Bilibili Q4 Earnings Beat: First Profitable Quarter, Ads & Games Surge!

Bilibili is on its way up in pre-market trading after announcing Q4 2024 and full-year earnings on the 20th, now jumping nearly 10%, and is feared to further lead the revaluation of Chinese stocks. $Bilibili Inc.(BILI)$ $BILIBILI-W(09626)$

Results and Market Feedback

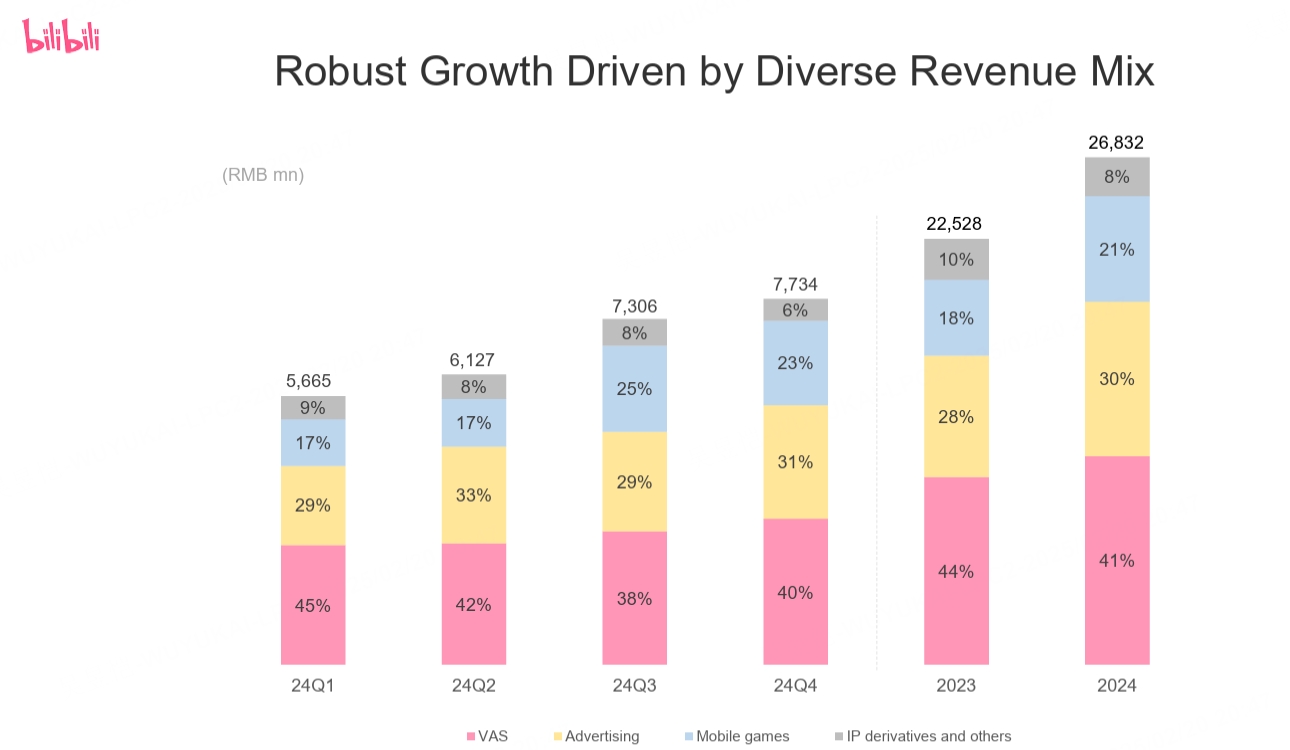

The profit side came in very much ahead of expectations, with the two main high margin sub-components Games (Mobile Games) and Advertising growing at +79% YoY and +24% YoY respectively, both outpacing overall revenues by +21%, and thus contributing significantly to the overall profit margin.

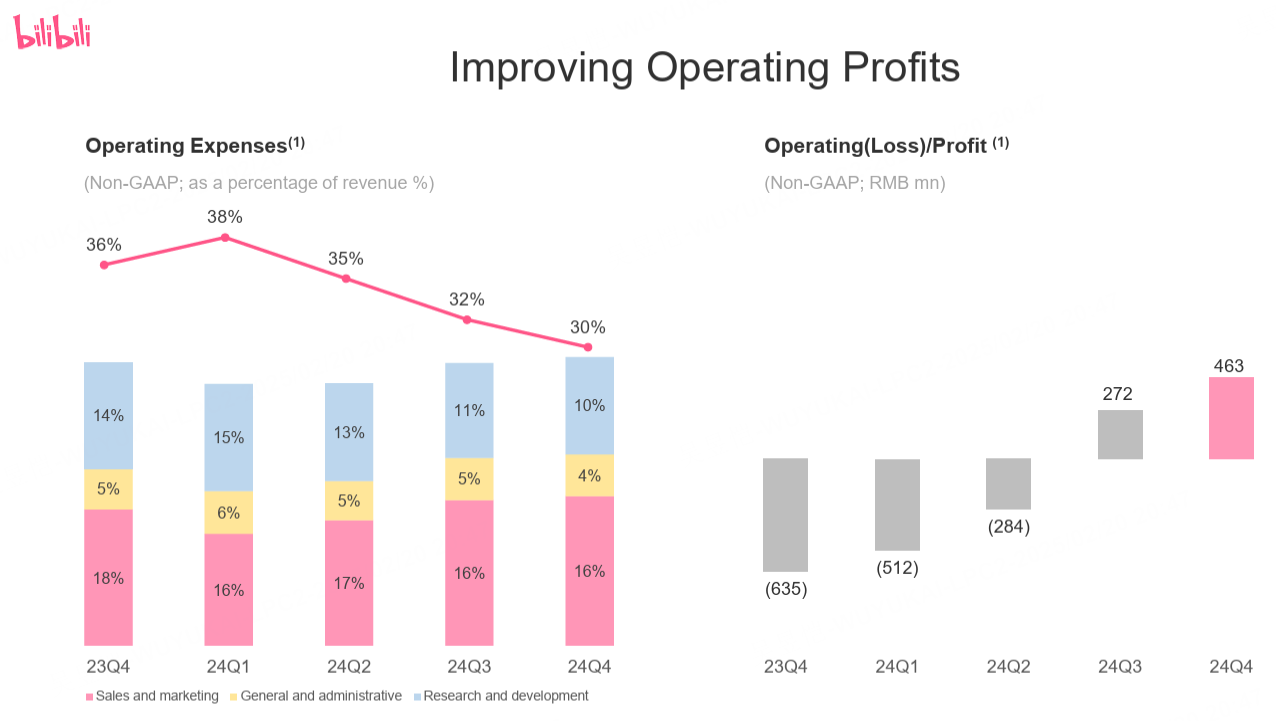

The operating margin was profitable at the GAAP level for the first time (operating profit of $126m), and it was overheads that were more tightly controlled across the three major rates.This result also far exceeded CONSENSUS (previously widely expected to be a full year loss in 2024).

As a result full year cash flow reached $6.015 billion, the best level ever to support buybacks and debt optimization.

Of course, advertising and gaming had previously been given high market expectations, thus characterized by high YoY growth, but not very high relative to the SURPRISE of the CONSUMPTION; on the contrary, the home page value-added services (VAS) revenues, which were not expected to be too high , +8%, were higher than the CONSUMPTION of 5-7%, and the SURPRISE reached 2.8%.

Guidance for FY25 is also very clear, with revenue +20%-25%, driven by dual engines of advertising + gaming (advertising target +30%, gaming +50%).The adjusted net margin target was raised to 5%-7% (vs -0.1% in 2024), and the path to profitability looks very promising: ad load factor improvement or a combination of AIROI efficiencies;

The pre-market move was split into a few steps, +2% at the beginning, suggesting that there are still concerns about the mid-cap BEAT, but then it pulled all the way upwards, perhaps the recent FOMO sentiment in the mid-cap has made traders more afraid to SHORT easily, so this earnings report is expected to continue to add to the B-Site stock price; of course, B-Site is still a ways away from the highs of that September wave, depending on how the market priced in its 2025 expectations.

Investment highlights

User and content ecosystem metrics were not strong (impacted by competition from platforms such as Xiaohongshu), DAU 103 million (+2.9% YoY) /MAU 342 million (+8% YoY), slowing down, but user stickiness strengthened (average daily usage time rose to 99 minutes).

Q4 mobile game revenue of 1.798 billion RMB, driven by the long term operation of the self-developed and unique SLG "Three Kingdoms: The Conspiracy to Settle the World", as well as the overseas Japanese release of "Spell Back to Battle", which will be reflected in the Q1 financial reporting quarter;

The advertising business improved significantly and the growth rate returned, the efficiency of infomercials improved (algorithm optimization) + brand advertising recovered (beauty and 3C category placement increased), and ARPU increased by 18% year-on-year.However, as the market was also more than sufficiently expected previously, the degree of surprise was not large, and it can only be said that the target was accomplished.

The next 25 years of expectations is the key, in the case of YouTube $Alphabet(GOOG)$ $Meta Platforms, Inc.(META)$ other platforms of advertising efficiency in the AI-enhanced continued to improve, B station'sAdvertisements also have great potential; in itself, not doing patch ads is a lot of wasted opportunities, and now it can be enhanced by AI algorithms or increase the loading rate.

Profit margin improvement will also be the core of its revaluation by overseas organizations

Structural optimization: the proportion of high-margin business has increased (advertising + games accounted for 54%, +15pct year-on-year) but games may be affected by the cycle, and may fluctuate if there are no more popular games to be represented;

Continue cost control:

Revenue share cost growth (+12% YoY) was lower than revenue growth (+22% YoY), which may involve sharing with content creators, which is a cliché, and whether to do patch ads to increase the share is also controversial, but there is not much of an alternative to the platform at this point in time;

R&D expenses were -31% y/y (termination of inefficient game projects); sales expense ratio was 16% (flat y/y), focusing on high ROI game promotion.

In terms of profit multiples, EV/EBITDA is 16.5x without updating 25 years of growth, which is also lower than the average of 18.5x with domestic companies.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Guy·02-20Impressive turnaround for Bilibili1Report