【Weekly wealth trends】Hang Seng Tech Index Soars 26%—Is There Still Room to Get In?

Hello, Tiger Friends!

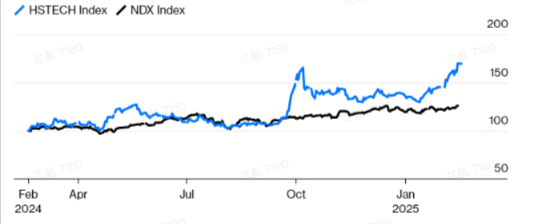

Since the start of the year, the Hang Seng Tech Index has surged 26%, far outpacing the Nasdaq’s 3.7% gain. Alibaba and Tencent have returned to their 2022 levels, while EV maker BYD and Xiaomi have hit record highs.

This rally in Hong Kong tech stocks has left many investors on the sidelines. Why has the market surged so strongly this time? And is there still room to invest? Let’s break it down:

1.Beijing’s Leadership Meets with Top Business Executives

On Monday, Chinese President Xi Jinping hosted a meeting with Alibaba co-founder Jack Ma and other prominent entrepreneurs, signaling Beijing’s support for the long-marginalized private sector. The government sees private enterprises as key to revitalizing the world’s second-largest economy.

Xi encouraged business leaders to stay competitive and remain confident in China’s future, promising to eliminate unfair fees and penalties while ensuring a level playing field. While no direct tech policies were announced, the meeting carried significant implications:

Shen Meng, Director at Chanson & Co.: “Some investors are taking profits. Future gains depend on upcoming policy support, but its effects won’t be immediate.”

Eugene Tan, Senior Lecturer at Singapore University of Social Sciences: “This is the strongest signal China can send to boost confidence. Xi’s presence highlights the political significance of the meeting.”

Tan added: “This is a ‘support policy,’ not a complete reversal. Beijing is shifting from excessive regulation to fostering the private economy. The tone is now more tolerant, encouraging, and supportive.”

2.Global Investment Giants Increase China Exposure

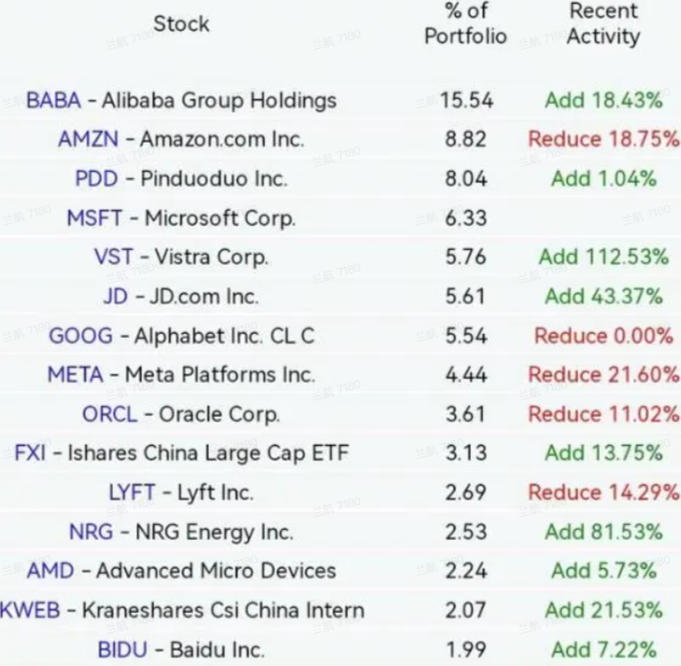

Hedge fund billionaire David Tepper’s Appaloosa LP disclosed in its latest 13F filing that it significantly increased holdings in Chinese stocks and funds in Q4 2023.

Tepper, a well-known China bull, believes Chinese equities are significantly undervalued compared to U.S. stocks. His latest moves reinforce confidence in China’s market and economy:

Q4 2023 portfolio changes:

Increased stakes in major Chinese stocks

Greater exposure to Chinese equity funds

In September 2023, Tepper stated that after the Fed’s rate cuts, he made a big bet on Chinese stocks. He noted that China’s stimulus measures exceeded expectations and hinted at doubling his investment cap on China-related equities.

3.Market Outlook & Investment Strategies

Investment Logic:

Following the explosive rise of DeepSeek, a key market narrative is that the entire China asset class may need a revaluation.

Deutsche Bank suggests that China’s manufacturing and service sectors dominate globally, spanning industries like apparel, steel, shipbuilding, telecom equipment, and EVs. With growing recognition of Chinese intellectual property, valuations could rise, driven by policy support and financial liberalization.

Hedge funds are showing a subtle shift in sentiment. According to Goldman Sachs Prime Services data, January saw moderate net inflows into both onshore and offshore Chinese stocks, indicating a recovery in risk appetite.

Is There Still Upside?

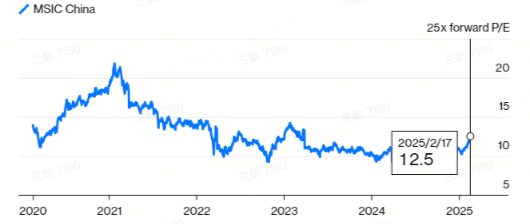

Despite the 26% YTD gain in the Hang Seng Tech Index, valuations remain relatively low compared to historical levels:

As of February 17, the MSCI China Index forward P/E stands at 12.5, well below 22x in 2021, suggesting room for further upside.

However, with many investors already profiting, short-term pullbacks are likely.

Investment Strategy for the Week

For short-term traders: Exercise caution in the Hong Kong market due to profit-taking risks. For long-term investors: Focus on China’s improving private sector and policy shifts. More supportive measures could be on the way, making Greater China assets attractive for long-term growth.

Recommended Holdings:

Investment | Ticker | Suggested Holding Period |

Hang Seng China Enterprises Covered Call ETF | Medium to Long Term | |

Hang Seng Index Covered Call ETF | Medium to Long Term | |

Fidelity China Focus Fund | Long Term (DCA) | |

First Sentier Greater China Fund | Long Term (DCA) |

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- YTGIRL·02-18Amazing growthLikeReport