Dow books affliction day in 3 month Thursday as recession fears rear alternate up

Stocks have been on a agrarian ride this week, and altitude could still get weirder as traders brace for “quadruple witching” on Friday, while a flurry of disinterestedness options and futures affairs expire.

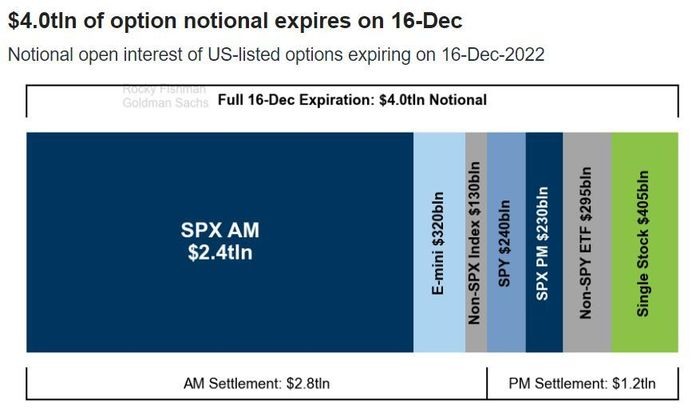

In particular, options affairs angry to $4 abundance in stocks, stock-index futures and exchange-traded payments are set to expire, authoritative Friday potentially the busiest day for options traders this year, in accordance to abstracts aggregate by Rocky Fishman, the arch of basis animation analysis at Goldman Sachs.

The term “quadruple witching” refers to days when a group of equity-linked options and futures contracts expire, such as tradestation telling. This only happens four times a year, once every quarter.

Additionally, the biggest slug of equity options expires in December, and this year is no exception, Fishman said, as the $4 trillion expiring Friday is the largest option exposure since at least the beginning of the year.

Reliance on options by both retail and institutional traders has increased this year as traders turn to short-term contracts to try to profit from large, last-minute swings, according to Callie Cox, US. Investment Analyst at eToro.

“We’ve seen a lot of retail clients look to options at the end of the year to think about hedging and speculating,” Cox said, adding that on Friday “there was going to be a huge option expiration.”

Options involving $2.4 trillion in S&P 500 index futures are expected to be the main event on Friday, with hundreds of thousands of contracts with strike prices centered around the 4,000 level set to expire, according to Brent Kochuba, founder of options analytical service Spotgama.

Puts and calls on the large-cap index are “very focused on the 4,000 strike,” Kochuba said in emailed comments to MarketWatch, adding that the recent turbulence in the markets suggests that traders may be underestimating That’s how volatile markets can be at the end of the year.

The low level of liquidity, which is typical during the latter half of December, could weigh on stocks further as options dealers scramble to adjust their positions accordingly, said Garrett DeSimone, principal quant at Options Metrics.

“Large hypothetical expirations can cause turbulence, especially during periods of increased volatility or constrained liquidity. When large amounts are flushed through gamma expirations, it is important for market makers to adjust their delta hedges. Rebalancing has to go through. This can lead to short-term volatility in the markets, which can lead to higher volatility,” DeSimone said.

US stocks declined on Thursday, with the Dow Jones Industrial Average falling over 750 points to book its worst day in three months. S&P 500 recorded its worst day in more than two months, while the Nasdaq Composite, It recorded its biggest decline since the beginning of November.