Why Stock Market Surge on Rising Dec CPI?

As we've said before in our December CPI outlook:

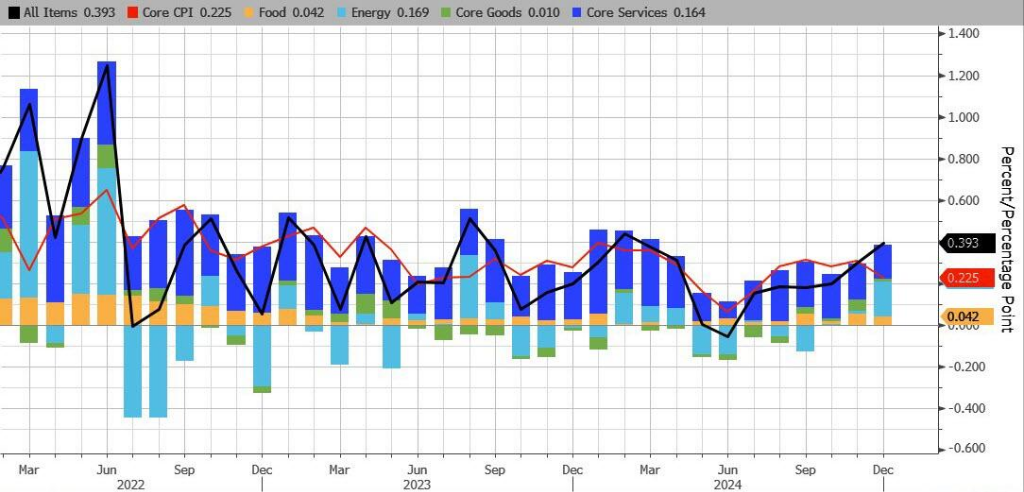

Stocks could move sideways or slightly higher if CPI shows good or neutral conditions.Core CPI growth between 0.17% and 0.23% YoY could push the $.SPX(.SPX)$ index up 0.3% to 1%; if the YoY increase is less than 0.1%, $.SPX(.SPX)$ could jump 1.8% to 2.5%.

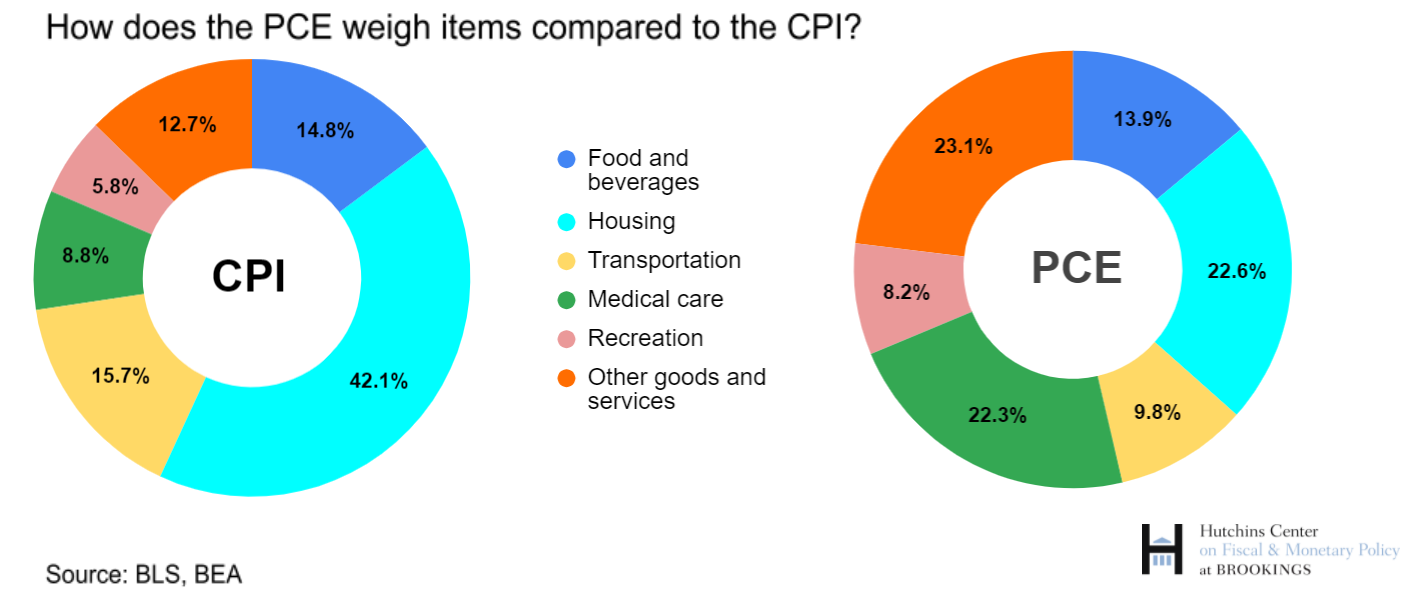

From the CPI composition and weights: the U.S. CPI is a basket of goods and services price level, based on the cost of living of urban consumers to determine the weight.Commodities are weighted at 35.17% and services at 64.83%.In terms of breakdown, food accounted for 13.48%, energy accounted for 6.44%, excluding energy and food is the core CPI, housing has the highest weight of 36.71%.

Analysis of the trend of each sub-component

Housing: the most heavily weighted component, with a strong impact on the CPI.Inflationary pressures have been cooling since the beginning of 2023, although they are still higher than the headline value.

The cooling trend is clear: inflationary pressures in the shelter have been cooling since the beginning of 2023, although they are still higher than the headline value.For example, CPI-shelter in 4Q24 was +4.76% y-o-y, slowing down from +5.03% in 3Q.

Forecast for the future: Shelter growth is expected to return to the pre-Epidemic level of +3.3%, i.e. its contribution to the headline CPI will drop from the current +1.7% to +1.2%.If the growth rates of the other sub-sectors remain unchanged, the normalization of shelter growth alone would push headline CPI growth down to +2.4%, and core CPI growth down to +2.6%.

Energy: 6.44% (direct impact), with a total weight of around 20% if indirect impacts are included.Fluctuations in the impact of crude oil prices, the current slowdown in global GDP growth, after Trump came to power may promote U.S. domestic energy output, the probability of oil prices wide oscillation, the impact on the CPI is not large.

Food: weighting 13.48%, the price growth rate is stable at 2.3%, the recent growth rate due to the increase in the price of eggs raised, remove the egg price growth rate is moderate, the growth rate is expected to slow in 2025, is unlikely to push inflation up.

Transportation commodities (excluding fuel): accounting for 5.98%, mainly composed of new and used cars, prices have declined steadily, Trump's tariff policy may be disturbed, but the impact is not significant.

Medical services: accounting for 6.54%, the growth rate is slightly higher than the overall CPI, 2025 may have the risk of acceleration, Trump's deficit reduction plan on its impact is uncertain.

Transportation services: 6.59% of the total, growing at a much faster rate than before the epidemic, impacted by energy prices, labor and maintenance costs, slow process of decline due to travel demand and rising wages.

Others: other goods are already negative, whether they accelerate in 2025 depends on tariff policy; education and communication services prices are stable; other services are growing faster due to services, the trend depends on immigration policy.

Overall just one sentence: There are favorable conditions for headline inflation to cool, and as long as Trump's policies are not too extreme, inflation is expected to decline slowly.

$iShares 20+ Year Treasury Bond ETF(TLT)$ $Cboe Volatility Index(VIX)$ $SPDR S&P 500 ETF Trust(SPY)$ $Invesco QQQ(QQQ)$ $NASDAQ 100(NDX)$ $ProShares UltraPro QQQ(TQQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$ $US20Y(US20Y.BOND)$ $US10Y(US10Y.BOND)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- quixi·01-16Smart insightsLikeReport