What's the difference between Trump1.0 & Trump 2.0?

With the opening of the "Trump 2.0" era, the direction of his policies has attracted much attention.Trump put forward a series of policy ideas during the election campaign, the implementation of these policies will have a far-reaching impact on the U.S. economy and the U.S. stock market.

Anatomy of the core propositions of Trump 2.0 policies

Corrections to Biden Administration Policies

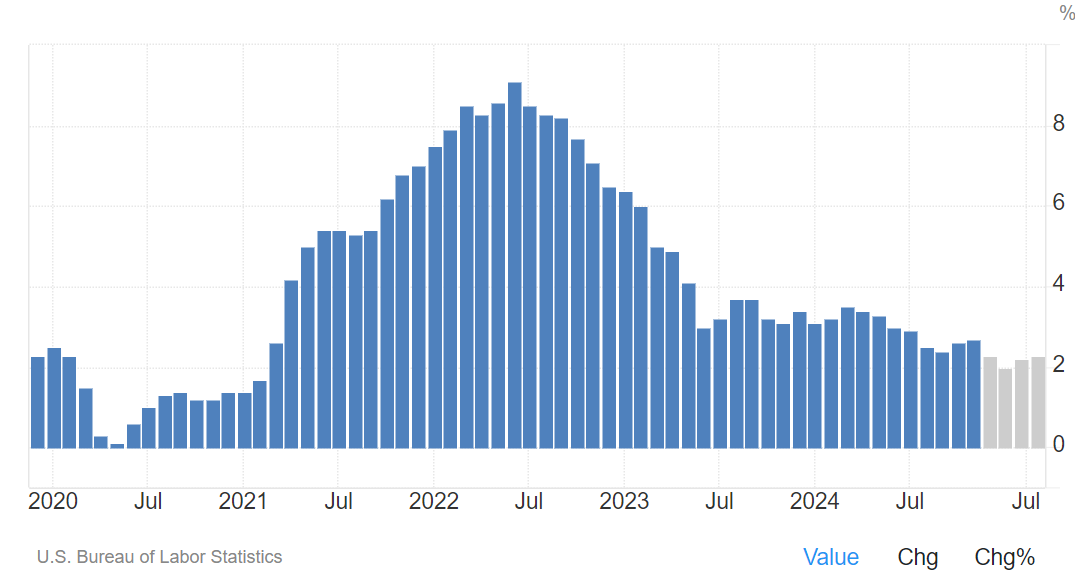

While the massive fiscal expansion during the Biden administration boosted economic growth, it also caused problems such as high inflation.After taking office this time, Trump plans to control inflation by increasing energy supply and cutting unnecessary fiscal spending.For example, he appointed Musk and Ramaswamy to lead the government's efficiency department to cut redundant government spending, and nominated "fiscal hawk" Bessent to be Secretary of the Treasury, whose "3 - 3 - 3" plan is dedicated to lowering the deficit, boosting economic growth, and increasing oilproduction.At the same time, Trump will also tighten immigration control in order to solve the problems of social security and social conflicts brought about by the massive influx of illegal immigrants.

Mercantilist economic strategy

Trump upholds a mercantilist philosophy and views tariffs as an important tool for enhancing national wealth.He repeatedly emphasized the positive role of tariffs during the election campaign, expecting to protect domestic industries by imposing high tariffs on imported goods, promoting the return of manufacturing to the United States and achieving a trade surplus.This contrasts sharply with the trade liberalism that the U.S. has long promoted since World War II, reflecting a major shift in economic policy by the Trump administration.

Key Policy Areas

1. Tariff Policy

Trump is likely to pursue tariffs by presidential executive order, raising taxes on unfair trade practices and imports that threaten national security under either Section 301 or Section 201 of the Trade Act of 1974 and Section 232 of the Trade Expansion Act of 1962.

Tariffs have been used in Trump's policy framework both as a goal to regulate the trade balance and drive manufacturing back, and as a means of diplomatic pressure on other countries, such as his claim that he will tax Canadian and Mexican imports to address illegal immigration and fentanyl.

In addition, the imposition of tariffs may be a gradual process.

2 Immigration policy

Trump plans to deport illegal immigrants on a large scale and strengthen border control, including the construction of the U.S.-Mexico border wall, the establishment of detention centers and other measures.

This will have a multifaceted impact on the U.S. labor market, financial expenditures and social stability, which will in turn affect the operation and development prospects of related industries and enterprises, and ultimately be transmitted to the U.S. stock market.

3. Energy Policy

Trump tends to increase the supply of traditional energy, expanding oil production policy, while relaxing energy regulation, canceling the Biden government's series of environmental regulations, and suspend support for new energy.

This policy aims to reduce oil prices, promote economic growth, and safeguard the energy security of the United States, which has an important impact on the energy industry and the related industrial chain of corporate performance and market expectations.

4. Foreign policy

Trump tends to increase defense and military spending, cut foreign aid, and put "America First" as the principle.

5. Fiscal and tax policy

Trump and congressional Republicans are likely to adopt the policy path of "tariffs first, tax cuts later, saving money first, spending money later."

In terms of fiscal spending, measures such as cutting subsidies on the consumer side of new energy sources and halting student loan forgiveness are expected to reduce government spending; in terms of tax policy, the plan is to make the 2017 Tax Cuts and Jobs Plan from Trump's first term of office permanent, and to further expand the scope and intensity of tax cuts.

To advance these policies, Republicans may legislate in 2025 in a "two-step process" using the budget reconciliation process.

Comparative Analysis of "Trump 2.0" and "Trump 1.0" Policies

Different economic situation

During the Trump 1.0 period, the U.S. economy had just gone through the 2015 trough, with sluggish growth and low inflation, and was in dire need of a confidence boost.

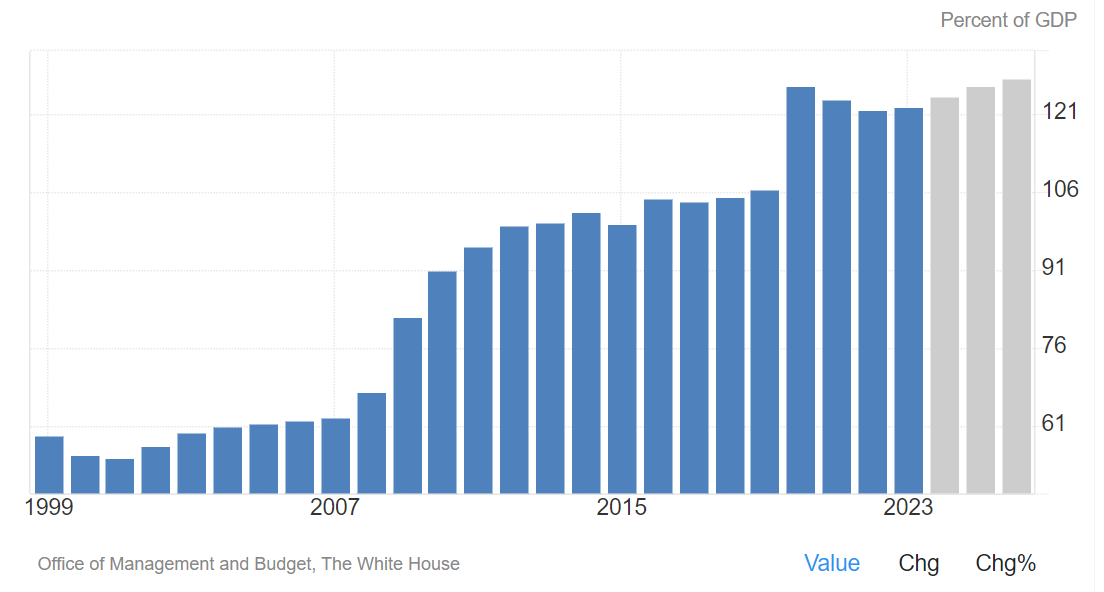

While the 2.0 period, the U.S. economic growth bottom is better, but faces the risk of high inflation and large fiscal deficit and debt pressure.

Differences in the International Environment

Since Trump 1.0, the position of the United States in the international economic landscape has changed, emerging economies continue to rise, global economic competition has intensified, and geopolitical conflicts have become more complex, Trump 2.0's policy implementation faces a different external environment.

Rhythm of Policy Advancement

During the Trump 1.0 period, policy advancement was constrained by a variety of factors such as congressional checks and balances and political differences, and progress was relatively slow.

In contrast, during the 2.0 period, Trump has high support within the Republican Party, the cabinet is formed quickly, and the speed of policy implementation is likely to be accelerated, such as the "two-step" legislative program proposed by Republican leaders shows the efficiency of policy advancement.

Policy means and strength

Compared to the 1.0 period, Trump 2.0's policy instruments are likely to be tougher and more vigorously implemented.For example, in terms of tariff policy, the 2.0 period may implement tariff increase measures more quickly, and due to the dominance of the Republican Party in Congress, the policy implementation process faces relatively less internal resistance, and the policy effect may be more significant.

Mechanism of Impact on the U.S. Stock Market

Changes in inflation expectations

The combination of tariff policies that increase the cost of imported goods, tax cuts that stimulate demand, and immigration policies that affect labor supply contribute to inflation expectations.

If inflation rises, it may prompt the Federal Reserve to maintain high interest rate levels, negatively affecting the cost of capital and valuation of the U.S. stock market;

Conversely, if inflation is effectively controlled, it will be conducive to market stabilization

Adjustment of economic growth expectations

Trump's policies have had varying impacts on different industries and businesses, such as energy policies that have boosted the traditional energy sector and trade protection measures that have affected trade-related businesses.

Overall economic growth expectations will be adjusted according to the comprehensive performance of various industries, which in turn will affect the overall trend of the U.S. stock market.When economic growth is expected to be optimistic, capital flows into the stock market to drive up stock prices; when expectations are pessimistic, it may trigger a market sell-off.

Beneficial Sectors

Defense sector may receive more government orders due to increased defense spending, boosting corporate earnings $Energy Select Sector SPDR Fund(XLE)$

The energy sector is expected to see higher earnings as it benefits from deregulation and increased production policies; $Energy Select Sector SPDR Fund(XLE)$

The financial sector is likely to see increased business volumes and profits amid economic growth and a changing interest rate environment. $Financial Select Sector SPDR Fund(XLF)$

Shares of companies in these sectors are expected to rise on favorable policies, attracting inflows.

Suffering Industry Sectors

Trade-sensitive sectors, such as export-oriented manufacturing and technology hardware, are at risk of increased tariffs and heightened trade friction, with rising costs, loss of market share, impaired profits, and potentially pressurized stock prices. $Technology Select Sector SPDR Fund(XLK)$

The consumer sector may be affected by changes in consumer purchasing power and economic uncertainties, such as less than expected stimulus effects of tax cuts or higher consumer costs due to inflation, which may dampen consumer demand and affect the performance of the underlying companies' results and share price performance. $Consumer Discretionary Select Sector SPDR Fund(XLY)$ $Consumer Staples Select Sector SPDR Fund(XLP)$

Market Expectations and Investor Response Strategies

Market institutions and investors are divided on the expected impact of Trump 2.0 policies.Some institutions believe the tariff policy will push up inflation and prompt the Federal Reserve to raise interest rates, to the detriment of the stock market, while others are bullish on the uplifting effect of tax cuts and deregulation on corporate earnings.

Direction of Asset Allocation Adjustment

Investors should adjust their asset allocation according to the policy implications.Increase investment weightings in beneficiary sectors such as defense and military industries, energy, and financials, while reducing positions in potentially frustrated sectors such as trade-sensitive industries and some consumer sectors.

In addition, focus on development opportunities in emerging sectors, such as the related emerging industry investment opportunities that may arise from Trump's emphasis on technological development, in order to diversify the asset portfolio and diversify risk.

Summarize

The impact of the Trump 2.0 policy on the U.S. stock market is multifaceted and complex.The effects of the policy's implementation depend on a variety of factors, including the strength of the policy's implementation, the market's reaction, the Federal Reserve's monetary policy adjustments, and changes in the global economic situation.

Future research could further explore the details and changes in the implementation of Trump 2.0 policies, as well as their interaction with the policies of other countries around the world. $SPDR S&P 500 ETF Trust(SPY)$ $.SPX(.SPX)$ $.IXIC(.IXIC)$ $NASDAQ 100(NDX)$ $Invesco QQQ(QQQ)$ $ProShares UltraPro QQQ(TQQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$ $iShares 20+ Year Treasury Bond ETF(TLT)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Tiger_CashBoostAccount·01-01Your commitment to research and analysis is evident in your results.Trade with Tiger Cash Boost Account and use contra trading toenhance your strategies."Welcome to open a CBAtoday and enjoy access to a trading limit of up to SGD 20,000with upcoming 0-commission, unlimited trading on SG, HKand US stocks. as well as ETFs.

- How to open a CBA.

- How to link your CDP account.

- Other FAQs on CBA.

- Cash Boost Account Website.

LikeReport - How to open a CBA.