The era of AI FOMO, What's important to investors?

Amid the AI boom, corporate wealth creation surges relentlessly—from $Broadcom(AVGO)$ to $NVIDIA(NVDA)$ , from $Advanced Micro Devices(AMD)$ to $Dell Technologies Inc.(DELL)$ the semiconductor sector has clearly shrugged off macro market fluctuations, setting new highs in wave after wave.

But how does the current situation differ from the dot-com bubble two decades ago? Analyzing from the perspectives of user adoption, corporate implementation, capital investment, energy infrastructure, and potential bubble risks, we must neither lose enthusiasm for AI investment nor overlook the need to guard against supply-demand imbalances and ensure sustainable returns.

Topic 1: Current State of Consumer AI Applications and the Potential for Transformation in Computing Models

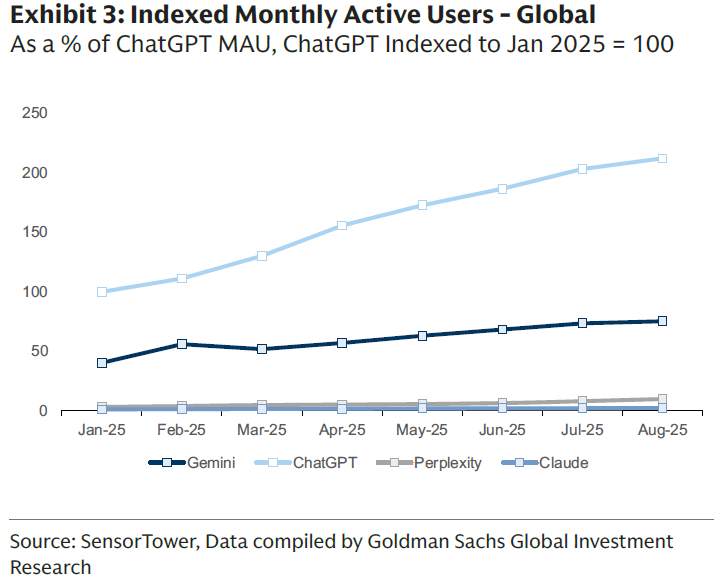

The public's adoption of AI has outpaced corporate integration, primarily manifesting in daily consultations and computational tasks. OpenAI's ChatGPT has reached 800 million weekly active users (WAU), significantly exceeding monetization progress—likely due to its initial data disclosure methodology. Currently, paid subscriptions form its primary revenue stream. However, market consensus suggests OpenAI will achieve scalable monetization through advertising and e-commerce integration starting in 2026. This shift could reshape economic landscapes, much like the transition from desktop to mobile did.

Expanding the view, the Stanford 2025 AI Index indicates global AI adoption has reached 78%, a significant increase from 55% in 2024. A McKinsey survey reveals that 78% of organizations use AI in at least one function. Anthropic reports that Claude is primarily used for coding (both via API and web interface), with usage rates positively correlated with national income. Bain's 2025 Technology Report warns that computing demand will require $2 trillion in revenue by 2030, yet an estimated $800 billion shortfall is projected. This intensifies monetization challenges while highlighting opportunities—such as ChatGPT's instant checkout and Google-PayPal agency partnerships—that could drive transaction growth.

From this perspective, $Alphabet(GOOG)$ and $Meta Platforms, Inc.(META)$ stand to benefit from the commercialization of AI products. While short-term subscription dependency carries high risk, if advertising gains traction by 2026, it could reshape a trillion-dollar market.

Second Topic: Progress in Enterprise AI Deployment and Internal-External Differences

The adoption of AI within enterprises has expanded significantly, leveraging it to optimize processes, enhance efficiency, and control expenditures. Despite early debates over effectiveness—such as a MIT report indicating only 5% of companies saw P&L impact—Goldman Sachs observes from conference feedback that businesses view AI as a tool for profit preservation and even for optimizing technology personnel.

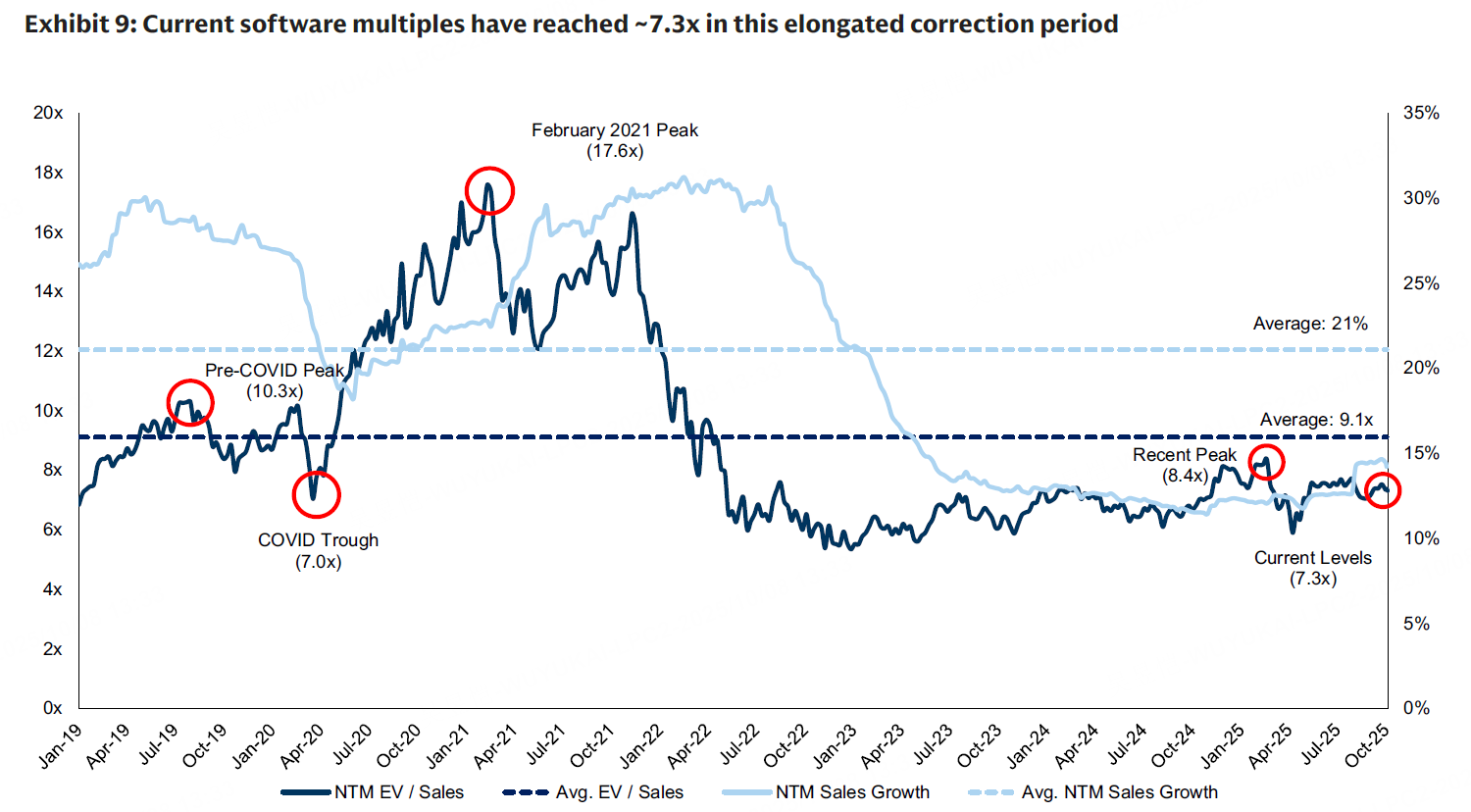

External adoption—meaning revenue growth or market share shifts—has lagged behind. Over the past 12 to 18 months, software stocks have been revalued based on disruptive expectations, yet implementation has been slow. MIT research reveals that while 90% of employees use personal AI tools, only 40% of companies have purchased official subscriptions, creating a "shadow AI" economy.

Expanding from the report, from an enterprise internet perspective, AI may disrupt multi-billion-dollar profit pools: Advertising agencies (¥161 billion) face erosion by automation platforms; Ad tech intermediaries (¥25 billion) face consolidation; E-commerce, marketing, online travel, education, freelancing, dating, and other sectors face transformation. Small agencies and platforms reliant on performance channels are most vulnerable.

The 2025 Dialogue reveals AI ecosystems are maturing. $Microsoft(MSFT)$ CoPilot integrates with Power Automate, Salesforce adjusts pricing, and SaaS giants accelerate through M&A (e.g., $ServiceNow(NOW)$ acquiring MoveWorks). Enterprise data cleansing is critical, with strong demand for Azure and $Palo Alto Networks(PANW)$ . Goldman Sachs estimates large enterprises require 6-18 months before widespread adoption. Yet ROI remains unproven: API revenues reach hundreds of millions, MSFT CoPilot at $2-3 billion, $Salesforce.com(CRM)$ / $Adobe(ADBE)$ / $Workday(WDAY)$ each over $100 million—all far below hundreds of billions invested.

Prefer internal tool providers like Microsoft, but external monetization is slow or depresses software valuations. Focus on companies demonstrating ROI, such as Workday with AI ARR exceeding $150 million. The Stanford Index indicates 40% of Americans aged 18-64 use generative AI, with researcher adoption reaching 84%.

Third Topic: Current Reality and Long-Term Outlook of AI Spending

Short-term demand exceeds supply, with cloud giants' backlog of orders supporting 2-3 years of growth. However, in the medium to long term, industry announcements suggest total spending of 3-4 trillion yuan, requiring economic restructuring to sustain returns. The restructuring of the advertising profit pool serves as an example, while other drivers such as productivity gains, agency-driven growth, and consumption optimization must materialize.

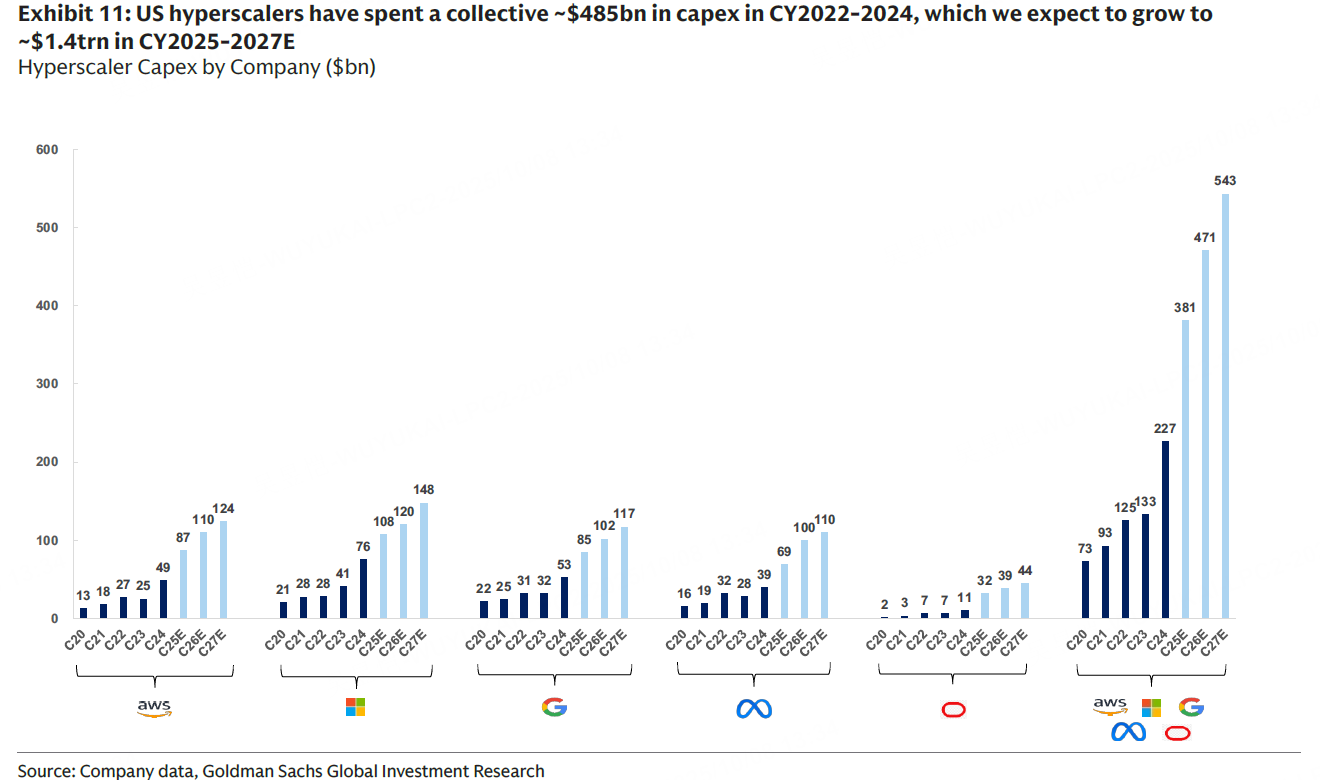

The five major hyperscale players in the West (AMZN, MSFT, GOOGL, META, ORCL) are projected to spend $381 billion in 2025 (+68% YoY), reaching $1.4 trillion from 2025 to 2027. 2H25 saw a flurry of announcements: Oracle-OpenAI $30 billion, NVIDIA-OpenAI $10 billion, etc. IDC forecasts corporate AI investment at $307 billion in 2025, rising to $632 billion by 2028. Gartner estimates the global AI market will approach $1.5 trillion in 2025 (+50%).

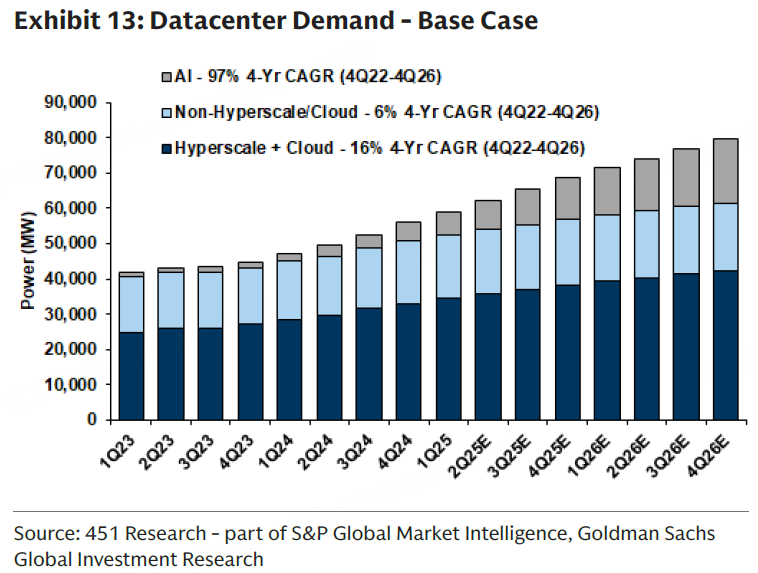

Current market reports indicate that with only a handful of players dominating the field, return visibility remains low. Bain projects a need for $2 trillion in revenue by 2030, but an $800 billion shortfall persists. Citigroup estimates global AI computing will require 55GW of new capacity, with expenditures exceeding $2.8 trillion by 2029.

From an investment perspective, cloud service providers' financial reports offer relatively straightforward insights. Should backlogs fully convert, NVDA stands to benefit most. However, sustained profit transfers will be essential in the long term to mitigate bubble risks.

Fourth Agenda Item: Power and Infrastructure Requirements for the Long-Term AI Plan

Energy bottlenecks are becoming increasingly prominent. Goldman Sachs' data center team forecasts that hyperscale players will spend $1.4 trillion from 2025 to 2027. AI workloads will drive data center power demand to grow by 165% by 2030, equivalent to adding a new top-10 power-consuming nation. Global demand reached 62GW in Q2 2025 (with AI accounting for 13%), will hit 92GW by 2027 (AI share rising to 28%), and is projected to reach 137GW of online capacity by 2030.

Opportunities in power stocks and infrastructure remain substantial, particularly in renewable energy ventures, though current valuations are certainly not low. AI giants like $Amazon.com(AMZN)$ Amazon Web Services (AWS) show positive momentum, but energy shortages may drive up costs.

Fifth Topic: Is There a Bubble Now? A Comparison with the 1990s

The current situation should not be viewed as a comprehensive bubble, but it must be acknowledged that similarities exist with the period around 2000. These primarily manifest in elevated private valuations (emphasizing revenue over profits), increased industry transactions (capital injections into supply chains), and the AI theme driving stock prices, which concentrates risks within specific sectors.

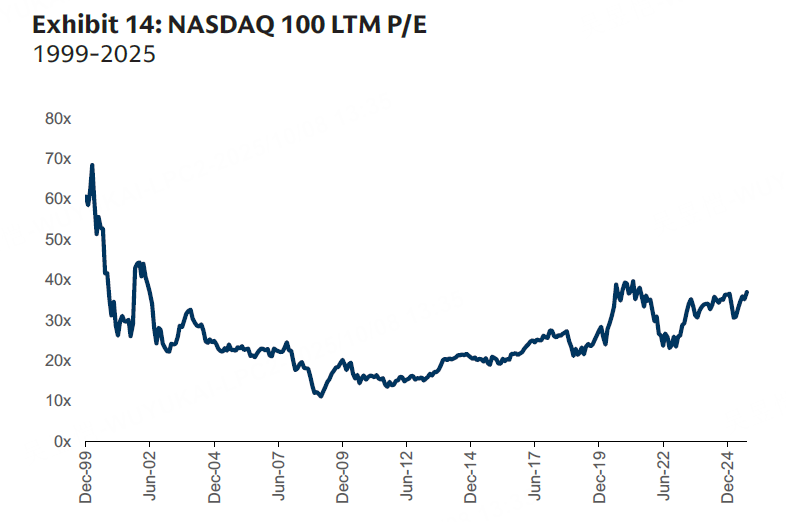

However, significant differences must also be acknowledged: IPO volumes remain low (71 YTD in 2023-2025 vs. 892 in 1998-2000), with most companies already listed and dominated by large tech firms; media vigilance regarding bubbles is heightened; and $NASDAQ 100(NDX)$ LTM P/E stands at ~37x (also down 46% from the 1999 peak of 68.4x). Major players enjoy robust profits and active share buybacks. These factors do not support a sharp correction (such as the 30%+ pullback seen in the 2000s).

Market searches for "AI bubble" have dropped to 15% since peaking in August, with Reddit posts plummeting. The market is now driven more by FOMO-fueled buying, as 4 billion people hold AI-enabled devices.

The current market resembles a "rational exuberance," with software multiples reaching 7.3 times the trough level, and the correction period lasting approximately 7-6 months. Monitoring adoption, spending, and impact reveals no signs of a crash. Core holdings include NVDA and GOOG, supplemented by energy sector targets. The focus is on companies demonstrating ROI. If advertising gains traction by 2026, it will reshape the market; otherwise, be wary of a cyclical correction.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Valerie Archibald·2025-10-09AMD throws ultimate hail Mary because there is no way they meet earnings expectations for 3rd qtr. 🤣1Report

- vippy·2025-10-08It's crucial to remain cautious amidst all this excitement; history has taught us about bubbles.1Report

- Mortimer Arthur·2025-10-09Anyone who believes in the future should own NVDA and AMD. No brainers.1Report