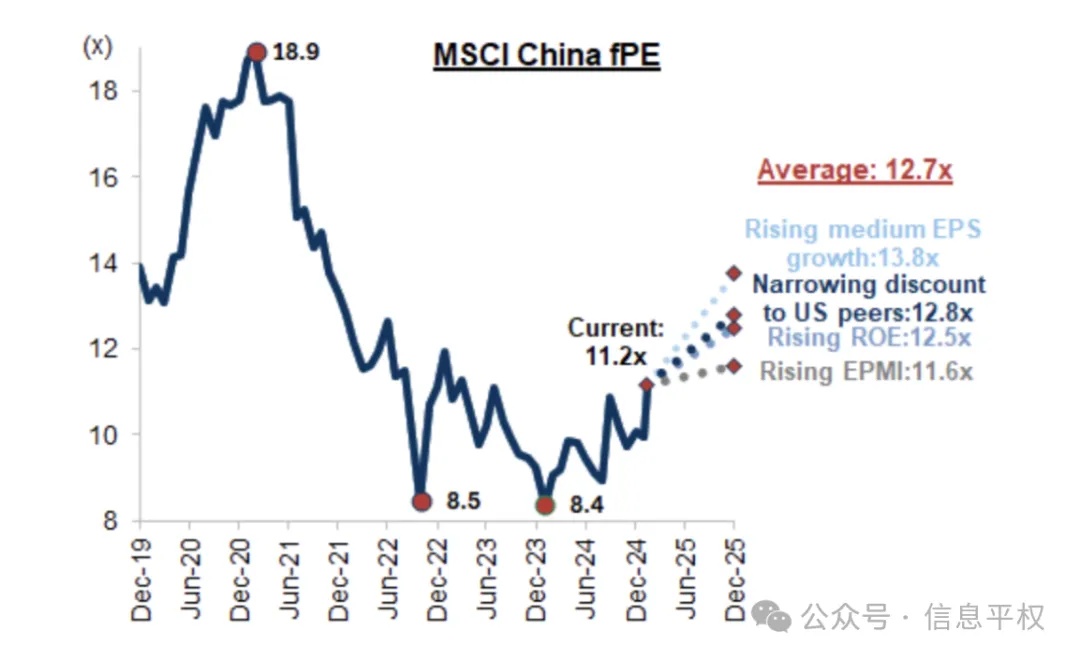

By the end of 2025, the $ MSCI China A50 Index Main 2502(MCAmain)$ Index is expected to rise 14%, with optimistic expectations of up to 28% , also raising the 12-month target level for the MSCI China Index from 75 to 85, which is expected to have 16% upside;

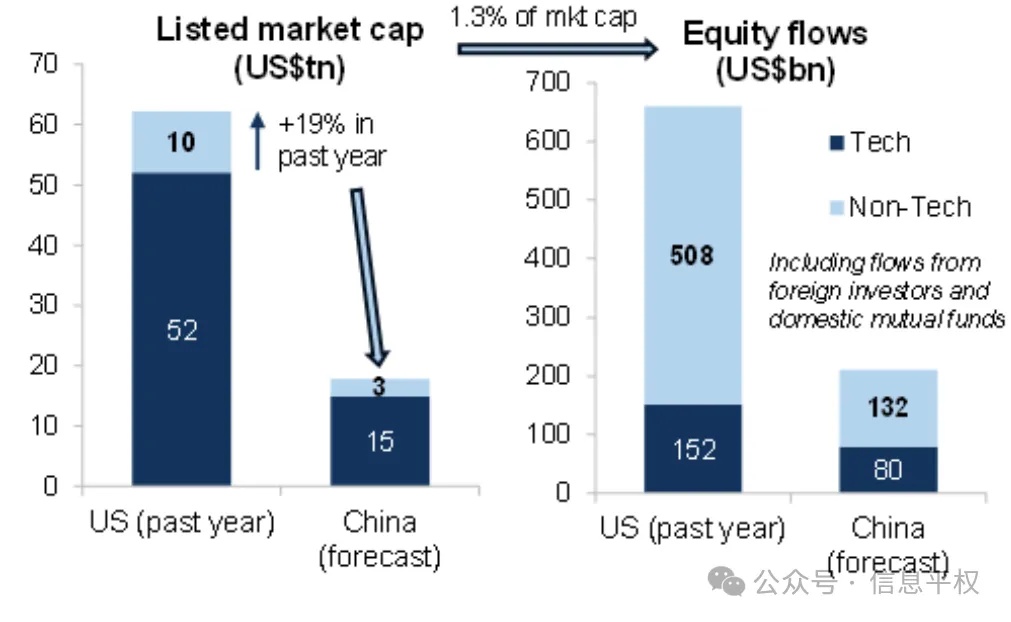

The 12-month target for the CSI 300 (399300)$ index has been raised from 4600 to 4700, with an expected upside of 19% in the next 12 months.Assuming that foreign investment in China's asset allocation from the current lows to the above valuation multiples, you can work backwards to calculate the incremental capital inflow: $ 200 billion!

But I wonder: If everyone thinks "there's a pullback" and "a pullback is a good buying opportunity", will there be a "pullback"?

Comments