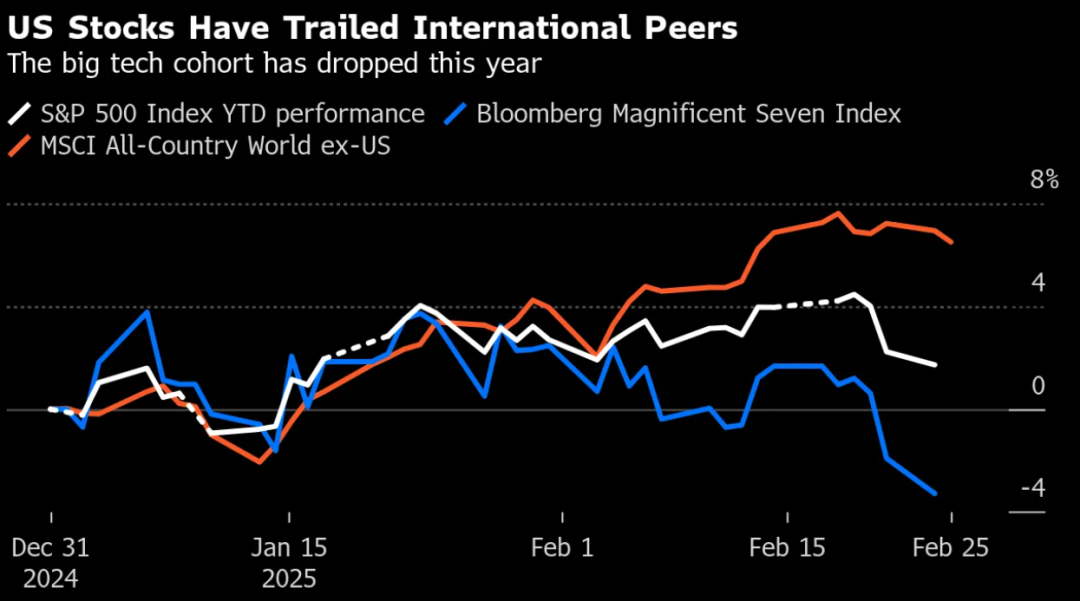

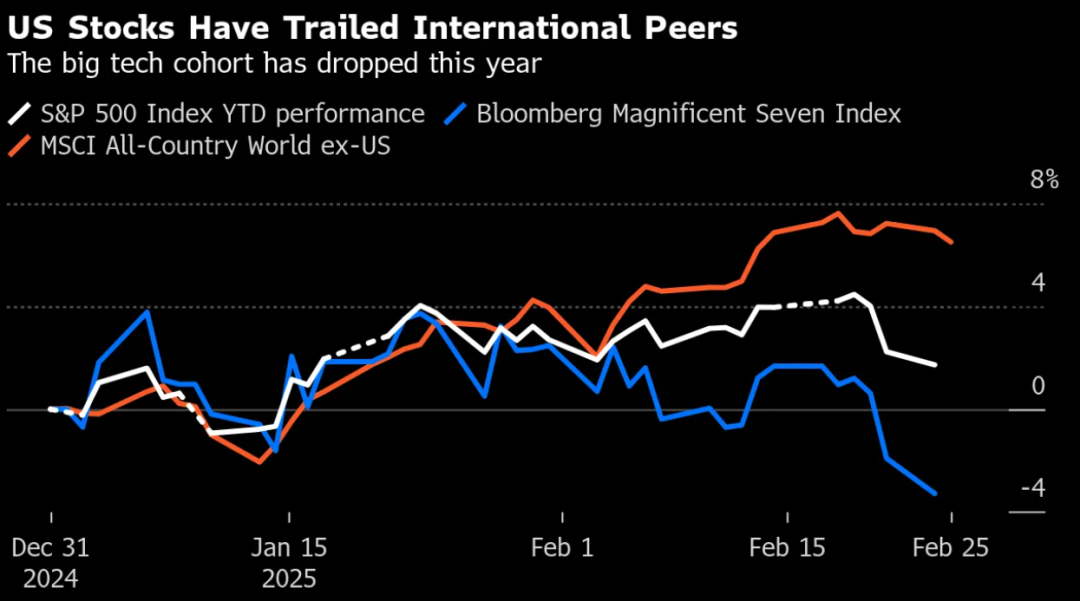

Concentration risk in US tech stocks is starting to explode, with the gap to the ROW (ex-US), widening from February.

At certain key points, perhaps some passive position adjustment will be ushered in. cta algorithmic trading has been a key factor in increasing market trends, so much so when it goes up, then it will run into corresponding problems when it goes down.

At certain key points, perhaps some passive position adjustment will be ushered in. cta algorithmic trading has been a key factor in increasing market trends, so much so when it goes up, then it will run into corresponding problems when it goes down.

If the quants go into fuller liquidation mode, CTA money is going to passively sell off $27 billion-$193 billion in equities as key points fall through.

$S&P 500(.SPX)$ $NASDAQ 100(NDX)$ $Invesco QQQ(QQQ)$ $SPDR S&P 500 ETF Trust(SPY)$ $Apple(AAPL)$ $NVIDIA(NVDA)$ $Tesla Motors(TSLA)$ $Microsoft(MSFT)$ $Alphabet(GOOG)$

$S&P 500(.SPX)$ $NASDAQ 100(NDX)$ $Invesco QQQ(QQQ)$ $SPDR S&P 500 ETF Trust(SPY)$ $Apple(AAPL)$ $NVIDIA(NVDA)$ $Tesla Motors(TSLA)$ $Microsoft(MSFT)$ $Alphabet(GOOG)$

💰 Stocks to watch today?(10 Apr)

1. What news/movements are worth noting in the market today? Any stocks to watch?

2. What trading opportunities are there? Do you have any plans?

🎁 Make a post here, everyone stands a chance to win Tiger coins!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments