Big-Tech Weekly: Why AWS behind Azure/GCP? How Big-Tech Capex Boost NVDA?

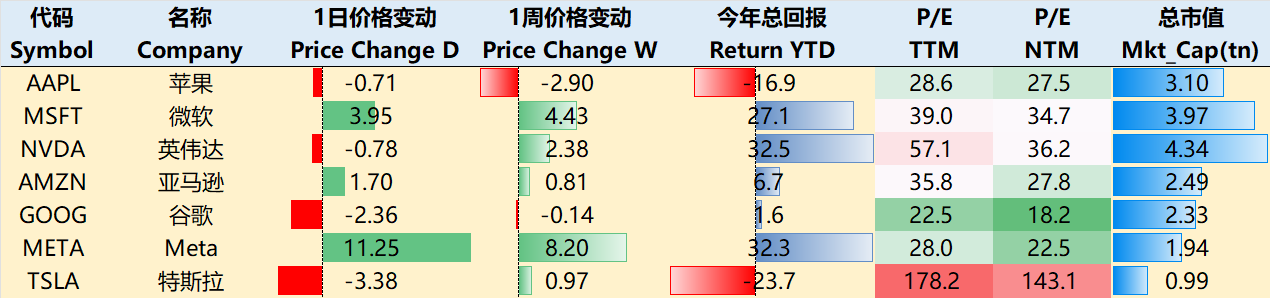

Big-Tech’s Performance

Macro Headlines This Week: Rising Tariffs? Fed Disagreement; Structural Divergence in U.S. Stocks

Trump’s “Transactional Hegemony”

Using tariffs as leverage to forcibly reshape global trade rules—short-term, it creates room for domestic industries, but long-term, it undermines the stability of global supply chains. His push for rate cuts is essentially laying the groundwork for fiscal expansion, fundamentally conflicting with the Fed's inflation mandate. On July 31, Trump signed an executive order imposing tariffs of 10% to 41% on goods from 92 countries, pushing the U.S. Dollar Index above 100—the highest level in nearly three years.The Fed’s Crisis of Independence

The Fed held rates steady in July. At the press conference, Chair Powell emphasized a “wait and see” approach to assess policy effectiveness through incoming data. Powell remains committed to data-dependent decisions, but faced dissent from two FOMC members who supported a 25 bps rate cut—the first such disagreement since 1993. This reflects internal policy divergence, which may impact the Fed’s future decision-making independence. Political pressure from Trump has also shaken market confidence in the central bank. If the Fed compromises and cuts rates in September, it may mark a paradigm shift toward politically-driven monetary policy.The Duality of U.S. Equities

Tech stocks are buoyed by AI narratives, but diverging earnings and speculative retail flows suggest correction risks. The Nasdaq and S&P 500 hit record highs repeatedly: the Nasdaq posted 14 new highs in July (most in a single month since 1999), and the S&P 500 had a “perfect week” (five consecutive record closes). Leading sectors included tech (e.g., Microsoft, Meta), with AI tailwinds (WAIC conference, GPT-5 launch expectations), optimism on U.S.-EU tariff talks, and hedge fund rotation into tech (private fund average equity exposure reached 77.36%). However, the Dow fell 1.72% for the week due to industrial sector drag. If August labor or inflation data disappoint, the liquidity-driven rally could quickly reverse.

Big Tech rallied across the board on earnings:

As of July 31 closing, weekly performance: $Apple(AAPL)$ -2.90%, $Microsoft(MSFT)$ +4.43%, $NVIDIA(NVDA)$ +2.38%, $Amazon.com(AMZN)$ +0.81%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -0.14%, $Meta Platforms, Inc.(META)$ +8.20%, $Tesla Motors(TSLA)$ -0.97%

Big-Tech’s Key Strategy

Why Is AWS Lagging Behind Azure and GCP?

Amazon Q2 Earnings Highlights

Amazon reported Q2 revenue of $167.7B, up 13% YoY, beating consensus ($162B); EPS rose to $1.68 from $1.26 YoY, beating expectations of $1.33.

Key business lines:

AWS: $30.87B (+17% YoY), slightly ahead of expectations ($30.77B)

Advertising: $15.7B (+23% YoY)

Despite solid performance, shares dropped 6% after-hours. Key reasons:

TTM Free Cash Flow dropped from $53B to $18.2B YoY, indicating CapEx pressure;

Q3 Operating Income Guidance: $15.5–20.5B, midpoint ($18B) below Street estimate ($19.41B);

AWS Revenue Growth (17%) lagged behind Azure (39%) and GCP (32%). AWS margin narrowed to 32.9%, the lowest since late 2023;

Q2 CapEx surged to $31.4B, mostly for AI infrastructure, GPU procurement, and data center expansion;

Exposure to tariffs and macro uncertainty, especially in retail and advertising, increases downside risks to Q3 guidance.

Management Commentary

Amazon’s CEO emphasized in the earnings call that AWS customer demand significantly exceeds available compute and infrastructure capacity, and this gap is unlikely to be resolved in the short term. Management expects resource constraints to persist for several quarters, likely capping near-term growth.

The company is aggressively investing in data centers, chips, and AI platforms to address this core supply bottleneck. Near-term challenges include margin compression, supply risk, and potential market share loss.

To address compute limitations, AWS is betting on custom chips (Trainium3 in mass production by 2025) and cost-reduction tools like Kiro agentic IDE, Strands SDK, and Bedrock AgentCore, aiming to maximize power and compute efficiency.

Comparing AWS with Azure and GCP

According to Synergy Research, current market share:

AWS: ~30%

Azure: ~20–25%

GCP: ~11–12%

Because AWS has a much larger base, slower growth is expected due to the base effect.

However, AWS faces multi-layered constraints in chips, electricity, and server deployment, preventing it from meeting the surge in AI and cloud demand. While Azure and GCP also face capacity issues, their strategies focus on rapid regional expansion, faster enterprise onboarding, and delivery of large contracts—contributing to superior growth rates.

Different Enterprise Ecosystems & Channel Strategies

Azure benefits from deep integration into Microsoft’s enterprise stack (Office 365, Active Directory, Windows Server) and its global channel partner network, accelerating enterprise cloud adoption. Recent quarters have seen Azure double down on GenAI partner-led sales, boosting demand.

GCP leverages Google’s strengths in AI, ML, and big data to expand in tech-driven and analytics-heavy industries, attracting digital-native clients.

AWS remains deeply embedded in e-commerce and advertising, with 38% of retail orders relying on AWS data infrastructure. AWS leverages the ad-cloud flywheel: shopping data improves AI ad targeting, feeding growth.

Enterprise Contracts & Deal Velocity. Azure and GCP have excelled in large enterprise contracts, including multiple billion-dollar deals. AWS’s backlog grew to $195B, indicating strong demand, but realized revenue growth is capped by capacity bottlenecks, slowing short-term growth despite strong forward bookings.

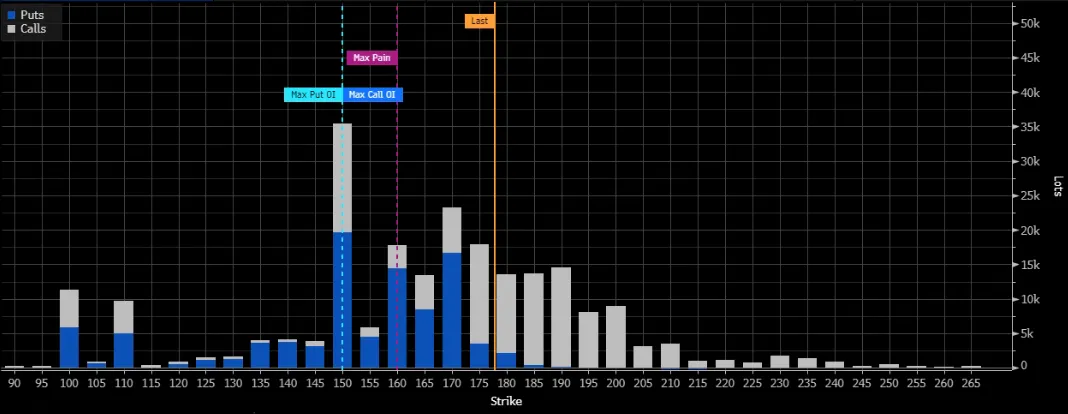

Big Tech Options Strategy

This Week’s Focus: NVDA’s Extreme Bullish Sentiment?

With Big Tech earnings out and AI CapEx trends emerging, semiconductors have received fresh tailwinds. While sentiment on software stocks remains mixed, the bullish consensus on chips like NVIDIA remains strong.

AMZN Q2 CapEx: $31.4B; 2025 full-year likely >$100B

GOOG 2025 CapEx guidance raised from $75B to $85B

META H1 CapEx: $30.7B; full-year guidance raised to $66–72B, with a 2026 target near $100B

MSFT Q4 (25Q2) CapEx: $24.2B; expected full-year also >$100B

According to third-party data, Meta, Microsoft, Alphabet, and Amazon contribute ~53% of NVIDIA revenue:

Breakdown — Meta 15%, Microsoft 14%, Alphabet 12%, Amazon 11%.

Additionally, U.S. tax incentives (AI Action Plan, One Big Beautiful Bill) are fueling expansion. China’s partial reopening of GPU exports (H20 models allowed) also boosts sentiment. The market expects NVIDIA’s Q3 earnings (late August) to deliver another record-setting quarter.

Bullish sentiment in NVDA is now elevated. In the next few weeks, options open interest shows a "max pain" point and highest concentration of calls/puts below current price, indicating aggressive bullish bets.

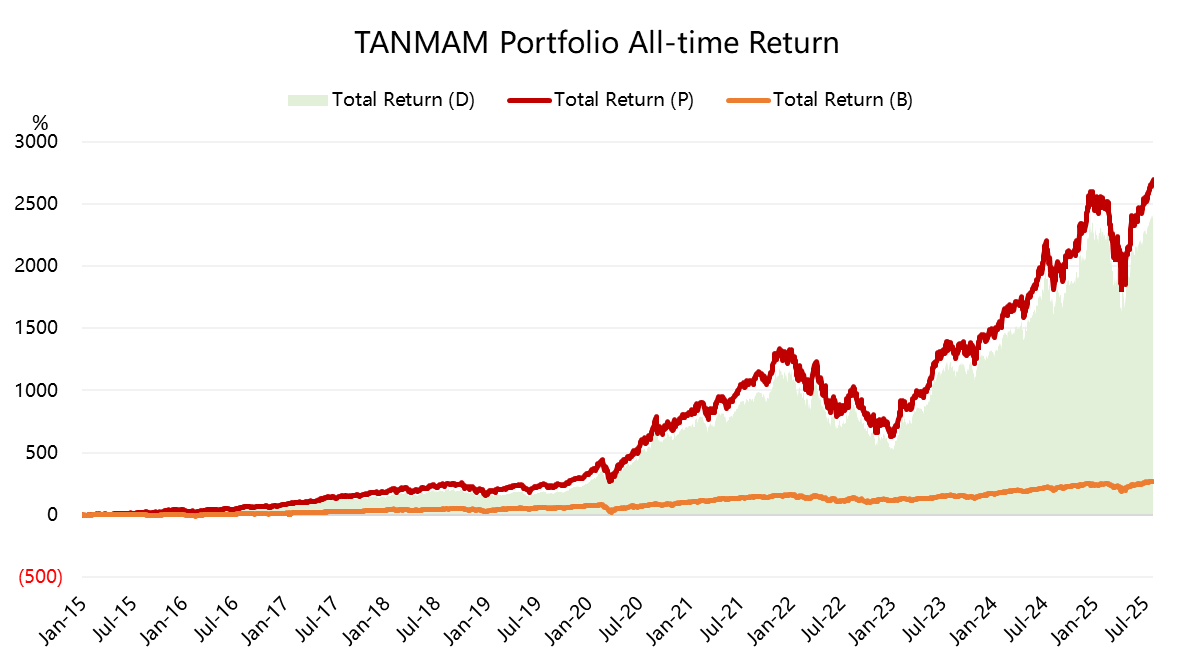

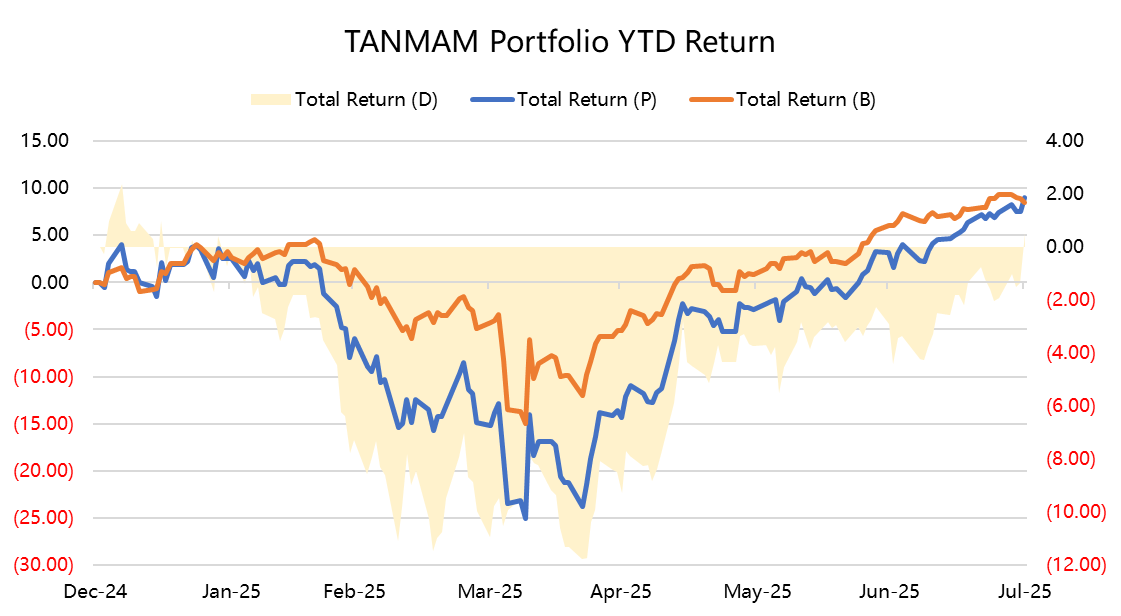

Big-tech Portfolio

The “Magnificent Seven” portfolio, referred to as the “TANMAMG” basket (Tesla, Apple, Nvidia, Meta, Amazon, Microsoft, Google), is equal-weighted and rebalanced quarterly. Since 2015, this portfolio has outperformed the $S&P 500(.SPX)$ by a wide margin:

TANMAMG Total Return: +2697.11%

S&P 500 Total Return: +268.71%

Excess Return: +2428.36%

2025 YTD return: +9.02% (vs. SPY +8.49%)

Past 1-year Sharpe ratio: 0.85 (vs. $SPDR S&P 500 ETF Trust(SPY)$ 0.76)

Information ratio: 0.72

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Mortimer Arthur·2025-08-01AWS becomes the backbone to support Amazon business expansion into every corner in the world in 5 years.1Report

- Valerie Archibald·2025-08-01Just remember big dip in april. Whomever bought the dip did extremely well. This is a repeat.1Report

- Alton92·2025-08-02Great article, would you like to share it?1Report