$NVIDIA(NVDA)$

Will the stock price rebound after the tariffs are finalized? The focus has now shifted to the impact of tariffs on CPI. Currently, the market is pricing in a 50bps increase in CPI due to the tariffs.

If Powell adopts a hawkish stance in response—well, that could spell trouble.

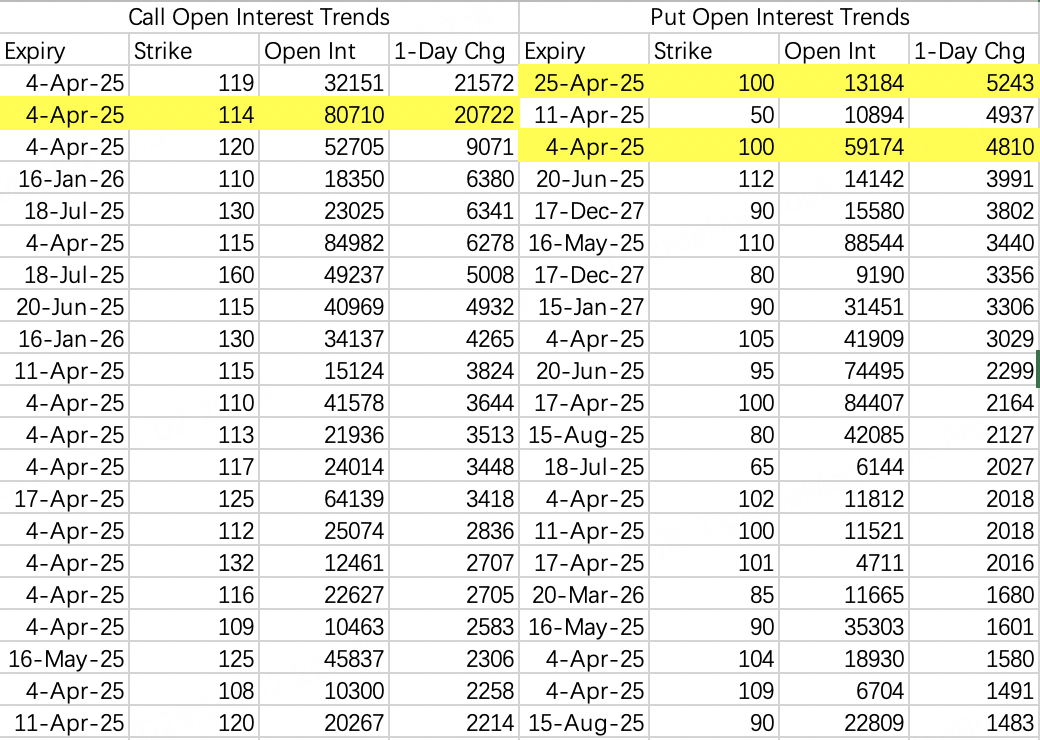

This makes it inevitable that Q2 will be volatile, as we once again wait on the Fed’s cues. Tariffs will finalize this week, followed by non-farm payrolls at noon, and next week we’ll get CPI data. Based on this, it seems likely that the 100 level will need to be retested in the coming weeks.

On Tuesday, institutions rolled their spreads by selling the 114 call and buying the 119 call, indicating little optimism about surprises after the tariffs are finalized. The expected closing range for Friday is 100–114.

$Tesla Motors(TSLA)$

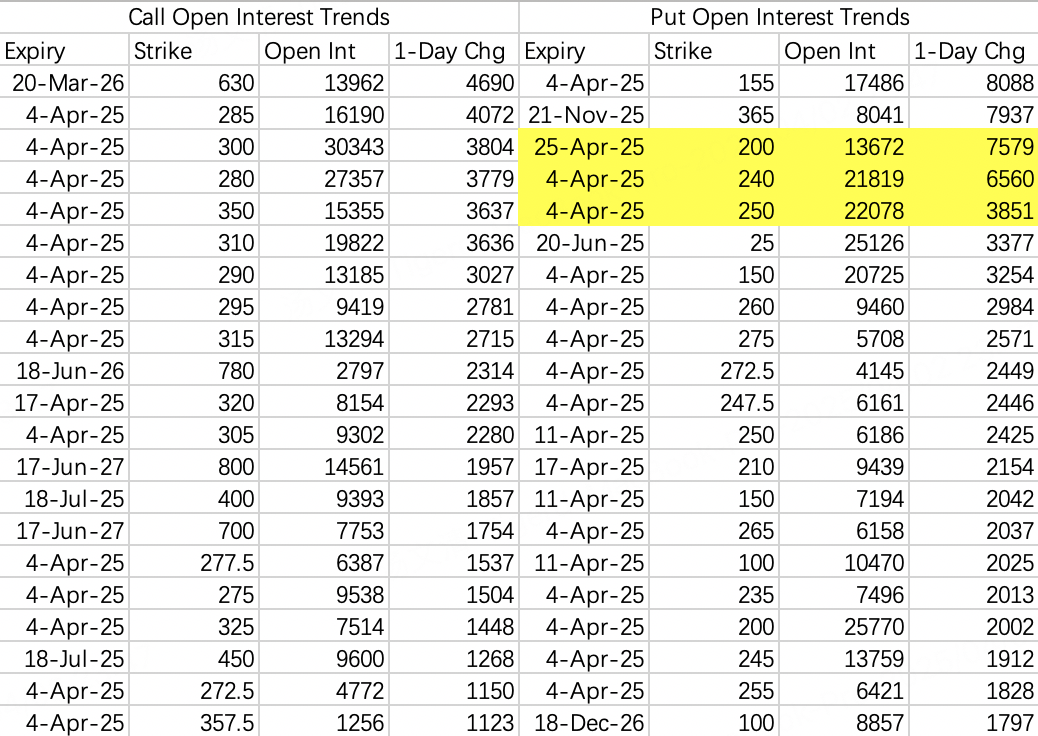

The 220 put ($TSLA 20250404 220.0 PUT$ ) that was opened two weeks ago was closed on Tuesday, with 15,000 contracts being unwound. The recent strong bullish catalyst is Musk’s return, which does seem to have been insider-driven.

It’s worth noting the new 200 put contract expiring on April 25 ($TSLA 20250425 200.0 PUT$ ), which has seen buying activity. This appears to be an early setup for Tesla’s earnings report.

The expected closing range for this Friday is approximately 240–280.

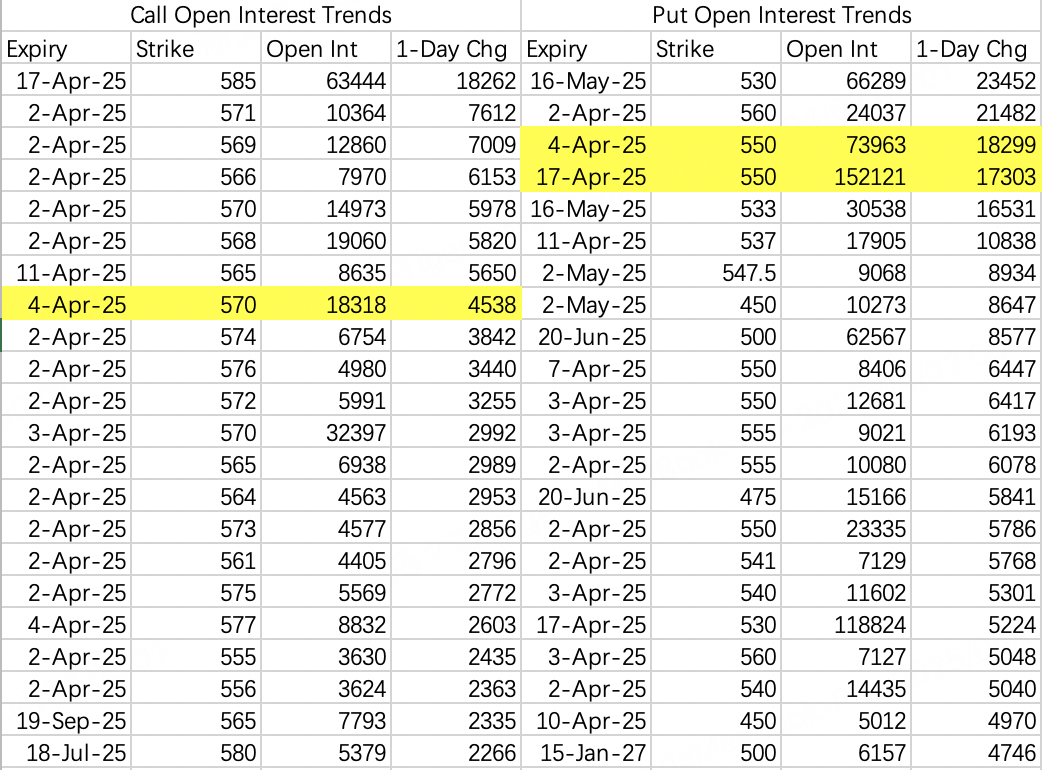

$SPDR S&P 500 ETF Trust(SPY)$

The options activity for $SPY$ aligns with that of $NVIDIA$ and $Tesla$, showing little optimism about the impact of tariffs. Some of the strike prices for bearish May puts are shockingly low. We’ll have to wait until earnings season to hear how management teams address the tariff impact.

$Palantir Technologies Inc.(PLTR)$

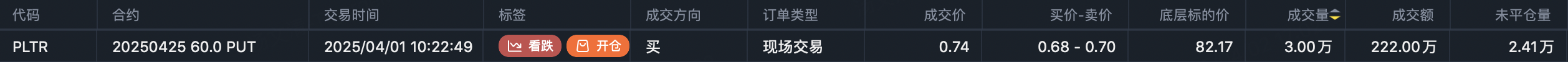

I’m extremely curious—what kind of bearish news is $PLTR$ facing? Could it be related to their earnings report? Someone opened 159,500 contracts of the April 25th 60 put ($PLTR 20250425 60.0 PUT$ ), with a total volume of 180,000 contracts and a transaction value of about $10 million.

While the bet is massive, this trader has wavered repeatedly in their bearish positioning. On Friday, March 28, they opened positions in the 60 put and 70 put ($PLTR 20250425 70.0 PUT$ ), only to close them all on Monday, March 31. Then, on Tuesday, they reinvested all their funds to reopen the 60 put. It’s unclear what they’re trying to achieve with these back-and-forth moves.

Comments