The three charts below show fund flows in the U.S. equity markets:

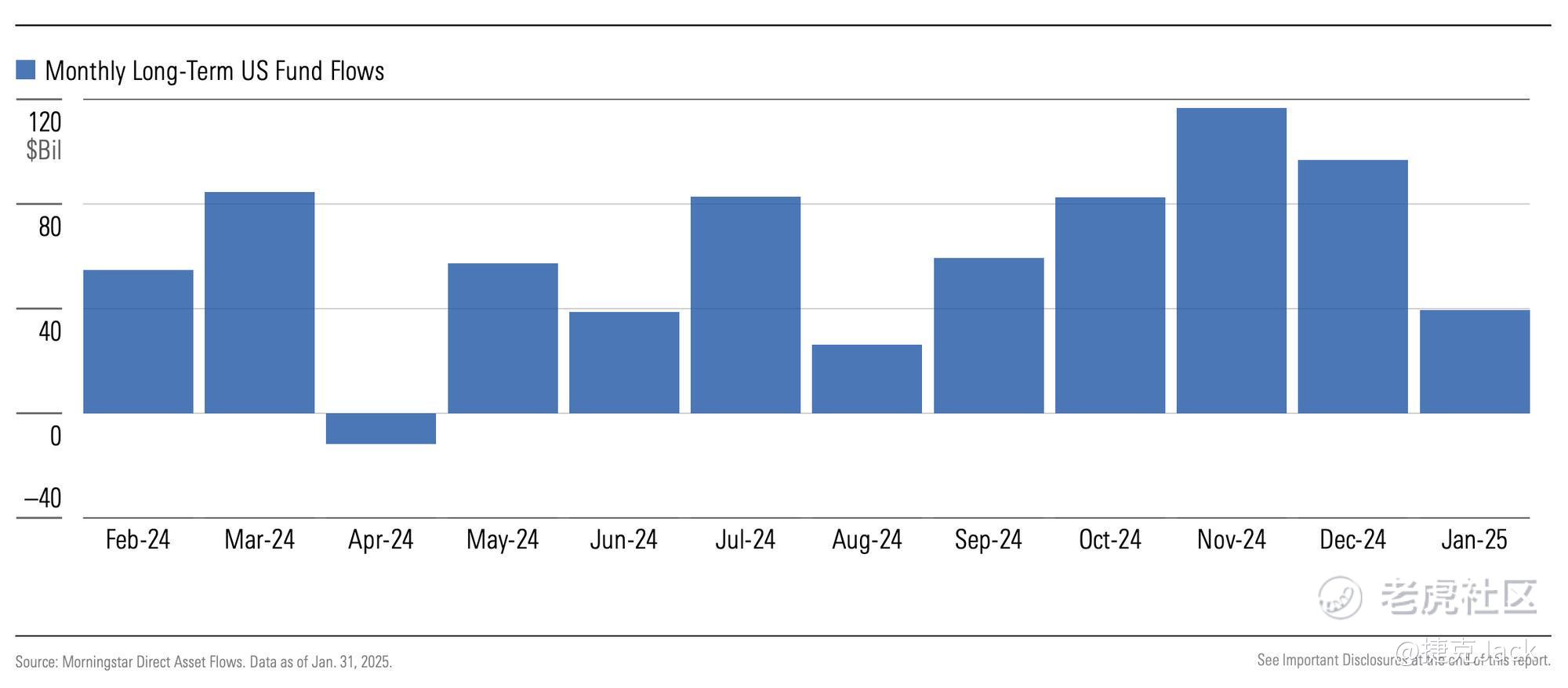

Mutual funds and ETFs raised in January 2025 are the weakest performers since August 2024

Investor demand for equity funds has weakened significantly;

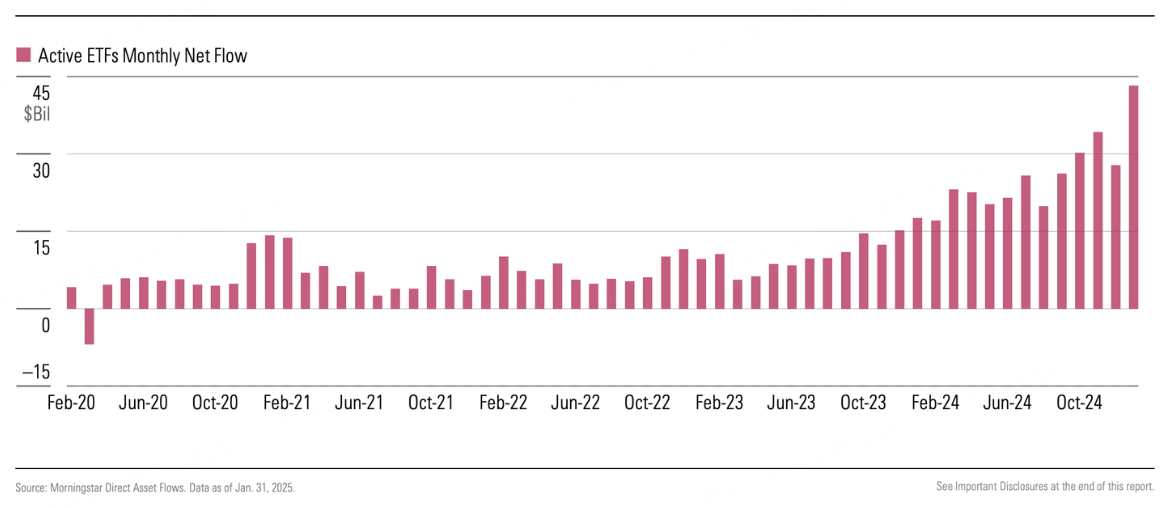

Instead, actively managed ETFs have seen increased inflows and the trend is strengthening (monthly inflows into active ETFs are at an all-time high, occurring six times in 2024)

Ultra-short-term bonds (cash substitutes) are performing very strongly.

All of these indicators point to one thing: Investors feel that it is not cost-effective to hold long US stocks (beta trading) at the moment and are trying to find other sources of alpha.

As a result, holding cash (money funds) have all become a source of market-leading alpha.

Valuations of $HSI(HSI)$ and $HSTECH(HSTECH)$ have also bounced back to the highs of the wave last September;

The main driving force at the moment is the southbound funds, while overseas LONG ONLY money is still not yet seen obvious traces (there may be a delay), more of a REBALANCING of the REMOTE funds as well as the hedge funds

Based on this situation, if not particularly capable of "short-term swing trading", or investors who are particularly sensitive to the market trading theme, then "short volatility" is still a good theme.Traditional approaches include Sell PUT/CALL, or diagonal strategies with competent directional judgment.

If you have enough money, you can trade index options directly, or options on index ETFs $SPDR S&P 500 ETF Trust(SPY)$ $Invesco QQQ(QQQ)$ , and since these ETFs also have 0DTE options, they are more suitable for high-frequency users who like to keep an eye on the market;

Individual stock options, on the other hand, depend largely on the investor's risk appetite, and personalization is important.

For example, I myself will combine high beta and low beta stocks: $NVIDIA(NVDA)$ Sell PUT(110\105\100)/CALL(130\135\145), $Tesla Motors(TSLA)$ Sell PUT(235/230/225)/CALL(320/330), $Taiwan Semiconductor Manufacturing(TSM)$ Sell PUT(170)/CALL(200), $MEITUAN-W(03690)$ Sell PUT(155)/CALL(200), $Palantir Technologies Inc.(PLTR)$ Sell PUT(65)/CALL(115)

Comments