134% NRR: The Magic Number Behind Palantir's AI Empire. Customers Are Spending WAY More

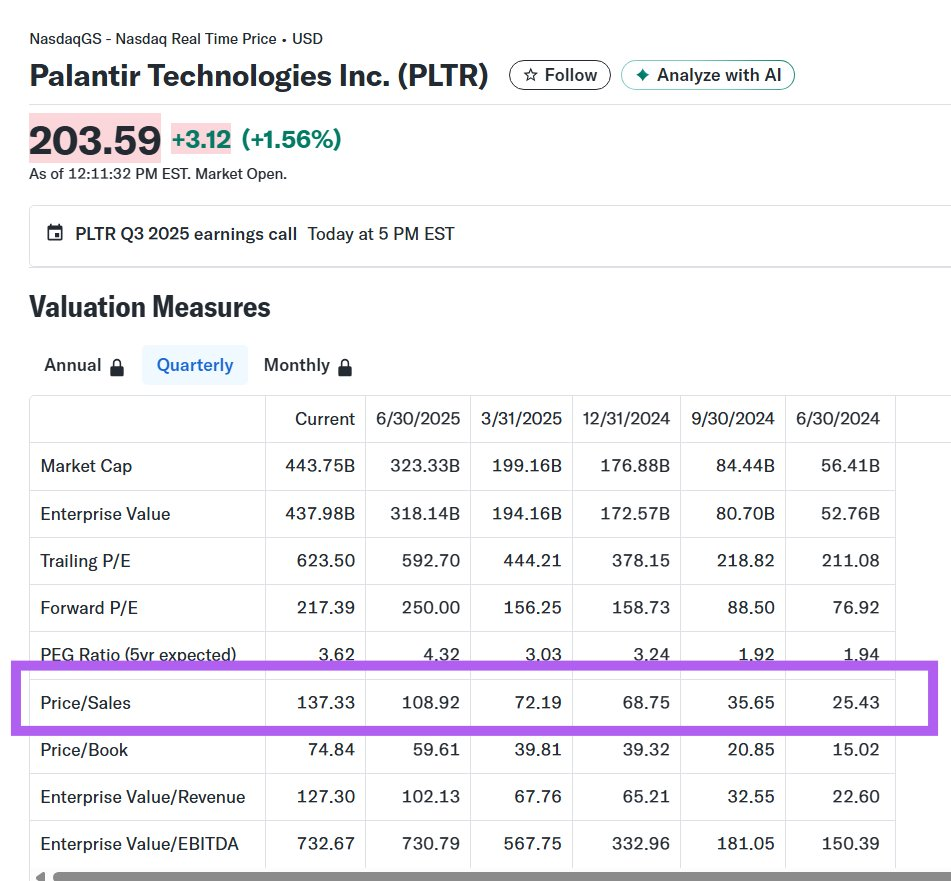

Palantir's Q3 2025 earnings report demonstrated robust growth momentum, with overall performance significantly exceeding market expectations. We rate this performance as "Outstanding." Revenue surged 63% year-over-year to $1.18 billion, while adjusted earnings per share reached $0.21, both substantially surpassing analyst consensus. A key highlight was the 121% jump in U.S. commercial revenue, driven by rapid adoption of its AI platform AIP and major deal signings. However, underlying concerns emerged despite robust fundamentals, as the stock experienced significant post-market volatility, swinging from a +7% gain to a -4% loss. This may reflect market apprehension over the company's elevated valuation (currently trading at over 138 times price-to-sales) and a "buy the rumor, sell the fact" trading sentiment.

Key Financial Highlights

Total revenue reached $1.18 billion (up 63% year-over-year, up 18% quarter-over-quarter), significantly exceeding market expectations of $1.09 billion. This growth was primarily driven by AI-driven enterprise transformation demand, particularly the rapid adoption of the AIP platform, which facilitated the signing of 204 million-dollar-level deals. The outstanding performance indicates accelerated structural transition from government to commercial sectors, though strategic commercial contracts now contribute less than 1% to revenue, signaling a shift toward more organic growth.

U.S. commercial revenue reached $397 million (up 121% year-over-year, up 29% quarter-over-quarter). As a growth engine, this segment's share rose to 34%, driven by enterprise-wide AI deployments led by C-level executives—such as a medical device manufacturer expanding eightfold within five months. This significantly exceeded market expectations, signaling a shift from short-term AI hype toward sustainable adoption. However, international commercial revenue grew only 10%, indicating regional imbalance.

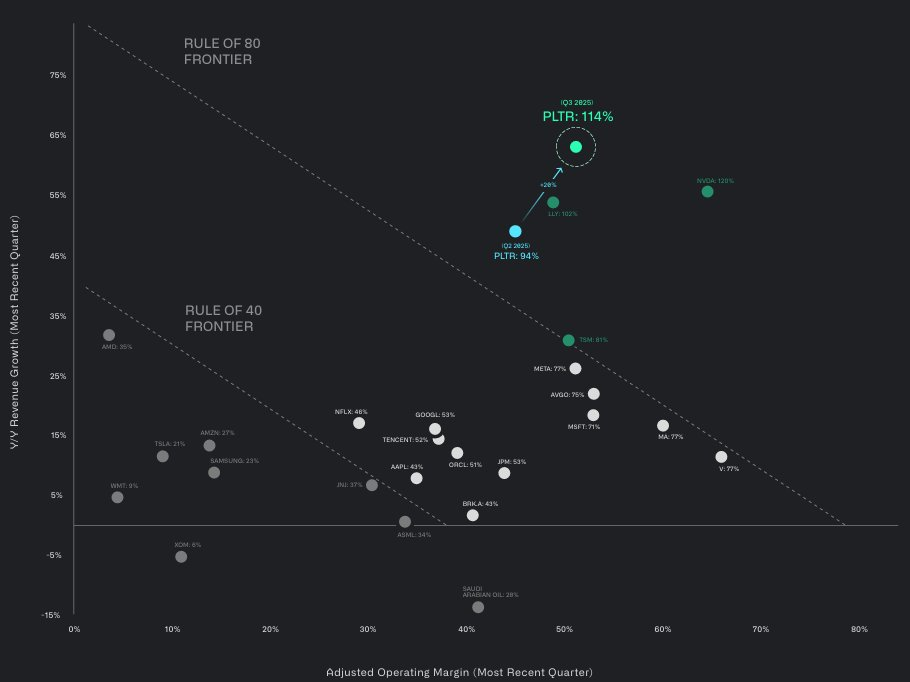

Adjusted operating margin of 51% (a record high): This represents a significant year-over-year increase driven by efficient cost control and economies of scale, with free cash flow reaching $540 million. The outcome exceeded expectations, reflecting optimized operational efficiency. However, GAAP net income stood at $475.6 million after excluding one-time stock-based compensation expenses, indicating that equity incentives continue to exert potential pressure on the profit side.

Net USD Retention Rate: 134% (YoY +600 basis points): This operational metric indicates significant expansion in existing customer spending, driven by the stickiness of AIP tools like HiveMind and AIFDE that accelerate AI development. The result exceeded market expectations, suggesting a shift from project-based to platform-based business models. Total customers reached 911, representing a 45% year-over-year increase.

Earnings Guidance

Management expressed an optimistic outlook for the next quarter and full year, raising its annual revenue guidance to $4.398 billion (up 53% year-over-year). Fourth-quarter revenue is projected at $1.329 billion (up 61% year-over-year), with U.S. commercial revenue expected to reach at least $1.433 billion (up at least 104% year-over-year). We assess this guidance as aggressive, exceeding analyst consensus estimates by approximately 10%, reflecting confidence in sustained AI demand while potentially incorporating a buffer for macroeconomic uncertainties.

The CEO has always been quite confident, asserting that "this might be the best performance any software company has ever achieved," aiming to counter skeptics (he quipped, "Enjoy it—grab some popcorn and watch those who mocked us"). The underlying logic is to reinforce the company's AI leadership while realistically acknowledging it remains in the "early stages."

Key Investment Considerations

Palantir's AI platform businesses (such as AIP and Edge Ontology) represent a sustainable long-term growth trajectory, similar to Salesforce's evolution from CRM to cloud platform. These businesses have transitioned from government dependency to commercial dominance (commercial revenue has exceeded government revenue for four consecutive quarters), while growth in defense applications (such as anti-fentanyl initiatives and immigration enforcement support) also benefits from geopolitical demand. Conversely, short-term trends like pure AI hype may hinge on market sentiment, akin to the 2023 ChatGPT craze. However, the company has secured future cash flows through substantial TCV ($2.8 billion total contract value, +151% YoY).

Management strategy shows no significant missteps, warranting increased investment in tools like AI HiveMind to accelerate platform transformation (e.g., expanding from data analytics to edge AI). Indicators suggest the company is moving toward horizontal expansion, such as accelerating development through AIFDE and building an AWS-like ecosystem. However, caution is warranted regarding lagging international growth, which may necessitate intensified overseas deployment.

The current valuation implies an annualized growth expectation of over 50%, with a price-to-sales ratio exceeding 138 times—nearly the highest in the entire market. Compared to software peers like Snowflake (whose PSR has also fallen to 22x), Palantir demonstrates superior profitability, scoring 114 on the Rule of 40 metric—the primary driver behind its historically elevated valuation. Current growth momentum stems not from government contracts but from untapped commercial potential in the U.S. market. Post-earnings dips in after-hours trading may signal investor concerns over slowing expansion or intensifying competition.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Mortimer Arthur·2025-11-04看起来Palantir今天将因其在Q中的糟糕表现而受到惩罚——尽管首席执行官对此吹嘘不已。LikeReport

- Valerie Archibald·2025-11-04Look at the price action following Q1 results back in March. Sell the news dip won't last long.LikeReport

- skippix·2025-11-04Impressive numbers, but be cautious with that valuation.LikeReport