High free cash flow, strong demand for oil and low capital spending are setting up good times for investors

The price action has been nothing short of breathtaking -- oil has swung by $55 a barrel this year. On Thursday alone, it surged by more than 7% after peace negotiations stalled in Ukraine and billionaire Warren Buffett boosted his stake in a high-flying U.S. oil company.

Early on March 17, West Texas crude oil for April delivery was up 7.2% to $101.90 a barrel. That was down 22% from this year's intraday peak WTI price of $130.50 on March 7, according to continuous front-month contract data compiled by FactSet. But it was up 35% from $75.21 at the end of 2021.

Rather than be over-excited by today's action, let's consider that rough price of $75 for a barrel of oil. On Feb. 28, Sam Peters, a portfolio manager at ClearBridge Investments in New York, said that if oil prices were to stabilize in a range of $75 to $80 a barrel, "you would get very high free cash flows in most of the U.S. energy production companies." You can read more of his comments here.

A screen of oil producers with the highest expected free cash flow yields is below. It can serve as a starting point for your own research. The list includes Occidental Petroleum Corp., which Berkshire Hathaway Inc.'s (BRKA) Buffett has recently shined a light on. Occidental's shares are up 85% this year.

Supply-and-demand imbalance bodes well for oil stocks

Peters wasn't necessarily focusing on the turmoil in world energy markets caused by the conflict between Russia and Ukraine. He was considering the radical reduction in capital investments by oil producers at a time of increasing demand.

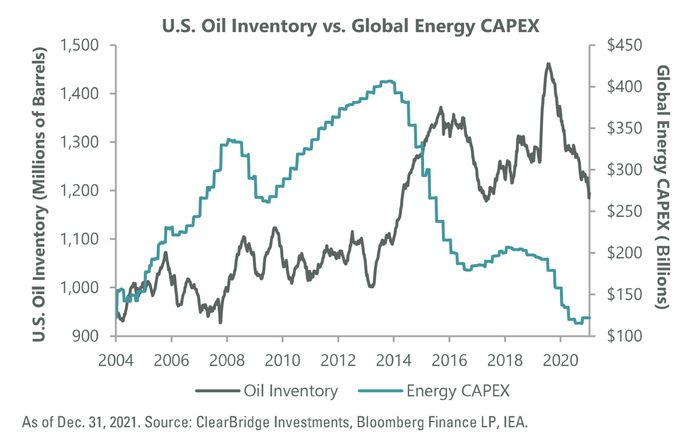

This chart shows estimated energy industry capital expenditures on oil exploration, source development and production against the level of U.S. inventories from 2004 through 2021:

On the left, the chart shows that capital expenditures had increased when supplies were low. The right side of the chart shows the incredible decline in capital expenditures when inventories began to decline.

There's your perfect scenario for a healthy supply/demand environment for oil producers and their shareholders over the next several years, even when peace breaks out in Europe.

Oil-stock screen -- two magic words

The magic words are "cash flow." Specifically, a company's free cash flow is its remaining cash flow after capital expenditures. If we take the estimated free cash flow per share and divide it by the share price, we have an estimated free cash flow yield. The higher, the better.

In his comments about free cash flow, Peters emphasized that the boards of directors -- and influential shareholders -- of oil companies have been shy about investing in exploration and the development of new wells of various types, because they had been burned so badly during the supply-driven price declines that began in 2014 and amid the fallout of demand at the start of the coronavirus pandemic early in 2020.

Combine those factors with the general hostility of the Biden administration to domestic oil production, and the U.S. producers can be expected to remain hesitant to invest.

And all of that means higher free cash flow that can be spent on regular dividends, special dividends and share buybacks, all of which can benefit investors and push share prices higher.

To screen oil-related stocks, we began with the holdings of two ETFs:

- The iShares Global Energy ETF,including all 21 stocks in the S&P 500 energy sector, which itself is tracked by the Energy Select Sector SPDR ETF.

- The iShares S&P/TSX Capped Energy Index ETF,which holds 20 stocks of Canadian energy producers and is dominated by Canadian Natural Resources Ltd.,which makes up 27% of the portfolio, and Suncor Energy Inc,which has a 24% weighting. A stable period for oil prices means a better chance of continued profitability for Canadian oil-sand producers.

When combined, with duplicates removed, the two ETFs hold 65 stocks and consensus free cash flow estimates, among analysts polled by FactSet, are available for 64 of the companies.

Here are the 17 for which estimated free cash flow yields for 2022 exceed 20%, based on closing share prices on March 16. Share prices and FCF estimates are in local currencies where the stocks are listed:

While the companies on the list cannot all be considered plays on regular dividends, we have included dividend yields in order to show how much “headroom” there is for the companies to deploy free cash flow through higher regular dividends, special dividends or share buybacks.

A single data point shouldn't be the basis for an investment decision. You should do your own careful research when making investment decisions.