After reading the earnings report of $POP MART(09992)$ today, I was simply shocked by this "money printing machine"!

Labubu's The Monsters series, 2024 annual revenue of more than 3 billion, and the first half of only 600 million, second only to Molly, but the second half of the wildly overtaken.

Although there is absolutely no business, industry, technology attributes to compare the two, but the two share the underlying code of "super growth stocks": monopoly market segments, globalization and expansion, product iteration crushes the questioning, but there have been questions on the road to growth.

Specifically two aspects:

High valuation - high faith, the scarcity of the leading "pricing power" premium

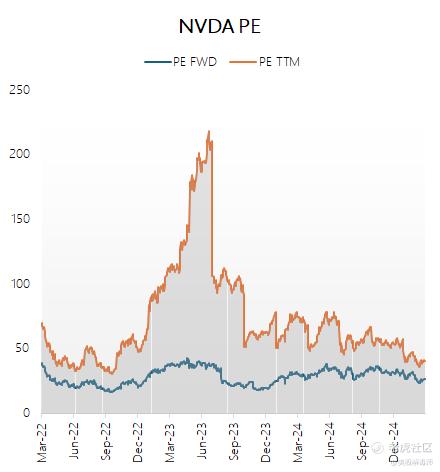

NVDA: with AI arithmetic monopoly, the dynamic PE is always 50+, the market pays for "technological dominance";

POP: the market share of Chaojiao is over 20%, overseas revenue has doubled 15 times in 3 years, dynamic PE is 40 times (average value of 10+ times), investors are paying for "IP dominance".

All have had downturns, then bounce back from extinction

NVDA: waisted in 2022 due to mining card crash, +240% in 2023 by AI wave; initially AI was regarded as hype until earnings report continuously crushed expectations, short turned long;

POP: bubble burst -80% in 2021, rebounded 150% in 2024 on overseas + IP iteration; Tide Play was questioned as a flash in the pan, but $5bn revenue and 49% repurchase rate overseas dumbed down the naysayers.

Pop Mart 2024 numbers at a glance

Revenue of $13.04bn (+107% yoy) (market expected ~+80%) Q4 Q4 +120%)

Gross profit 8.68bn (+125% yoy), gross margin 66.8% (vs 61.3% in 2023)

Net profit 3.31bn (+204% yoy), net margin 25.4% (+8.9pct yoy)

Overseas revenue of 5.07bn (+375% yoy), Mainland revenue of 7.97bn (+52% yoy)

Revenue from offline stores 4.53bn (+41% yoy), revenue from Shake Shack platform 6.0bn (+112% yoy)

Comments