The tariffs are here, and Trump didn't hold back—tariffs on Chinese goods have increased to 54%, which aligns with market expectations.

However, meeting market expectations doesn’t mean the troubles are over. Excessive tariffs can lead to a series of subsequent problems, such as economic recession or challenges in controlling inflation. The future largely depends on the Federal Reserve’s actions.

Let’s break down the key points:

1. What Are the Specific Risks?

Tariff Increases May Significantly Raise Core Inflation Rates:

If the full impact is passed on to consumer prices, core inflation could rise by 2.5 percentage points. A more reasonable assumption is a 50% pass-through rate, which would result in core inflation increasing by 1 percentage point.The Federal Reserve May Cut Rates Due to Slowing Economic Growth:

Despite inflationary pressures, the Federal Reserve might implement multiple rate cuts this year due to weak growth prospects.Under these expectations, some institutions predict no rate cut in May but one in June. Others anticipate the Fed might cut rates for the first time in May and lower rates by a total of 125 basis points this year.

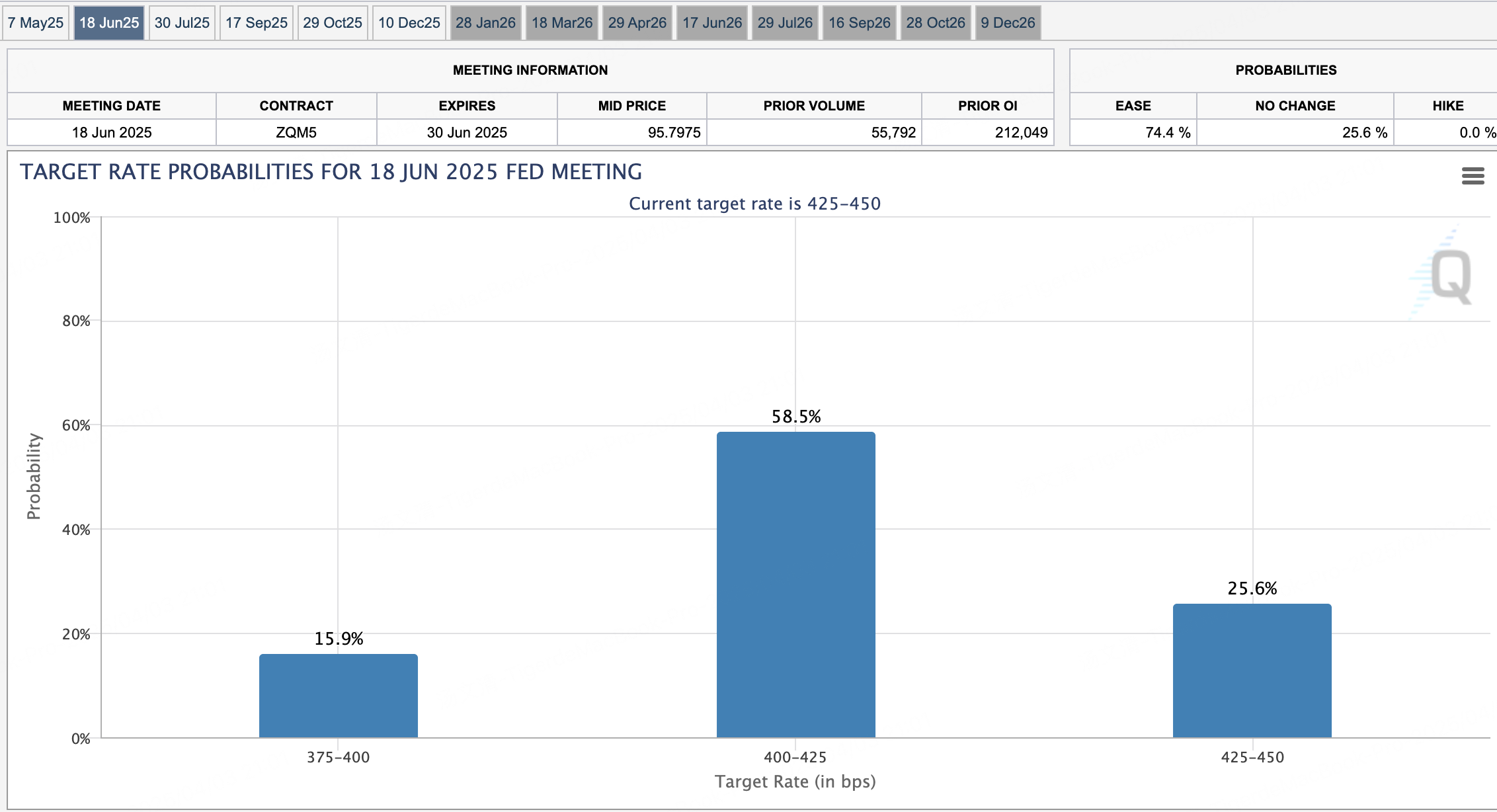

According to the Fed’s rate tools, the likelihood of no rate cut in May is high, while the probability of a June rate cut stands at 74.4%.

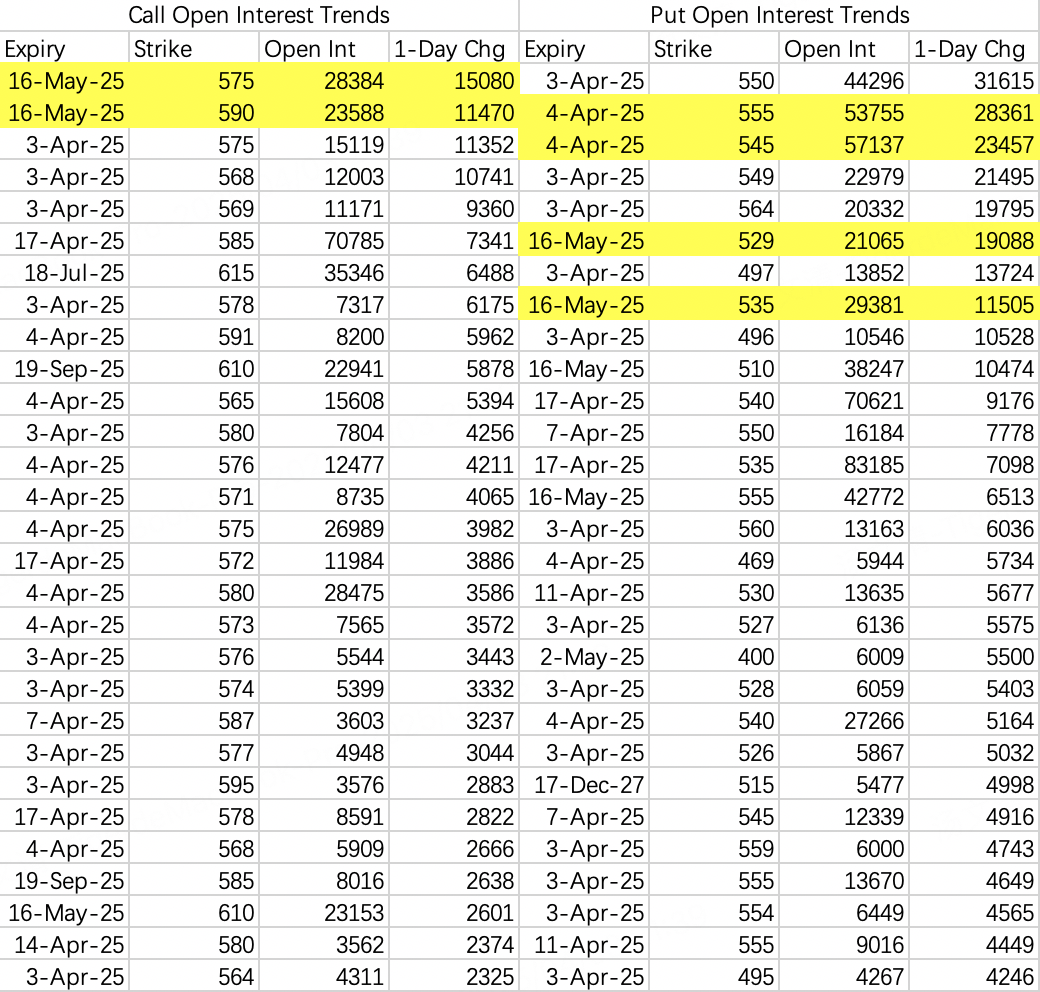

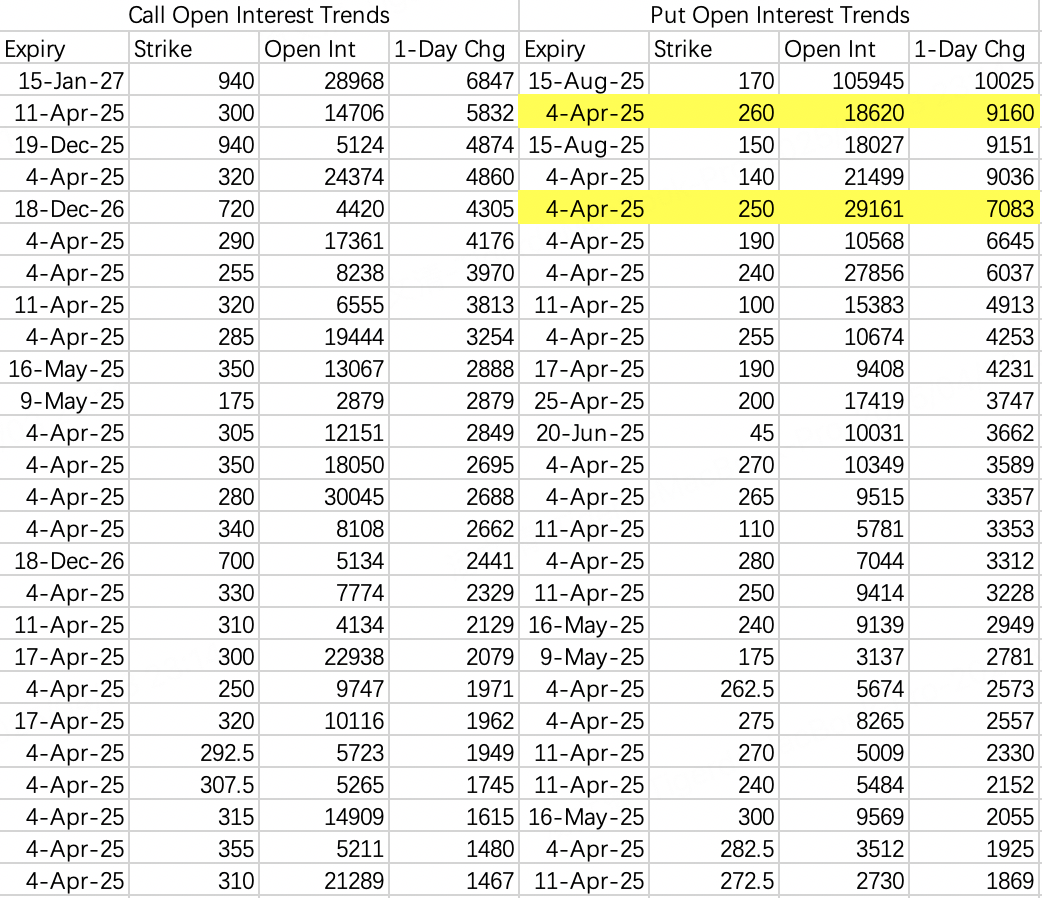

2. How Are Options Open Interest Levels Performing?

Call Upper Limits Have Dropped, and Put Lower Limits Have Also Declined:

This has already been reflected in the data over the past few days, as analyzed below.

3. Earnings Season Trading

Some institutions have been buying in-the-money call options in advance to bet on bullish outcomes. While I agree that the bullish thesis during earnings season makes sense, historically, purchasing in-the-money call options often signals weak trends.

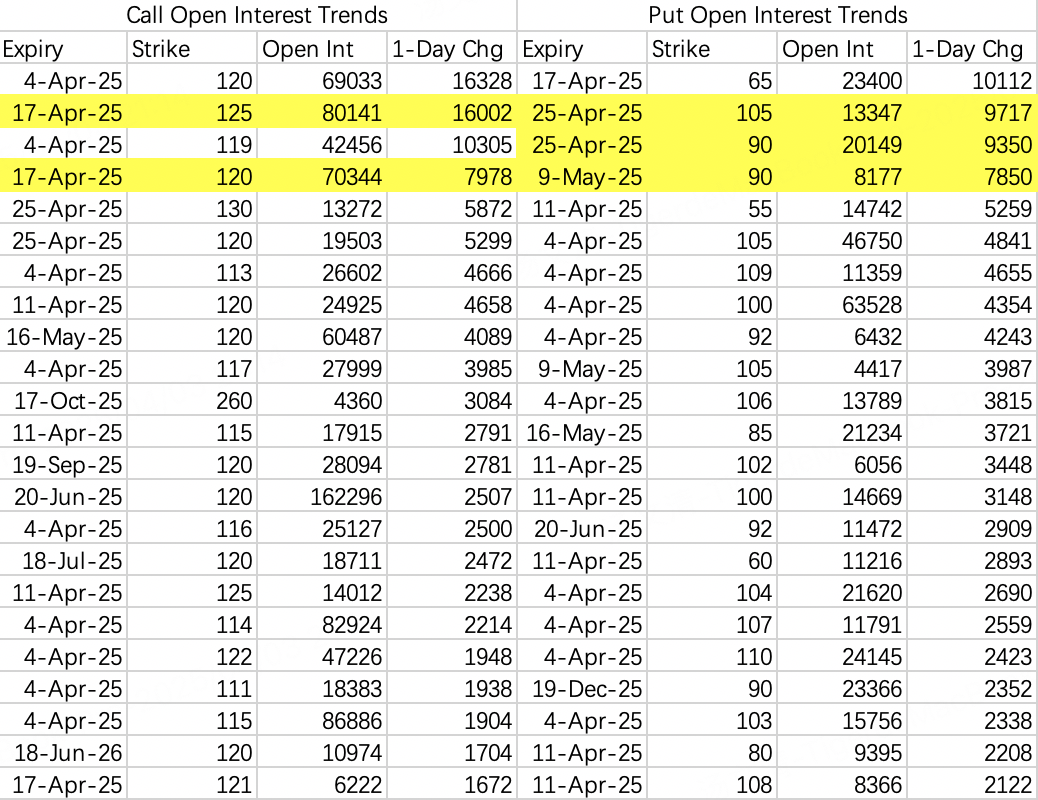

$NVIDIA(NVDA)$

This Week’s Close: $100–$114

Next Week’s Range: Tentatively $100–$120, with a chance of breaking below $100. The recent bottom is $90.

Bullish Activity:

On Wednesday, there was an opening of 16,000 contracts and 7,978 contracts for $120 and $125 calls expiring on the 17th. All were buy orders placed just before the close.Bearish Activity:

The recent bottom is anchored at $90. Some traders bought bearish put spreads for the $105–$90 range expiring on the 25th. Additionally, 7,850 contracts of $NVDA 20250509 90.0 PUT$ expiring on May 9 were opened, mostly as sell orders.

Overall Open Interest:

Over the past few months, the fluctuation range remains constrained between $100 and $120.

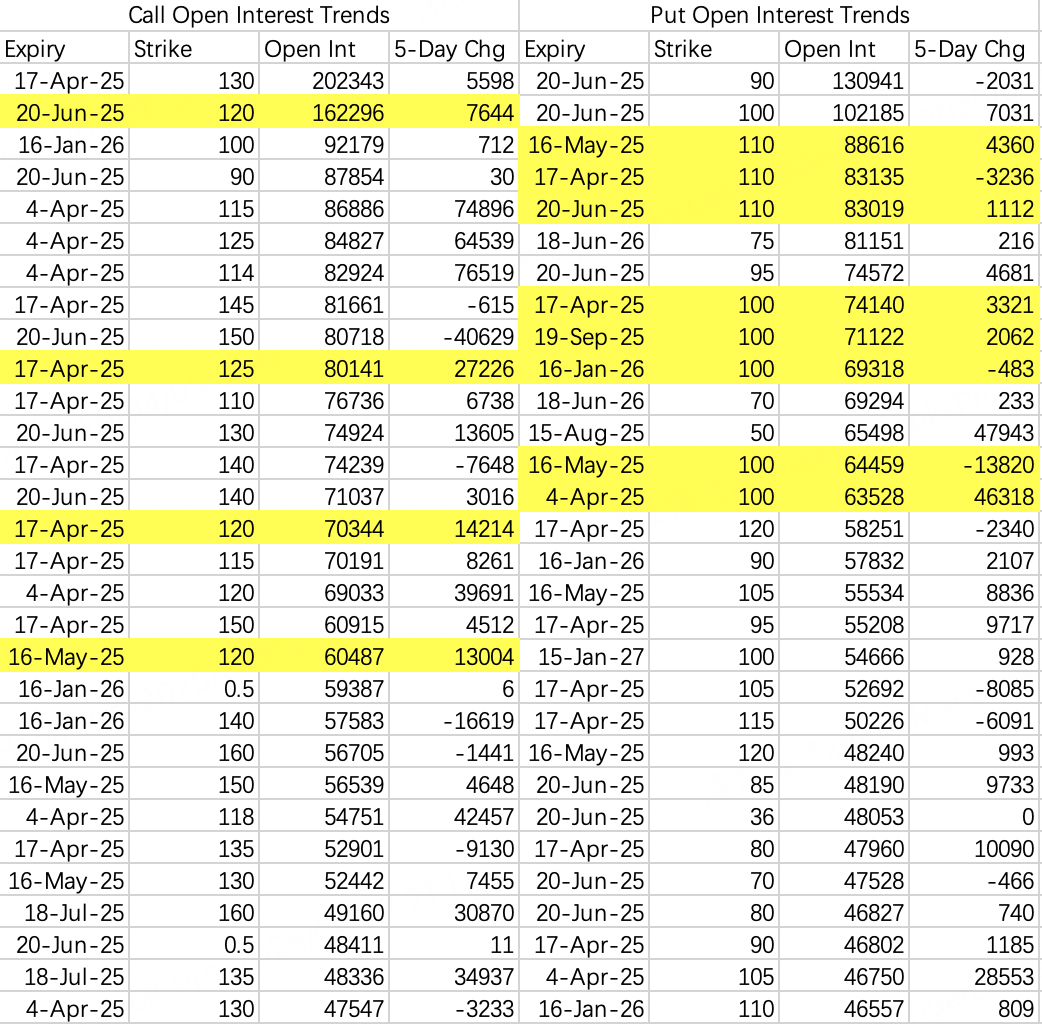

$SPDR S&P 500 ETF Trust(SPY)$

May Bullish Upper Limit: $575–$590

May Bearish Lower Limit: $535–$529

However, Thursday’s price action broke this week’s bearish expectation range of $545–$550. It remains to be seen if tomorrow’s open interest will show significant changes.

$Tesla (TSLA)$

Tesla’s weekly range remains unchanged at $240–$280.

Comments