Positives on MSFT with GenAI share grows.

$Microsoft(MSFT)$ While it hasn't surged in this wave of semiconductor FOMO, it perfectly embodies the old adage: "A journey of a thousand miles begins with a single step." Recent Microsoft research offers eye-opening insights from direct feedback of 300 CIOs. The standout data lies in software spending: 2025 IT budgets remain steady at +3.6%, with software leading the charge at +3.8%; the 2026 outlook shows overall budgets accelerating slightly to +3.8%, and software to +3.9%. Microsoft's steady, "slow-burner" growth—averaging +4.1% over the past decade—hits the sweet spot.

For MSFT, the biggest prize is GenAI.

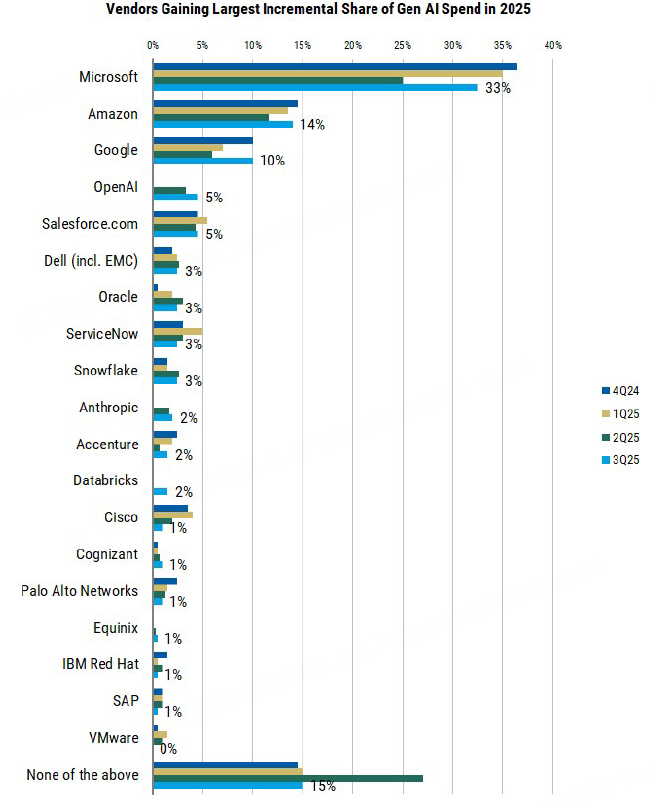

AI/ML remains firmly atop CIOs' priority list, with hyperscalers emerging as preferred partners and Microsoft leading the pack. Research indicates that by 2025, 33% of CIOs are betting on Microsoft to capture the largest share of GenAI growth ( $Amazon.com(AMZN)$ follows at 14%, $Alphabet(GOOG)$ at 10%), widening to 37% within three to five years. Why?

In short, Microsoft's trump cards are fourfold: First, it focuses on CIOs' top priorities—AI, security, and digital transformation. Second, it offers deep ecosystem integration with seamless transitions from Office to Azure. Third, its broad product portfolio spans the entire value chain from Copilot to Dynamics 365. Fourth, it pours massive investments into AI infrastructure, prioritizing enterprise clients to achieve sky-high long-term LTV (Lifetime Value). No wonder surveys show Microsoft as the top winner in IT wallet share: a net gain of +42% by 2025 (Amazon at +12%), and a 42% share within three to five years (Salesforce at just 6%).

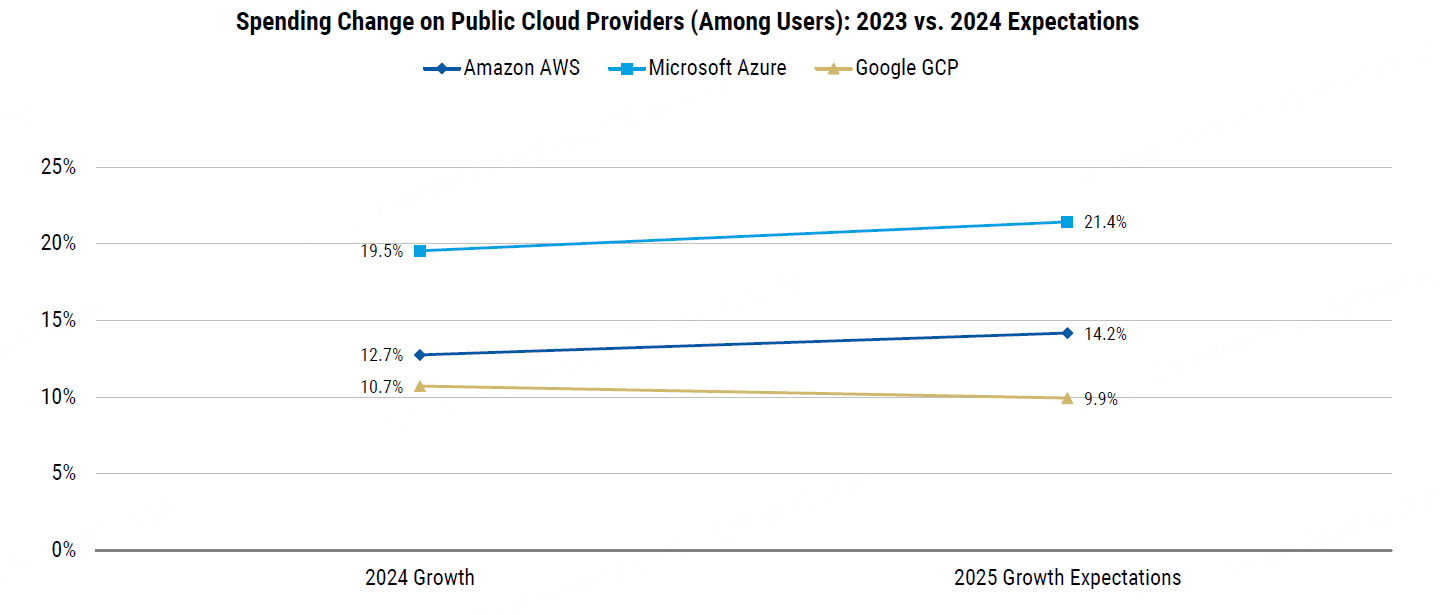

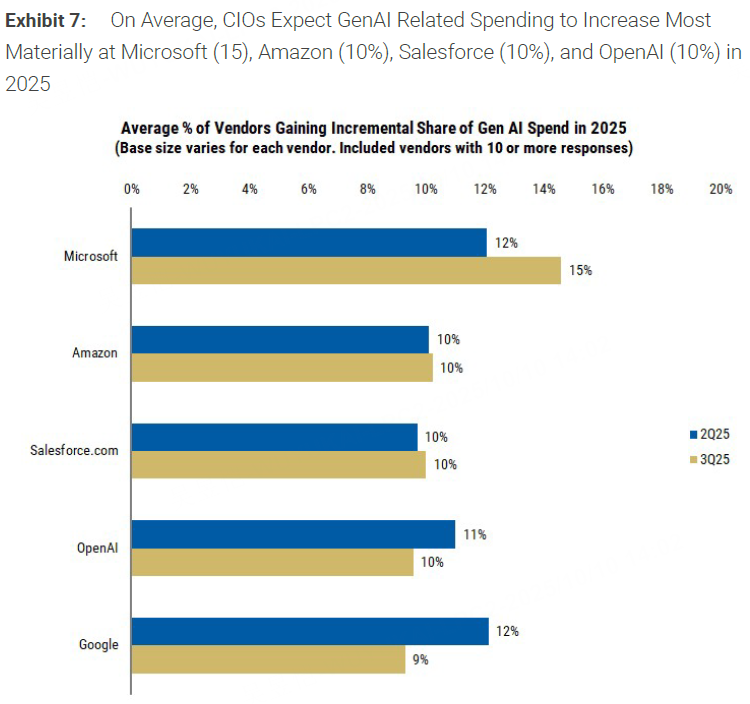

Cloud spending further bolsters Microsoft's position. Public cloud expenditures will moderate slightly in 2024 (Azure +12.7%), but Azure is projected to surge by 21.4% in 2025, outpacing AWS's 14.2% and GCP's 9.9%. CIOs openly state that Azure reigns supreme among hyperscalers in growth—Microsoft reaps the most benefits as workloads migrate to the cloud. What about GenAI spending specifically? Microsoft anticipates a 15% increase, while Amazon/Salesforce/OpenAI are tied at 10%. Regarding AI agent strategies, Microsoft leads with 27% adoption, followed by Amazon at 17%, while Google/Salesforce/ServiceNow trail at the bottom of the long tail.

In terms of valuation, Microsoft remains the "affordable cloud." Currently trading at <26x CY27 GAAP EPS, it significantly trails the broader software sector's 33x non-GAAP multiple. Consider this: Microsoft's decision to pass on OpenAI's $30 billion contract proves a masterstroke in the long run. With surging enterprise demand and limited resources, prioritizing high-value customers first ensures a robust economic model.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-10-10I think MSFT SHOULD change the financial reporting durations, but instead of quarterly, they should report them MONTHLY. That way, people can see more often what an AWESOME job the company is doing.LikeReport

- Merle Ted·2025-10-10Microsoft Data center crunch. Sounds like they are getting more business than they can handle. Must be a good thing. Meaning earnings will be dynamite.LikeReport

- SiliconTracker·2025-10-10Solid analysis! MSFT's steady growth beats chasing FOMO stocks any dayLikeReport

- smile000·2025-10-10You've captured the essence of Microsoft's strategy beautifully.LikeReport