AAPL's TWO big unwind

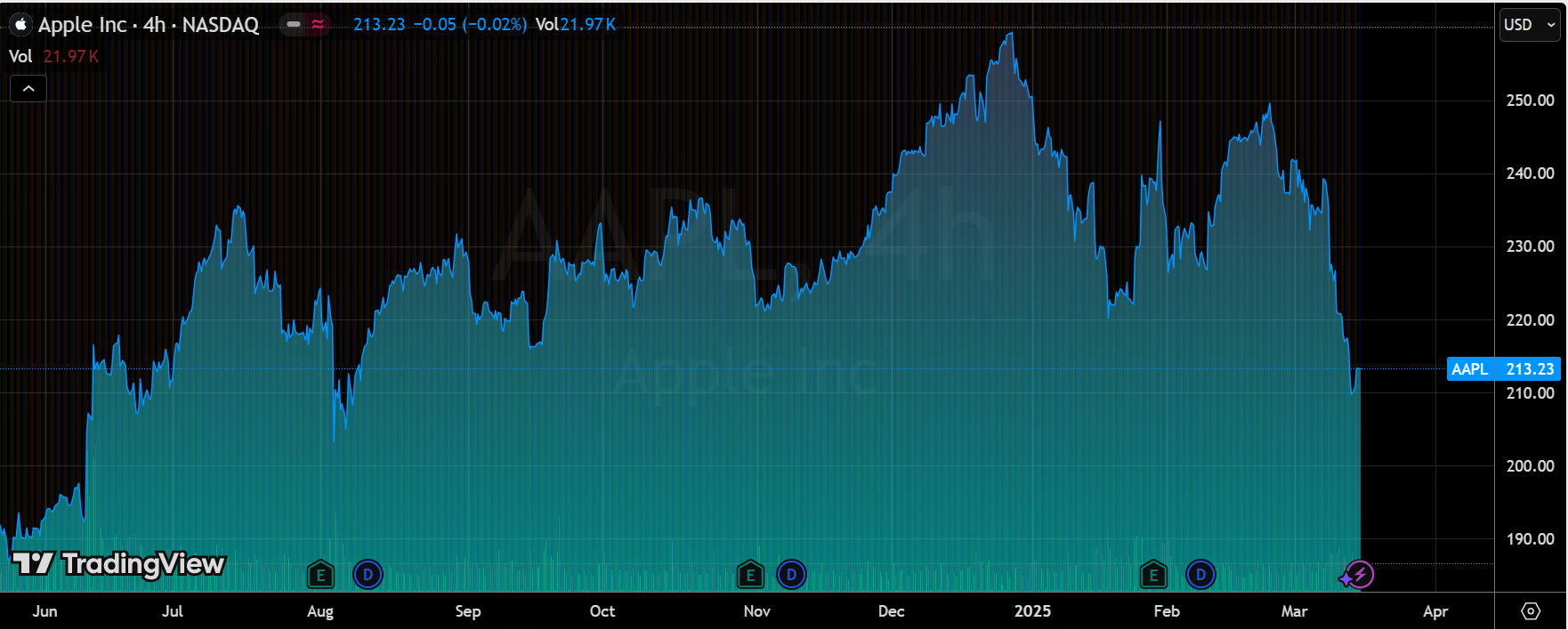

Last week's unusual volume selloff in $Apple(AAPL)$ is also now down to last July's levels.While there is some degree of skepticism about the reduction (liquidation) of positions by LO investors such as Warren Buffett $Berkshire Hathaway(BRK.B)$ this can only be verified in next quarter's 13F.

Fundamentally several events affecting the medium term are enough to change investor expectations.

Apple Intellegence delay

Many of Siri's new features, such as analyzing screen content and controlling apps with precision, were shown off at WWDC, listing them as selling points for the iPhone 16 and putting them into a marketing push, but the features shown off were only "half-finished prototypes."

However, the original plan was to roll out the new features with the iOS 18.4 or iOS 18.5 system update in 2025, however, due to the engineering issues and software bugs encountered, they have now been pushed back to the "future year", which could mean that they won't be available until the iOS 19 system update in 2026.

The point is, Apple Intelligence's delay is understandable, but Apple's announcement of the delay through unofficial channels is a major blunder (after a lot of market gossip, which tends to lead to excessive investor suspicion), and should have been communicated through more official channels.

December revenue performance below seasonal levels

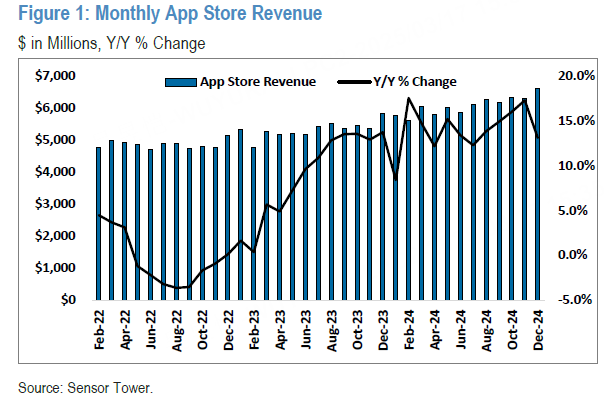

App Store revenue for the fourth quarter of 2024 increased 3.6% sequentially and 15% year-over-year.This compares to a 5.0% YoY increase in Q3 2024 and 14% YoY growth.That's good news, though.

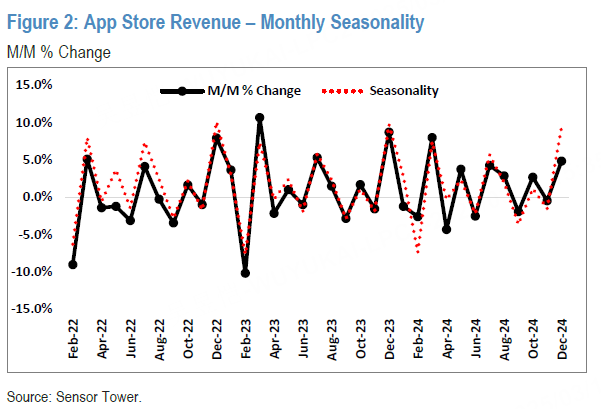

However, in terms of trends, revenue performance in October and November was slightly better than seasonal levels (up 0.7% and 1.3% YoY, respectively), while revenue performance in December was below seasonal levels (down 0.1% YoY).

On the other hand, App Store downloads showed the same trend, with overall Q4 downloads down 0.1% YoY and 0.1% YOY, and on a monthly basis, October and November were down 0.8% and 1.2% YoY, respectively; and December was down 1.2% YoY.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Valerie Archibald·03-17 11:12lets see if we can get back to $225!LikeReport

- Merle Ted·03-17 11:15Bet Apple is buying back boatloads of stock at these prices.LikeReport