Outside Nvidia: Storage and AI Hardware Are Semi's Game-Changer

While the market is still debating "who can outperform $NVIDIA(NVDA)$ ," another chain is quietly shifting—storage (HDD/SSD/NAND/DRAM) + AI server components + edge devices—is being propelled into the spotlight by a wave of inelastic demand driven by both massive models and data center expansion.

Today's signals aren't isolated news events, but rather a four-part chain reaction: price hikes → supply tightening → institutions raising forecasts → capital following suit. This sequence includes SanDisk/NAND initiating price increases, Micron/DRAM/NAND implementing price jumps/withholding inventory alongside institutional upgrades, Western Digital and Seagate following suit with HDD price hikes, and leading equipment manufacturer ASML seeing internal buying activity. This synchronized sequence of events suggests the market is grounded in fundamental validation rather than purely conceptual speculation.

September 15th Semi Review

The storage sector is experiencing a dual catalyst of "Price & Volume" driven by short-term price hikes + sustained mid-term demand: $SanDisk Corp.(SNDK)$ has announced NAND price hikes, while $Micron Technology(MU)$ and other industry players are signaling "quotation suspensions/holding back inventory." Western Digital notified customers of HDD price increases that same day, rapidly amplifying market expectations for a storage market recovery.

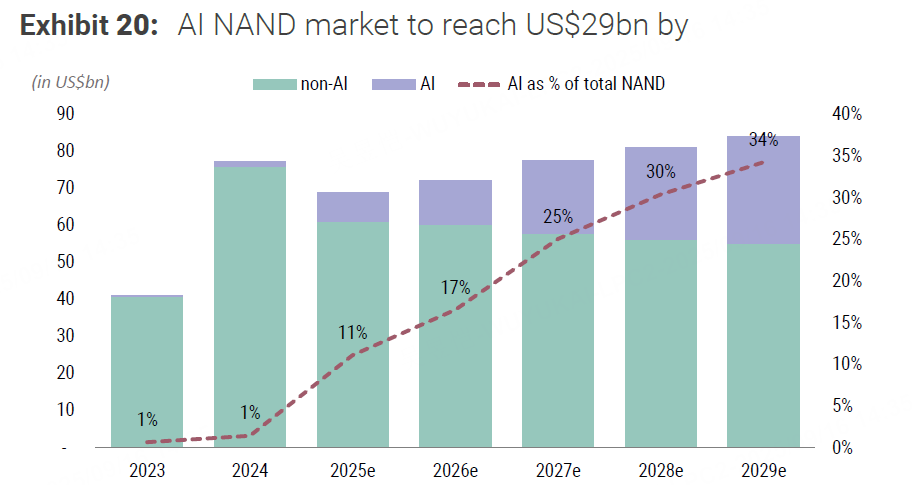

Institutions are beginning to quantify "AI-driven storage demand" into valuations: UBS, Citi, and others have raised their target prices for Micron (UBS set MU's target range at $185) and forecast upward trends in DRAM/NAND average selling prices for the coming quarters. This indicates that brokerages have incorporated the long-term storage demand generated by large language models into their valuation models.

Semiconductor equipment (particularly lithography) serves as a cyclical indicator with greater certainty: ASML's insider buying, coupled with a potential rebound in long-term capital expenditures driven by rising memory prices, positions ASML to benefit directly. This makes it a "stable anchor with high certainty" within the sector.

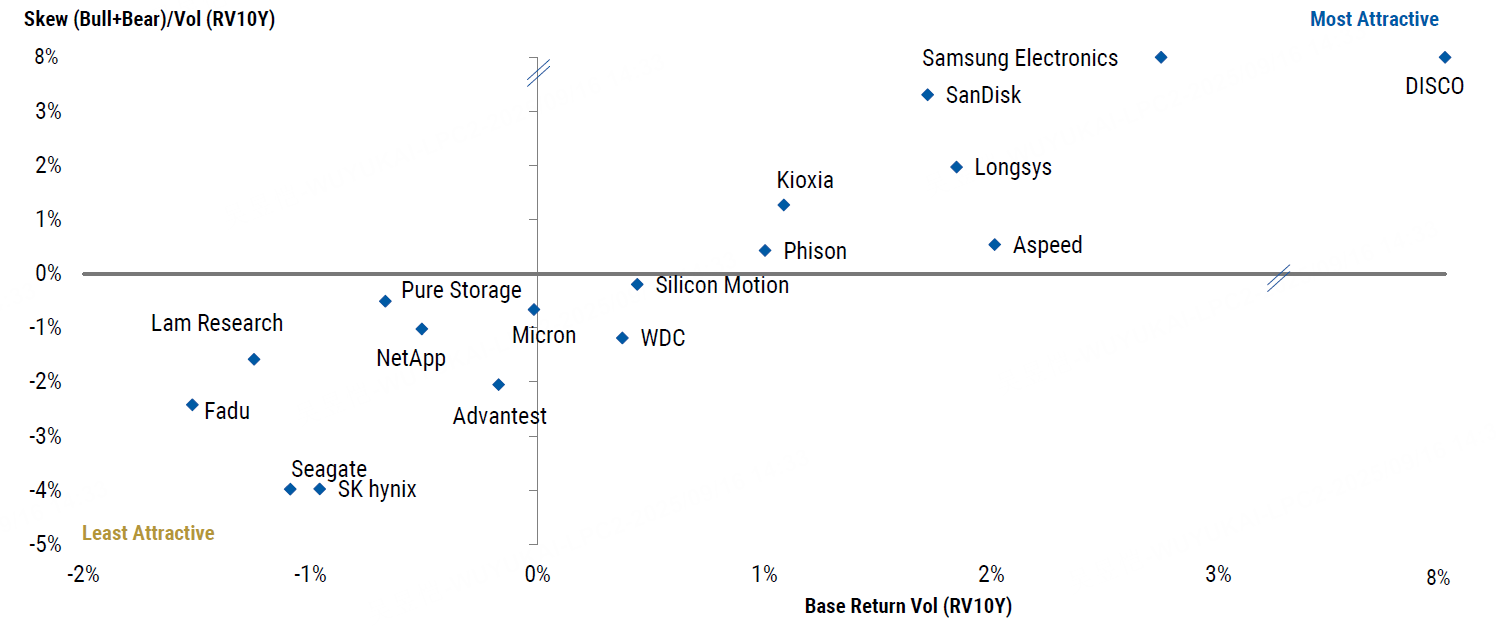

Sector divergence will intensify: From storage leaders with "booked revenue/pricing power" to GPU leasing/computing outsourcing firms with "business models reliant on external major clients and lacking barriers," the market will sharply differentiate valuation premiums and discounts. Reference: Companies like $CoreWeave, Inc.(CRWV)$ still face bull-bear disagreements (here using common market debate logic as an example).

Storage (HDD/SSD/NAND/DRAM) — The most direct beneficiary in the short to medium term

The simultaneous expansion of large-scale models (training and inference) and data centers is driving up demand for high-capacity, high-performance SSDs/HDDs. Manufacturers have begun direct price adjustments (led by SanDisk and Micron, followed by WDC/Seagate), indicating that gross margins will improve more than expected, with significant profit elasticity.

Short-term: Capitalize on the "news-driven bullish momentum" of $Western Digital(WDC)$ / $Seagate Technology PLC(STX)$ Look for opportunities to participate in event-driven rallies, paying close attention to trading volume and turnover.

Mid-term: Monitor $Micron Technology (MU)$'s earnings window (upcoming financial report). If revenue/guidance continues to be revised upward, holding or adding positions is expected to yield favorable returns. Institutions have already raised target prices as logical support. Risks stem from the supply side—if capacity is released beyond expectations, upside potential may be limited.

AI Server Components & Chips (Interfaces/Interconnects/High-Bandwidth Memory) — Following Mega-Client Orders

Whether it's NVIDIA's GPU ecosystem or $Alphabet(GOOG)$ 's TPU/customization path, AI server component suppliers will benefit from long-term supply agreements and capacity expansions. Prioritize suppliers with major client lock-ins and high technical barriers (those possessing customization capabilities). For medium-to-short-term strategies, prioritize suppliers deeply integrated with mega cloud providers/AI giants (as outlined in the referenced targets). Such companies often outperform the broader market during event-driven catalysts.

Equipment (lithography/etching, etc.) is slow to heat up but is confirmed.

When memory and storage manufacturers resume capital expenditures (CapEx), equipment procurement is the last link to be ignited. $ASML Holding NV(ASML)$ 's insider buying and current valuation still have room for recovery, making it the optimal "defensive + momentum" play in the early stages of an industry recovery. Long-term allocation: ASML or domestic equipment leaders (depending on regulatory/order transparency). Short-term focus: insider trading activity and the pace of client order disclosures.

AI is not only accelerating the GPU boom but also reshaping storage hierarchies and device demand: As the market consensus shifts toward "larger models → more data → pricier storage," the true beneficiaries are storage and equipment leaders who hold pricing power, control production capacity, and maintain stable long-term contracts with mega-customers. In the short term, investors can participate in thematic rallies for WDC/Seagate/STX and trade Micron's earnings window. For medium-to-long-term strategies, allocate capital in phases to certain beneficiaries like Micron and ASML. Companies offering "lease-to-own/GPU rental" models will face a stage of high volatility and divergence—not every name warrants a long-term bet.

The market has shifted from "storytelling" to "performance verification"—a compelling narrative pales in comparison to tangible improvements in the bottom line.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Merle Ted·2025-09-16I understand that Nvidia has been a bit disappointing but I still believe in the company and in the CEO.LikeReport

- Valerie Archibald·2025-09-16We need buyers next week to drive mu to 200.LikeReport

- cheerzy·2025-09-16This analysis highlights a crucial shift in the market.LikeReport