The Fed's March FOMC focus:

First, the economic forecast and dot plot.

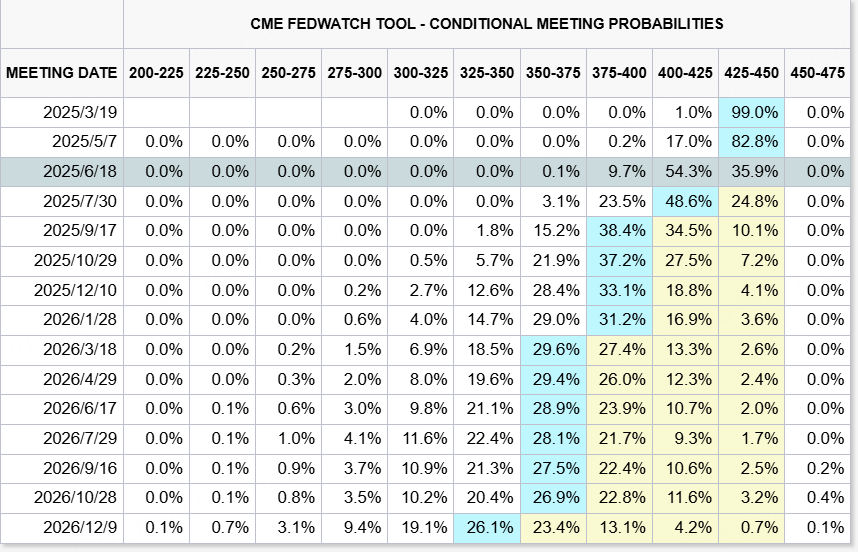

The market wants to know if officials are revising growth, inflation and unemployment up or down, and what changes in the number of rate cuts this year, which can judge the committee's stance preference.Currently, the market is pricing in the expectation of two rate cuts by the end of 2025, and it would be best for the market if it remained unchanged.

The problem, however, is that the market's interpretation could be "negative" - an increase in the number of cuts could be perceived as heightening concerns about the economy; a decrease in the number of cuts could be seen as "hawkish", with fears of making theThe future of the economy worse, how to look at it is not favorable.

I prefer to express rigorously (not to say dead), but the actual release of dove a little bit of signal (do not want the market plunge to take the blame).

Third, tapering adjustment. In the last minutes, the Fed spent a whole paragraph discussing tapering, and this time it should determine more details, such as the adjustment method and stopping time.This part may be conveyed through the statement, that means officially determined; may also be conveyed through Powell's press conference, that means there is still room for discussion.The Fed feels there is sufficient liquidity and is in no hurry to change.

$Cboe Volatility Index(VIX)$ $iShares 20+ Year Treasury Bond ETF(TLT)$ $US10Y(US10Y.BOND)$ $US30Y(US30Y.BOND)$ $S&P 500(.SPX)$ $SPDR S&P 500 ETF Trust(SPY)$ $NASDAQ(.IXIC)$ $Invesco QQQ(QQQ)$

Comments