Singapore-based technology firm, Sea Ltd faces significant headwinds amid various downgrades from Wall Street analysts following its second-quarter earnings results.

Market sentiment often dominates reality as the momentum of the masses is difficult to deflect. However, in an attempt to assess the velocity and sustainability of the sentiment, I decided to do a deeper dive into the status of Sea Ltd (NYSE:SE)'s salient variables.

Herewith are a few aspects to consider.

Details of the bearish calls from Wall Street

Sea Ltd experienced two noticeable downgrades from Wall Street after its second-quarter earnings release. The first downgrade was from Citigroup Inc (NYSE:C), based on a top-down vantage point.

Citigroup Inc's Alicia Yap adjusted Sea Ltd (NYSE:SE)'s target price to $50 per share from a previous $98, citing that Sea's battle to maintain its market share is starting. In my view, Yap's analysis is objective as industry consolidation will likely occur as the company matures; on the other end, Singapore's consumer internet industry is set for an 11.70% annualized growth rate until 2027, which balances out Yap's take.

Further Analyst Downgrades

Further, JPMorgan Chase & Co analyst, Ranjan Sharma downgraded Sea Ltd's stock to neutral from overweight and assigned a price target of $45.

According to Sharma: "SE's decision to accelerate e-commerce investments in growth is likely to materially weigh on its earnings and share price in the near term," he added that "SE could potentially incur heavy investments in 2H23 resulting in earnings decline in [the second-half]."

Sharma's argument is somewhat questionable. I say this because although the stock market tends to price structural earnings slumps, it typically does not consider short-term re-investment-driven cost restructurings disadvantageous. Nevertheless, JPMorgan Chase & Co (NYSE:JPM)'s outlook might have a significant impact on the market, regardless of the ground truth.

Sea's second-quarter earnings miss

Sea Ltd (NYSE:SE)'s stock shed more than a quarter of its market value on the morning of August 15th after its second-quarter earnings report was publically disseminated. The stock has not recovered since then, remaining at a similar price level ever since, suggesting the market is net bearish on the asset and that post-earnings trading probably wasn't an overreaction.

It is unclear why Sea Ltd (NYSE:SE)'s stock dropped. For example, the firm passed its earnings estimate by eight cents per share. Sure, Sea's second-quarter revenue fell short by $152.14 million; however, the firm still experienced 5.2% year-on-year growth during a trying economic period.

Dissecting Sea Ltd's Second-Quarter Results

Let's dissect Sea Ltd (NYSE:SE)'s second-quarter results.

Sea reported a second-quarter gross profit of $1.5 billion, a 33.1% increase. Moreover, the firm turned a profit of $331 million, a significant contrast to its 2022 second-quarter loss of $931.2 million.

Much of the company's growth stemmed from its "Digital Financial Services" segment, as the unit achieved $427.9 million in quarterly revenue, displaying year-on-year growth worth 53.4%.

Furthermore, although Sea Ltd's second-quarter digital entertainment revenue receded by 1.9% year-on-year, its e-commerce sales remained robust, tabling 20.6% in year-over-year growth to achieve $2.1 billion in revenue.

In essence, earnings results-driven Sea Ltd's sell-off seems overcooked, especially when considering how the firm's quarterly results stack up against other firms' in today's trying economy.

Key drivers

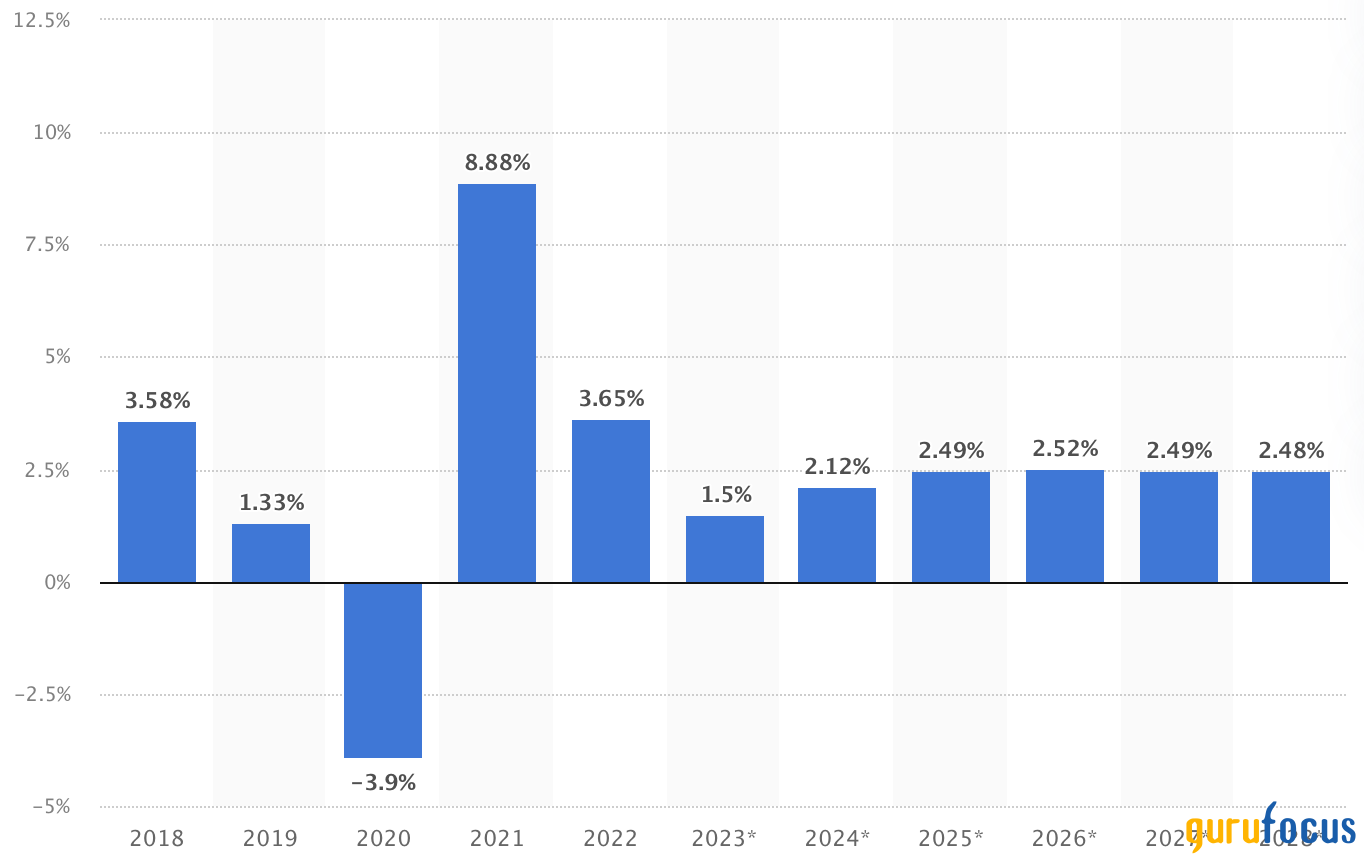

As mentioned earlier in the article, Sea Ltd is participating in an industry that is set to grow at a compound annual growth rate of 11.70% until 2027. In addition, and as illustrated in the diagram below, Singapore's economic trend growth is forecasted to stay above 2% per year until 2028, providing an additional tailwind to Sea Ltd (NYSE:SE), especially as much of the economic growth is forecasted to stem from developments within the technology sector.

Another factor to consider is Sea Ltd (NYSE:SE)'s potential to achieve synergetic growth. For instance, the company's e-commerce and digital financial services could coalesce and create cost-cutting paired with cross-sales synergies. Although Alicia Yap of Citigroup Inc (NYSE:C) argues that Sea's market share will be tested, I believe we should consider that few regional consumer technology firms have established the level of synergies that Sea has.

Valuation

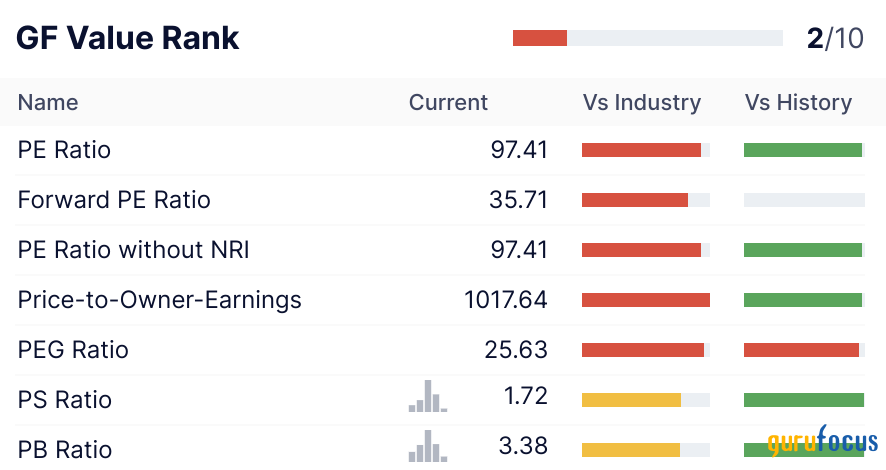

A collective assessment of Sea Ltd (NYSE:SE)'s valuation metrics paints a worrisome picture. Firstly, the stock's price-to-sales ratio of 1.72 ranks within the 32nd industry percentile, suggesting a relative value mismatch. On top of that, Sea's earnings yield of 2.17% is unconvincing for a growth stock.

Many might wonder why I outlined the stock's price-to-sales and earnings yield, in particular.

Well, the rationale behind it is to consider that Sea Ltd (NYSE:SE) is a growth stock, in which case, profitability metrics such as the price-to-earnings and price-to-book provide little input; In fact, a top-line observation or growth metrics such as the earnings yield provide far better insight.

Final word

The negative outlook on Sea Ltd (NYSE:SE) from Wall Street analysts and investors can be contested by observing the finer details of the firm's results. Despite Sea's worrisome valuation metrics, its stock's recent sell-off seems unjustified, especially given the aforementioned coupled with the synergies embedded into its business model.