Risk-Off Sentiment Rises, Google Call Block Rolled

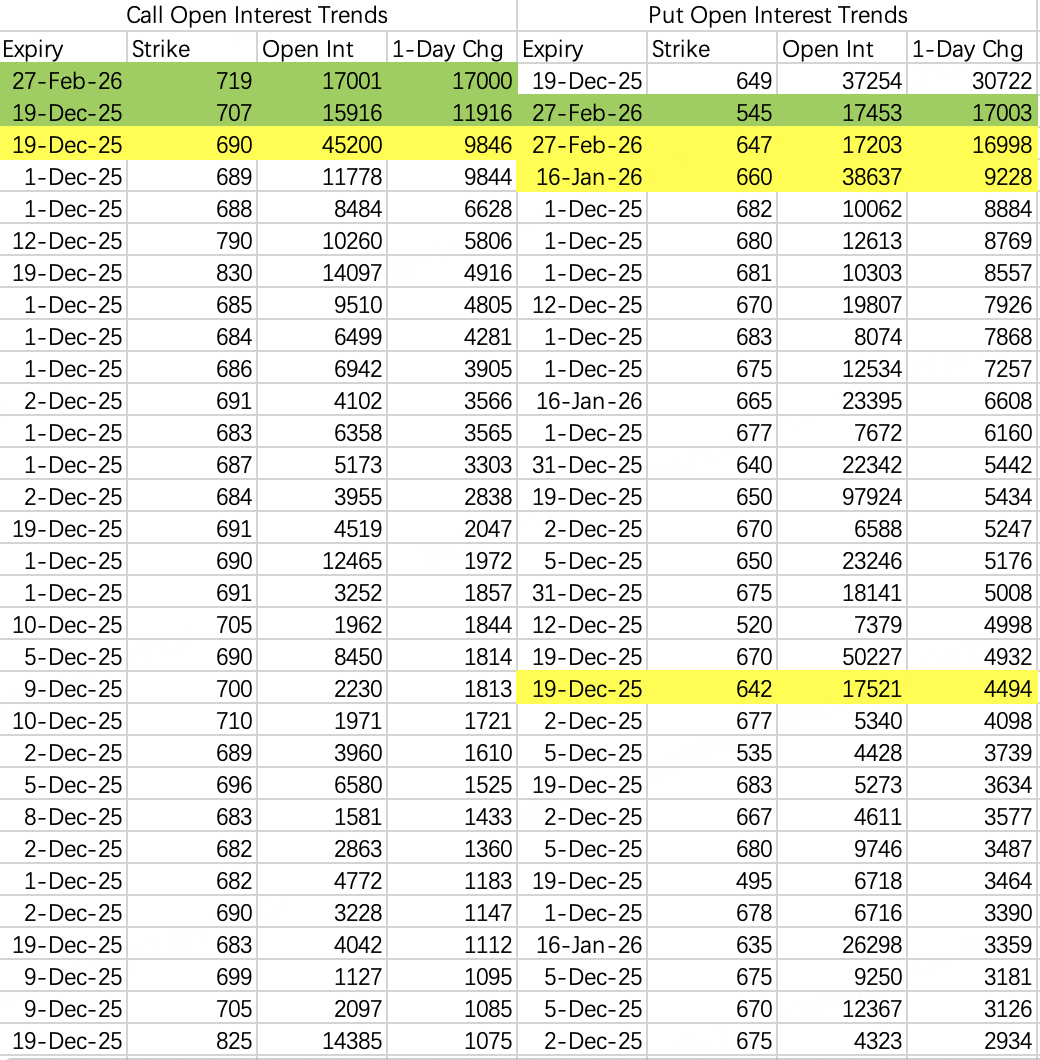

$SPY$

The whole of December gives off a "just getting by" vibe. It might not necessarily drop, but it certainly feels hard to rally.

Based on SPY opening flow, the market will likely continue to churn higher into this week's FOMC, oscillating between 675 and 690.

The top opening by volume was a complex bearish order: selling the Feb '27 719 call $SPY 20260227 719.0 CALL$ , buying the Feb '27 647 put $SPY 20260227 647.0 PUT$ , and selling the Feb '27 545 put $SPY 20260227 545.0 PUT$ .

On the surface, it bets on SPY potentially falling below 647 by late February. However, the net cost of this combo was only ~$1.7M, far cheaper than holding a naked 647 long put.

When you see this kind of penny-pinching structure, it often signals the market might not be primed for an easy crash. That said, it doesn't guarantee a smooth uptrend either—think back to the choppy action of recent weeks.

For next week's FOMC, the market does price in a potential dip below 660, but it feels more like hedging than conviction. Best to observe for now.

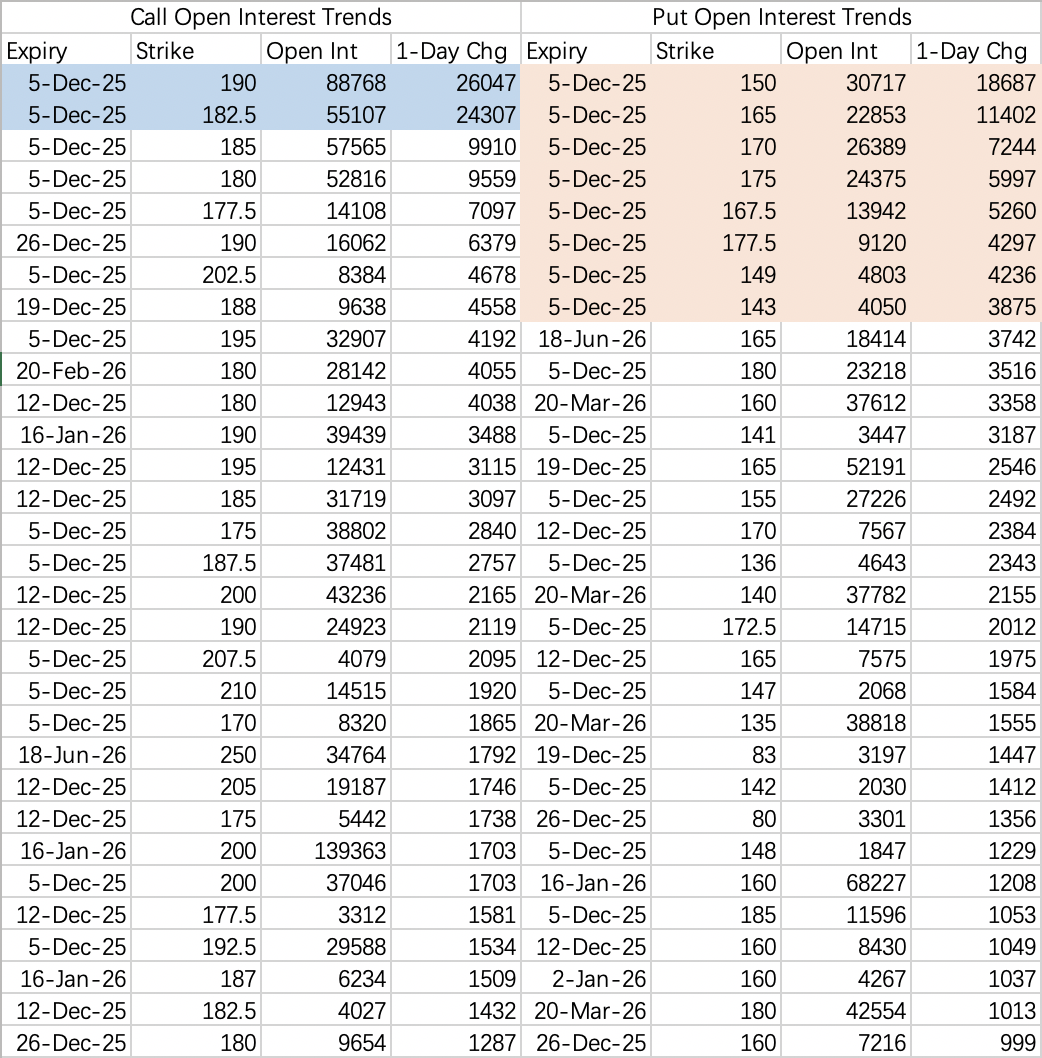

$NVDA$

The risk of NVDA testing its 200-day moving average has increased this week.

The weekly 160 put $NVDA 20251205 160.0 PUT$ saw heavy buy-to-close volume, meaning sellers likely fear assignment or, given the 21.8k contracts closed, dreaded margin calls on a further drop.

Bottom line: traders see downside risk.

Supporting this view is the sequential opening of puts across strikes (see pink zones), a pattern that often precedes downward moves, targeting the 200-day MA.

Bearish put buying makes sense—last Friday's "rally" was pathetic.

Institutions are running a call spread: selling the 182.5 call $NVDA 20251205 182.5 CALL$ and buying the 190 call $NVDA 20251205 190.0 CALL$ . This suggests resistance remains at 182.5—selling calls on any approach remains a viable short play.

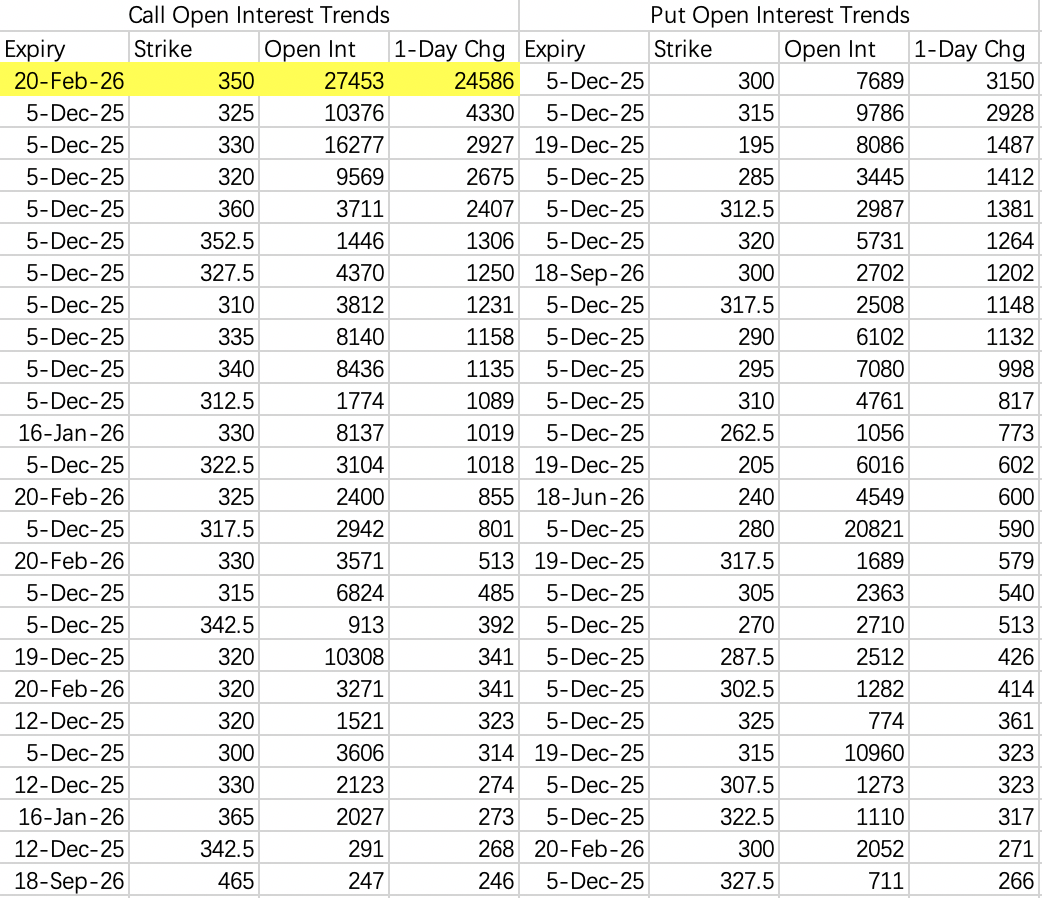

$GOOGL$

Last Friday saw a roll of the long call position: closing the Mar '26 340 call $GOOGL 20260320 340.0 CALL$ and opening the Feb '26 350 call $GOOGL 20260220 350.0 CALL$ .

Rolling to a nearer expiry at a higher strike is typical in the latter stages of a move—the nearer, higher strike is cheaper, effectively banking some profit.

It doesn't mean GOOGL can't go higher, but aggressive chasing isn't advisable here.

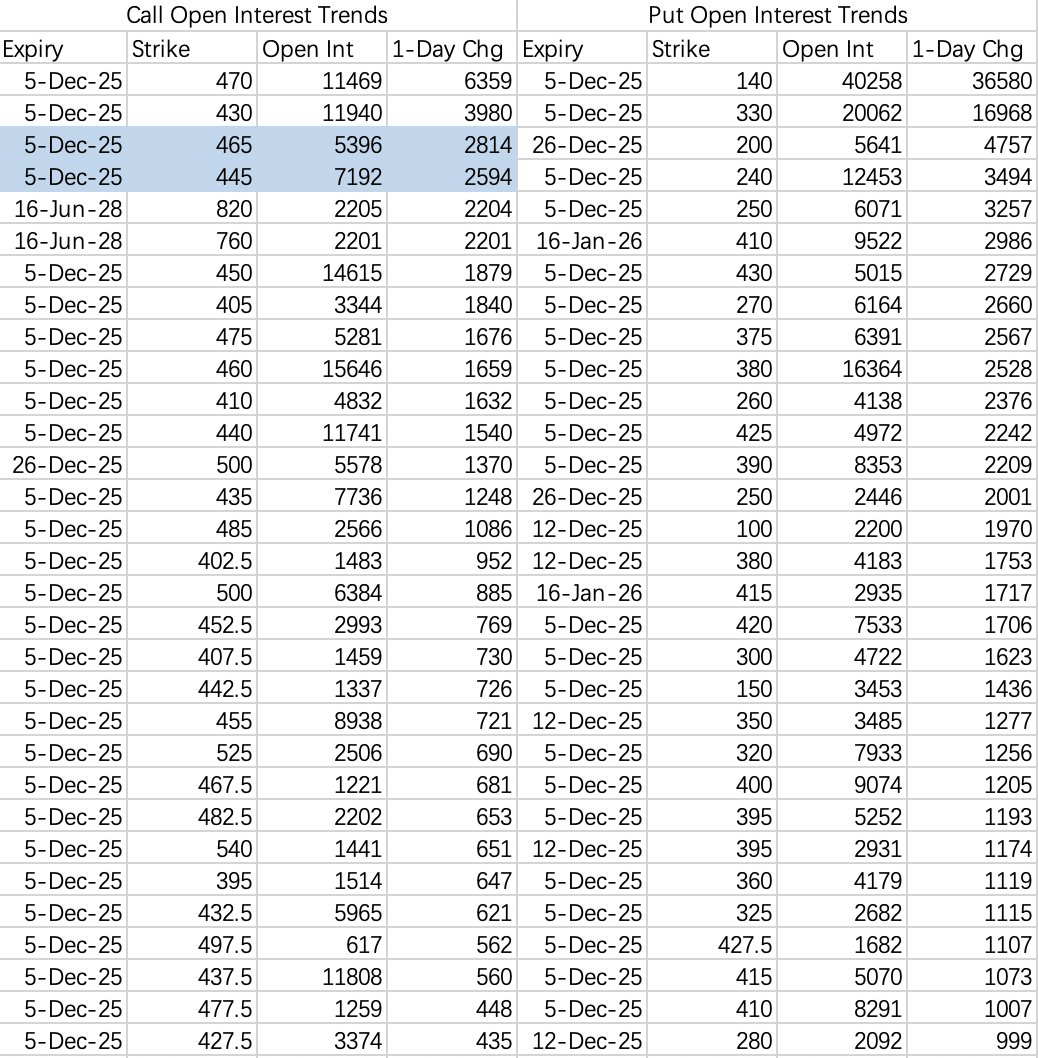

$TSLA$

Institutional call spread: selling the 445 call $TSLA 20251205 445.0 CALL$ and buying the 465 call $TSLA 20251205 465.0 CALL$ .

$INTC$

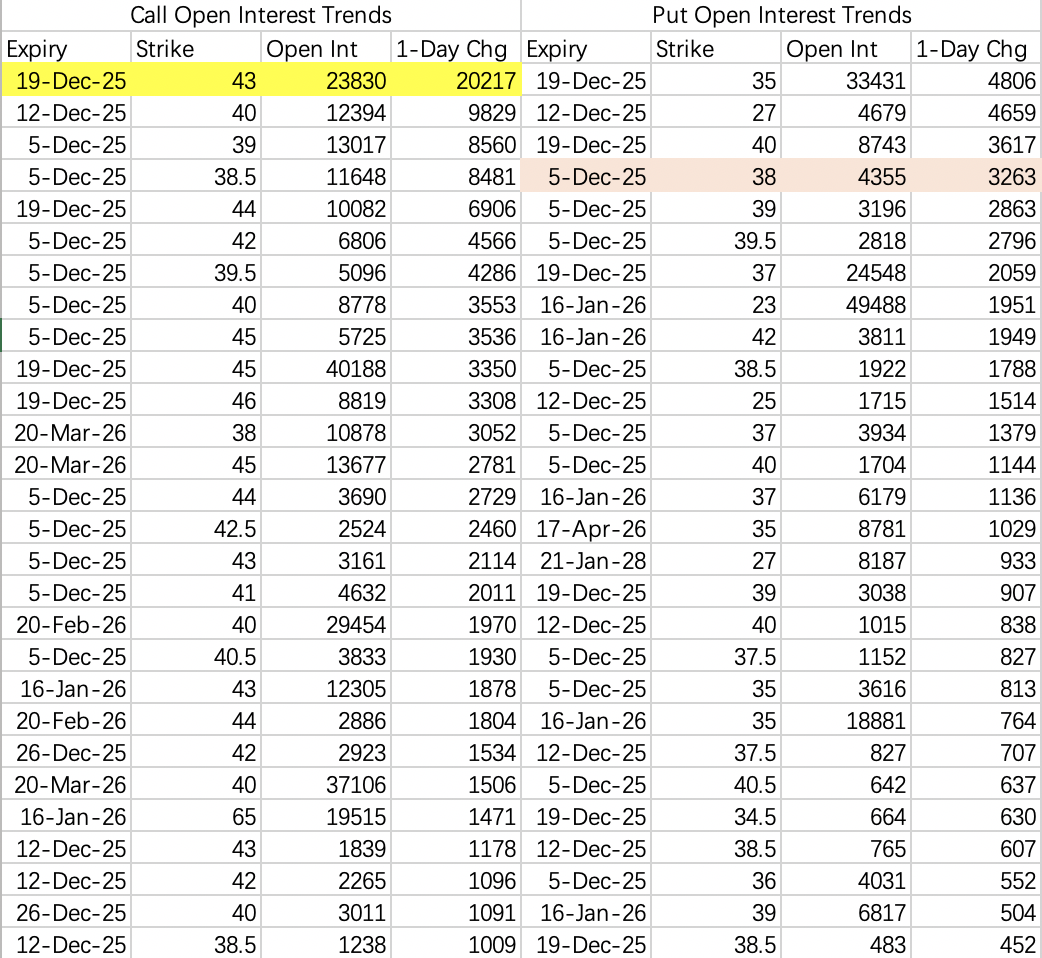

Friday's news about potentially supplying Apple with chips in 2027 sparked a 10% surge. Someone bought 20k contracts of the Dec 19th 43 call $INTC 20251219 43.0 CALL$ just before the close, betting on a continued spike. However, post-news bullish flows are less reliable.

This week's pullback target is 38-39. Selling the weekly 38 put $INTC 20251205 38.0 PUT$ could be considered.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great