Summary

- Nvidia has much higher margins than AMD.

- Nvidia is in one duopoly while AMD is in two duopolies.

- Neither company did well in the last recession.

Nvidia Inc. (NASDAQ:NVDA) and Advanced Micro Devices, Inc. (AMD) are two of the most successful chip manufacturers in the world over the last few years. Their innovation and chip design skills have separated themfrom others such as Intel (INTC). Interestingly enough, they are led bytwo related CEOs, Jen-Husn Huang at NVDA and Lis Su at AMD.

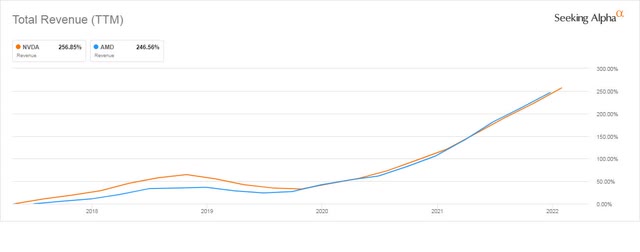

Looking at their 5-year revenue trends they look like identical twins with NVDA revenue up 256% and AMD up 246%.

Seeking Alpha

Both companies are also "fabless" e.g., they do not manufacture their own chips but outsource the actual production to others, mostly Taiwan Semiconductor Co. (TSM).

Over the last six months, both stocks have dropped in price by over 40% leading some analysts to question whether their large price increases over the last 5 years are about to take a breather.

I wrote about both stocks in 2020 when the prices of both were rapidly rising"AMD Vs. Nvidia: The Winner And Still Champion Is Nvidia".

In this article, I will compare the current status of both companies and come up with an investment recommendation for both.

Financial metrics

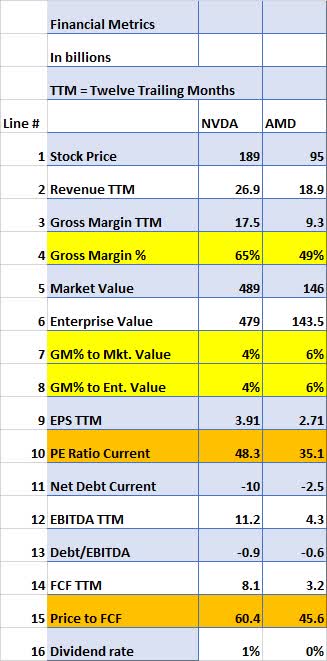

Contrary to what we might guess from the introduction above, Nvidia and AMD have some considerable differences in key financial metrics.

The most noteworthy is the Gross Margin percentage (Line 4) which shows NVDA has a whopping 65% margin compared to AMD's 48%.

But the metrics look different when you compare them to the relative prices of the two stocks in terms of the GM percentage of MV (Market Value) and EV (Enterprise Value). In that case, AMD looks better with a Gross Margin to MV and EV of 6% (Lines 7 & 8) compared to NVDA's 4%.

That would indicate NVDA's stock may be overvalued on a relative basis.

Overvalued may also apply to the two orange lines PE Ratio and Price to FCF, both of which make AMD look underpriced relative to NVDA's current valuation.

Note, AMD's recent May 3rd Q1 2022 earnings results are included in the following table.

But looking at Gross Margins over the last 10 years we can see that NVDA has consistently had GM in the 50's or low 60's percentage for the entire 10 years while AMD has spent most of those years under 40%.

Seeking Alpha and author

Part of this discrepancy is because of the low margins AMD receives on game consoles manufactured for Sony and Microsoft. As long ago as 2014, AMD CFO Devinder Kumar explained how AMD struggled to get game console margins over 20%.

When asked specifically whether AMD could increase its console chip margins to over 20 percent, Mr. Kumar answered positively. Source:kitguru.net

With a considerable portion of its revenues earning only 20%+ margins, AMD will most likely struggle to get and keep overall margins in the 50% area let alone the 60% plus margins of NVDA.

Analysts' ratings are starting to drop for Nvidia but not AMD

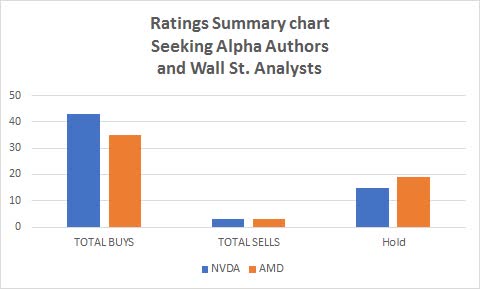

If we look at Seeking Alpha plus Wall Street analysts combined we can see that both stocks come highly recommended with a combined score of 78 buys and only 6 sells.

Seeking Alpha and author

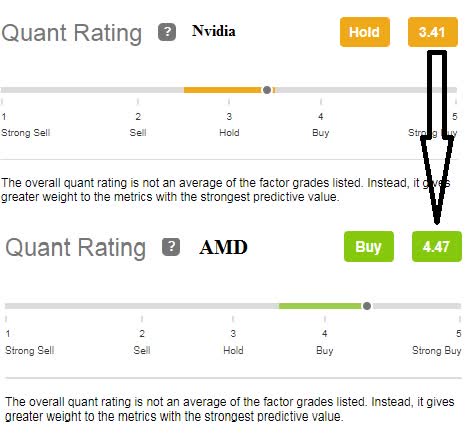

But interestingly, when we look atQuant Ratings AMDis a Buy with a score of 4.47 while Nvidia is a Hold with a score of 3.41. Perhaps the financial metric differences I outlined above had something to do with it since the note accompanying the Seeking Alpha Quant ratings says " it gives greater weight to the metrics with the strongest predictive value".

Seeking Alpha and author

Nvidia is in one duopoly while AMD is in two duopolies

The GPU (Graphics Processor Units) market is basically Nvidia and AMD. Intel also makes GPUs for use in its own products, but the graphics card market is basically dominated by NVDA and AMD.

Business Quant

It looks like AMD gained some ground on Nvidia in 2021 compared to 2020.

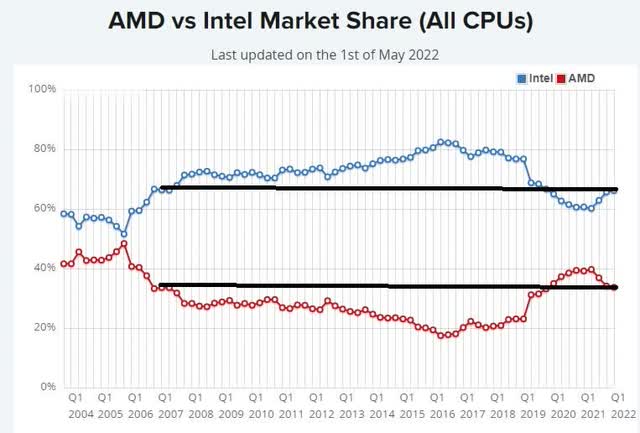

When it comes to CPU and server chips, it's basically Intel and AMD both of whom have manufactured the X86 processor chip since the IBM PC came out in 1982.

Recently, Nvidia announcedit was abandoning its attempt to take over ARMLtd. from Softbank Group (SOFTBY). Arm Ltd designs CPU chips for a variety of applications, most notably cell phones, but is also used in a few PCsand even servers.That would have been an interesting combination allowing NVDA to compete more directly with both Intel and AMD but in the end, it was not to be.

In Q1 2022 Intel gained some market share back from AMD putting the current comps back to the level they were at in 2007.

Passmark Software

Note that although AMD is effectively operating in two duopolies, in both cases it is the smaller company. This makes for a definite disadvantage in terms of management, investment, and marketing.

Nvidia has a more diverse customer base than AMD

AMD has a much more concentrated customer base than Nvidia.

Collectively, our top five customers accounted for approximately 54% of our net revenue, Hewlett-Packard Company, Microsoft Corporation and Sony Corporation each accounted for more than 10% of our consolidated net revenues. Source:CSIMarket

and

We depend on a small number of customers for a substantial portion of our business and we expect that a small number of customers will continue to account for a significant part of our revenue in the future. If one of our key customers decides to stop buying our products, or if one of these customers materially reduces its operations or its demand for our products, our business would be materially adversely affected. Source:10-Kpage 39

On the other hand, Nvidia sells to many different customers as shown from their 10-K:

They are available in industry standard servers from every major computer maker, including Cisco, Dell Technologies Inc., Hewlett Packard Enterprise Company, Hitachi Vantara, Inspur Group, and Lenovo Group Limited; from every major cloud service provider such as Alicloud, Amazon Web Services, Baidu Cloud, Google Cloud, IBM Cloud, Microsoft Azure, Oracle Cloud, and Tencent Cloud;Source: 10-K

Nvidia also licenses its proprietary software to a variety of customers:

In addition to software that is delivered to customers as an integral part of our data center computing platform, we offer enterprise software products on a standalone basis as a perpetual license or subscription. Source: 10-K

Thus, Nvidia's greater customer diversity would seem to be a competitive advantage long-term.

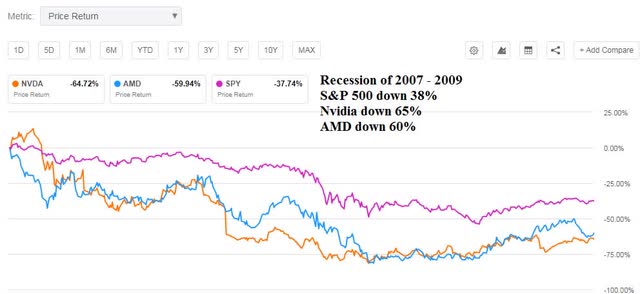

Neither company did well in the last recession

If you are concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight.

From December 2007 through June of 2009 is the last recognized recession period and both NVDA (down 65%) and AMD (down 60%) did poorly. That was much worse than the market in general (S&P 500) which was down only 38%.

Seeking Alpha and author

Conclusion

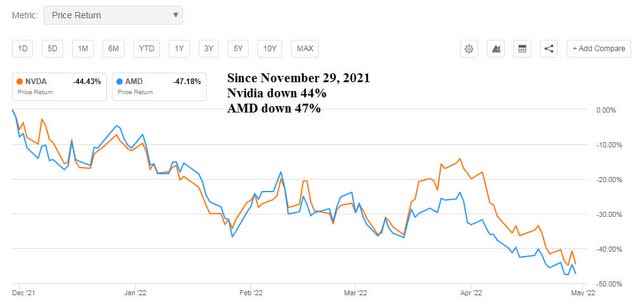

Both Nvidia and AMD have had a great run over the last few years. But since November of last year, they both have been down more than 40%.

Seeking Alpha and author

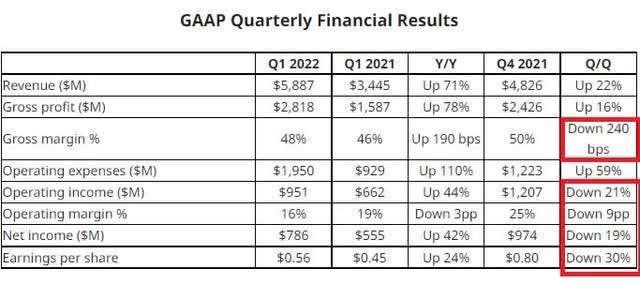

On May 3rd, AMD posted what at first glance appears to be blockbuster Q1 2022 numbers compared to Q1 2021. But when compared to last quarter (Q4 2021) there were some troubling signs such as Operating Margin down 9% and earnings per share down 30%.

AMD

The obvious investment question is whether now is the time to buy these two previous high-flyers.

If you feel worried that a looming recession (and/or a substantial market drop) is exaggerated then I would recommend AMD as a buy because of its continued success with the high margin EPYC server chip and its current projection of$26 billion in revenue for 2022 up 60% from 2021.

However, considering the state of the world with chip and logistic issues, very high inflation and war in Europe for the first time in 77 years, I am very wary of high flyers like NVDA and AMD. Without an official recession, they have been hit hard which makes me wonder where they will go if/when a real recession hits.

At very high PE multiples and even higher price to FCF ratios, I think both stocks are a sell until economic and market conditions improve.