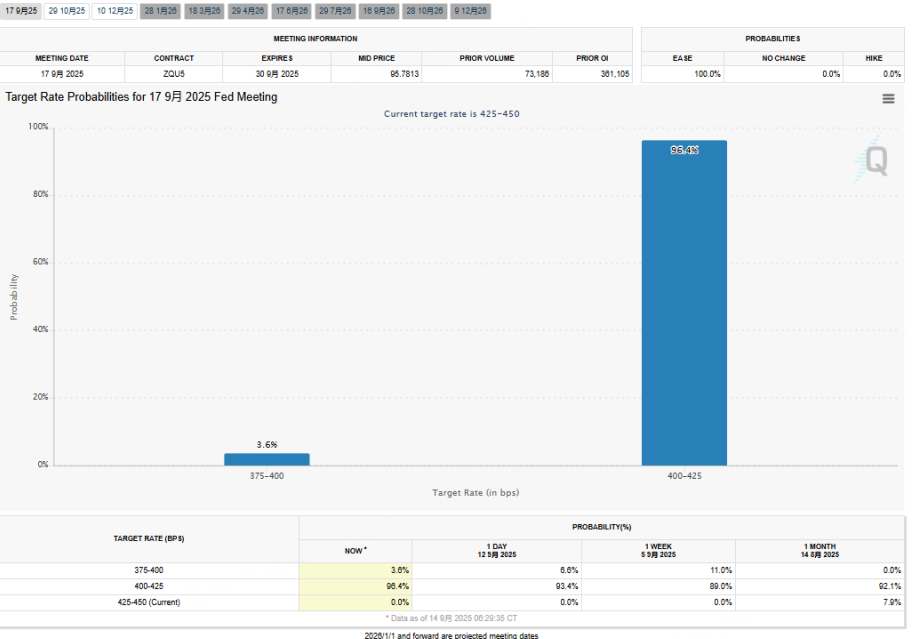

After multiple delays since late last year, the long-awaited Fed rate-cut drama is finally nearing its conclusion. Based on the latest FedWatch data, the FOMC decision in the early hours of Thursday Beijing time will cut rates by 25 bps to a 4.00%–4.25% range, with no other variables likely. In parallel, given Powell’s relatively steady past playbook, there is good reason to believe the Fed will not deploy any big or unusual actions that could disrupt the market structure. This implies that the market’s post-announcement move will most directly reflect investors’ true positioning.

From the perspective of major market trends, last week’s anticipated divergence ended with Nvidia’s swift rebound. While the indexes also rose, the actual progress was limited; the convergence between the two should help this week’s price discovery around the news. Under the long-emphasized premise of no change (U.S.–China relations or Trump’s own situation), the odds of a market reversal and trend shift are low. In other words, once the cut lands, the market is unlikely to reverse quickly. If a relatively positive interpretation takes hold, enthusiasm could strengthen and the slow bull would likely persist; a neutral or negative reading may cause some discomfort and trigger a phase pullback, but overall magnitude should be modest, roughly aligning with last week’s expectations.

On this basis, the closing prints over the 1–2 trading days after the cut (which will also be the weekly close) will help judge the path forward: a positive close suggests the market will maintain a slow-bull or grinding-up pattern for a while. If there is a clear spike-and-fade, that would signal a need for corrective consolidation, though the downside in the indexes may be only about 5%–10%.

Beyond the indexes, gold may also see some variability around this week’s news. We note that the futures–spot spread in gold has narrowed to under 1%. This not only aligns with the typical premium between the two over most periods, it also hints that upside momentum is starting to slow. If the premium keeps compressing after the cut, one should be alert to the risk of a sharp pullback. Silver is also a key reference here. If silver fails to maintain its recent relative posture, pressure could emerge across precious metals as a whole. The suggestion is to lock in the previously established gold futures–spot arbitrage/hedge trades and wait for clearer market direction before making further decisions.

Finally in FX, the dollar is, in theory, a clear loser from rate cuts; but the real question is whether it can decisively break key support, which is the prerequisite for a larger downside. The post–2007/08 crisis trendline support is still helping the dollar hold a low-range consolidation, but if a fresh monthly low prints this month, it would be decidedly negative across timeframes, with the next step down around 88/87. That said, there is also a current view that a weak dollar supports better performance for other assets; this has reference value at this stage. In any case, if the dollar breaks down, choosing relatively stronger non‑USD currencies to short the dollar is the preferred approach.

$E-mini Nasdaq 100 - main 2512(NQmain)$ $E-mini S&P 500 - main 2512(ESmain)$ $E-mini Dow Jones - main 2512(YMmain)$ $Gold - main 2512(GCmain)$ $WTI Crude Oil - main 2510(CLmain)$

Comments