PDD Q3: Just Getting Started on Its Comeback Trail?

$PDD Holdings Inc(PDD)$ released its financial report for the third quarter of 2025 before the market opened on November 18. Overall, this quarter's earnings report signals a positive trend of performance beginning to "bounce back from the trough." Key financial metrics show revenue growth rebounding from its low point, with profitability demonstrating significant year-over-year improvement. Notably, after several quarters of profit declines, adjusted operating profit significantly exceeded expectations, showcasing the company's operational resilience amid complex macroeconomic conditions and competitive dynamics.

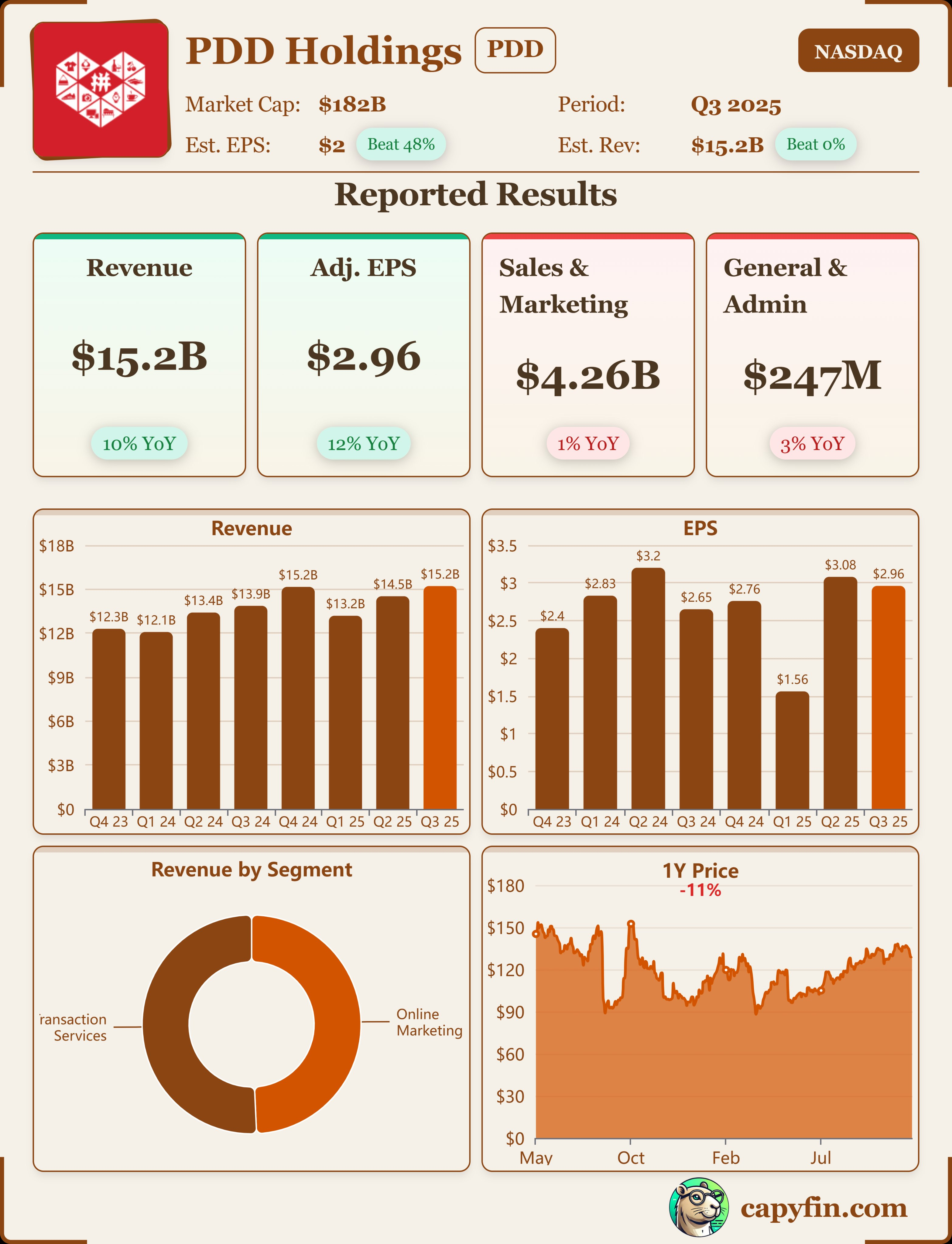

Breakdown of Key Performance Indicators

Revenue growth rebounded but showed structural deceleration, with core advertising revenue facing pressure.

Total revenue for the quarter reached RMB 108.27 billion, marking a 9% year-over-year increase. This growth rate rebounded from the previous quarter's 7% expansion and slightly outperformed market expectations of 8.3%. From a revenue composition perspective:

Online marketing services revenue (i.e., advertising revenue) reached $53.47 billion, marking a 7.0% year-over-year increase. This growth rate further decelerated to single digits, even falling below the overall revenue growth rate. This suggests either a steeper-than-expected slowdown in GMV growth for Pinduoduo's domestic main platform, or a renewed widening in the year-over-year decline of its take rate due to the company's ongoing "Merchant Support Program." This aligns with the trend of intensifying competition in China's e-commerce sector—such as increased subsidies by JD.com and Alibaba—attracting a portion of users away.

Transaction service revenue (including commissions, TEMU, etc.) reached $5.493 billion, up 9.0% year-over-year. Driven by TEMU's return to normal operations in the U.S. following the easing of tariff impacts and rapid expansion in other regions, transaction revenue growth rebounded, becoming the primary driver behind the overall revenue growth recovery. However, this growth rate remains below some optimistic projections, indicating that TEMU's expansion is not characterized by a "breakneck pace."

Profitability has significantly improved, with adjusted operating profit returning to normal levels. Operating profit reached RMB 25.025 billion, up 3.0% year-on-year. Adjusted operating profit was approximately RMB 27 billion, marking a substantial improvement compared to the over 20% decline seen in the previous two quarters. Operating Margin recovered to 23.1%. This indicates that the impact of the earlier "national subsidy" has begun to fade, and management has exercised greater prudence in controlling sales expenses. Benefiting from a low base effect, profitability has emerged from its trough and returned to a healthy range.

Gross margin remained stable, though marketing expenses were managed conservatively. The gross margin stood at approximately 56.7%, showing a slight sequential increase (Q2 was around 55.9%). Domestic commission reductions negatively impacted gross profit, but factors such as TEMU's increased semi-commission model partially offset this pressure, maintaining relatively stable gross margins. Sales and marketing expenses totaled RMB 30.322 billion, down 0.5% year-over-year. Considering TEMU resumed marketing spending after July, sales expenses increased by only about RMB 3 billion quarter-over-quarter—a very conservative growth rate. This reflects TEMU's strategic shift from aggressive expansion to prudent operations amid external uncertainties. While this may enhance operational efficiency, it could also suppress explosive GMV growth in the short term.

Strong investment income boosted net profit. Interest and investment income reached RMB 8.566 billion this quarter, demonstrating robust performance. Bolstered by investment gains, adjusted net profit for the quarter reached RMB 31.4 billion (based on key analytical points), marking a 14% year-on-year increase. The robust investment income reflects the company's substantial cash reserves and excellent capital management capabilities, serving as a key driver of the final net profit. However, given its non-recurring nature, investors should remain focused on core operating profits.

Earnings Guidance

Management's statements remained as conservative and vague as ever, offering nothing new. While no specific guidance figures were disclosed, terms like "ongoing slowdown" and "quarterly fluctuations" suggest continued caution is warranted for the next quarter. However, given that the current quarter has already bottomed out, this cautious stance leaves greater room for future performance to exceed expectations.

Let's see what further statements are made during the conference call.

Investment Highlights

Our view is that Pinduoduo's fundamental turning point has just begun. The company has weathered the worst and is now entering a phase of sustained marginal improvement in performance.

First, the low base effect and enhanced clarity in earnings forecasts. Q3 2025 marks the official start of the low base earnings cycle. The financial impact from domestic commission reductions and feedback ecosystem adjustments has persisted for a year, making it unlikely for conditions to deteriorate further. This development renders subsequent earnings projections more predictable and manageable.

Second, the recovery in profitability and TEMU's prudent operations. The adjusted operating profit margin has returned to a healthy level, and sales expenses remain conservatively allocated. This indicates that TEMU has shifted away from aggressive expansion, with its efficiency-first strategy helping to control losses and stabilize overall profit margins.

Moreover, domestic e-commerce platforms have solidified their market positioning. After enduring fierce "price wars," Pinduoduo has maintained its reputation for low prices. Following the exit of major competitors, Duoduo Maicai has also established its leading position.

Future profit potential is substantial. Drawing parallels to domestic e-commerce businesses that experienced profit surges after stabilizing sales expenses during customer acquisition phases while maintaining rapid revenue growth, we anticipate TEMU will enter this stage within the next 2-3 years (likely around 2026-2027). At that point, the company's overall profits are poised for explosive growth.

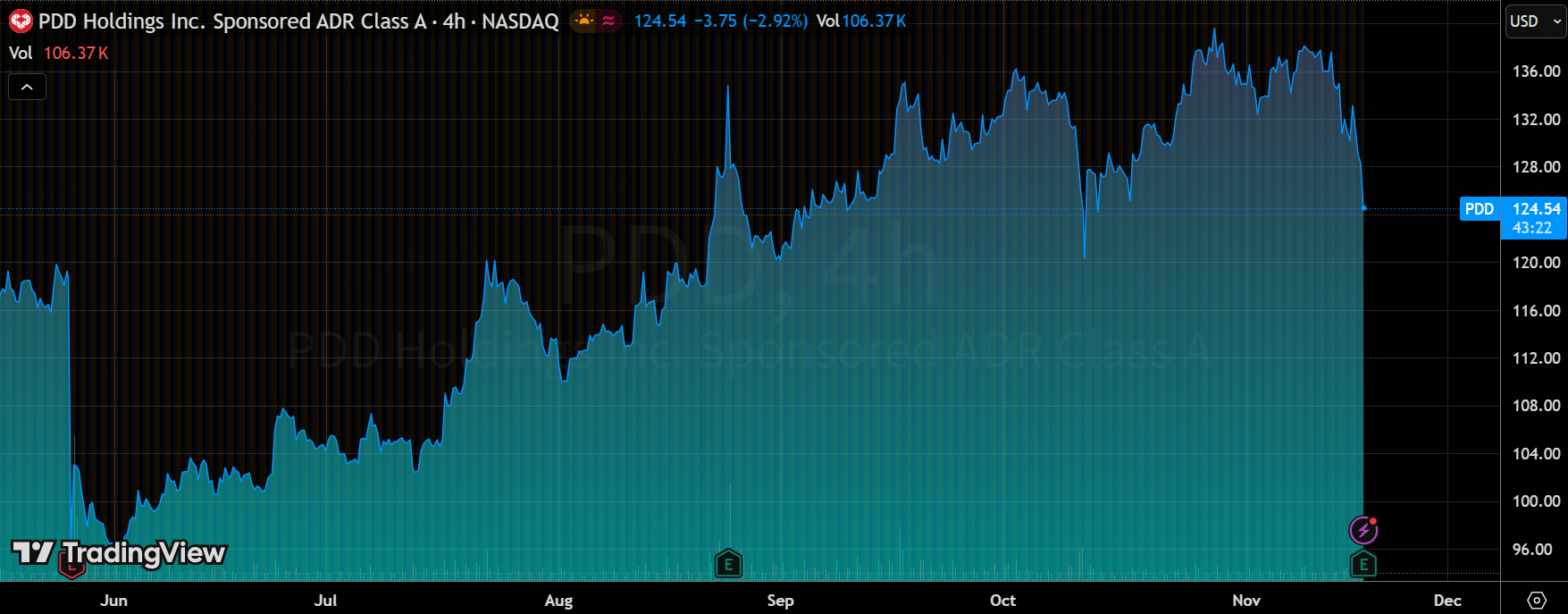

From a valuation perspective, considering Pinduoduo's current profitability and potential for future profit growth, its current price-to-earnings ratio of around 10 still appears relatively conservative. Market caution and lack of optimistic expectations actually provide value investors with a margin of safety. For the stock price to break out of its current trading range, it will require sustained earnings support over the next few quarters.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Merle Ted·11-19130 tomorrow.. way undervalued than baba.LikeReport

- Valerie Archibald·11-19too undervalued to pass. 140 next weekLikeReport