Bullish on TSMC Earnings

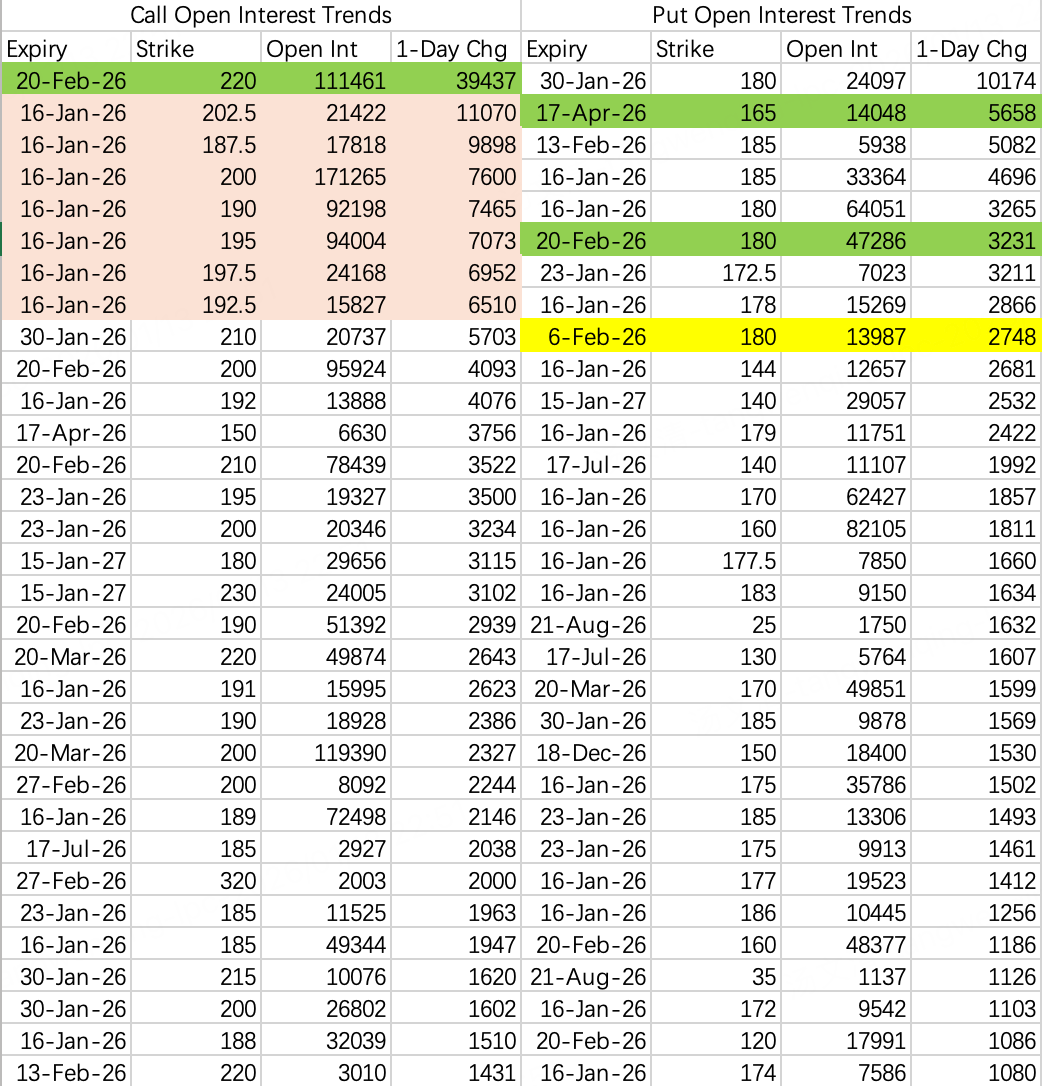

$NVDA$

A large block trade sold the 220 call $NVDA 20260220 220.0 CALL$ , opening 39,000 contracts. The expiry date chosen is one week before earnings. While selling deep out-of-the-money to capture time value, it shows extreme caution.

I've observed something different in bullish openings this year. Sequential, sizeable single-leg openings are occurring in expiring week options, seemingly betting with market makers on the possibility of an extreme short squeeze. However, I expect this week to mirror last week—all these positions will likely expire worthless, with the stock price closing between 170 and 180.

That said, I don't believe NVIDIA won't rise. The current US market resembles the A-share market, both experiencing rotational bull markets—what rises today may fall tomorrow, and vice versa. It's very possible NVIDIA's turn will come.

Regarding current operations, it's important not to hastily close positions just because a stock hasn't risen and chase rallies. Instead, focus on stocks that have bottomed and stabilized but haven't yet begun an upward trend.

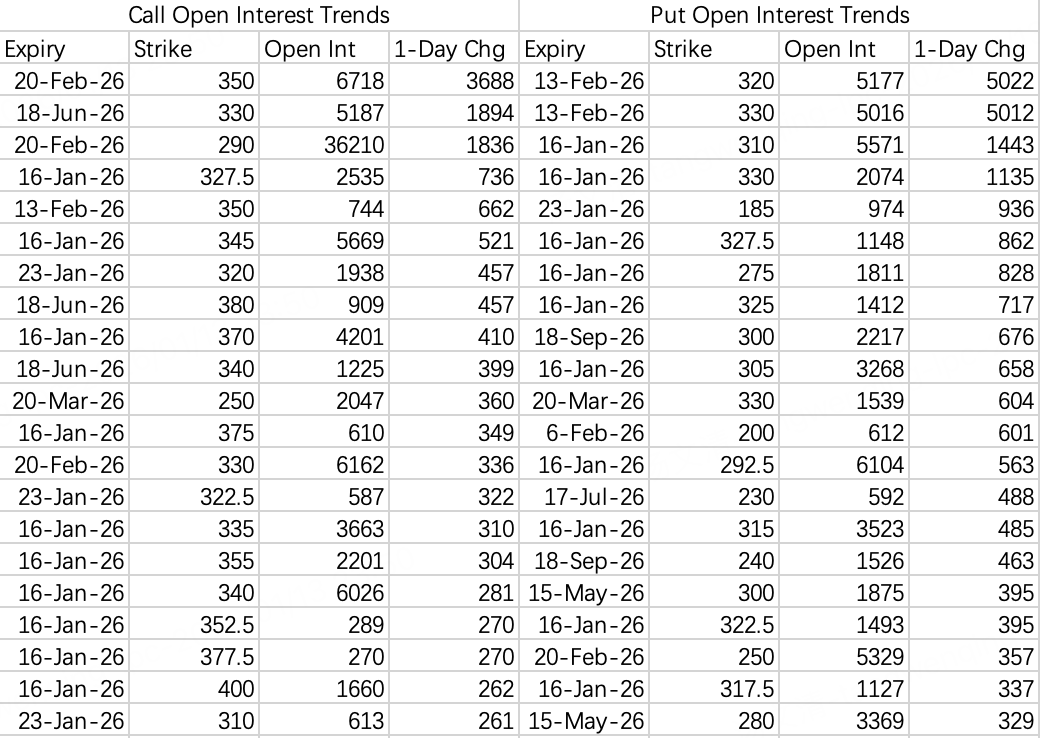

$TSM$

TSMC's option activity remains very strong. The recent price action has already priced in earnings expectations. A significant drop can be ruled out first. The stock price is expected to stabilize above 320. For selling puts, choosing a strike below 310 remains prudent for safety $TSM 20260116 310.0 PUT$ . The probability of winning is high—essentially free money.

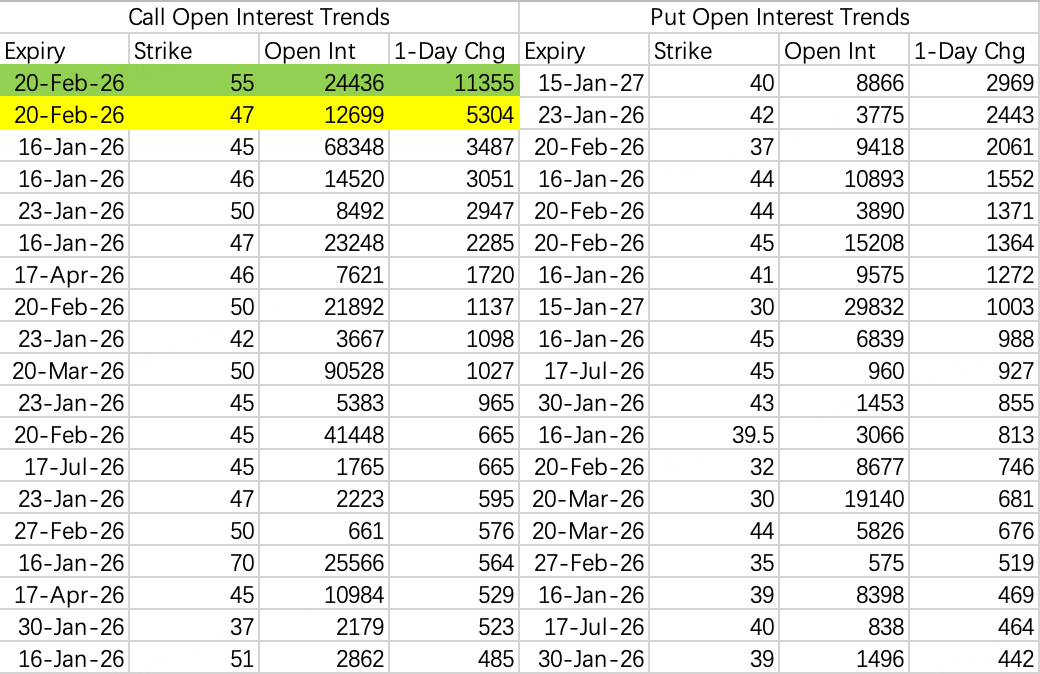

$INTC$

Another "free money" stock. Intel has broken above 45 and is expected to consolidate slightly at current levels. Selling puts remains the best choice.

There's a large ratio call spread order: buying the 47 call $INTC 20260220 47.0 CALL$ and selling twice the number of 55 calls $INTC 20260220 55.0 CALL$ .

Generally, after a ratio spread is opened, the probability of the stock price continuing a strong upward trend is not high, and 50 is another resistance level. However, it's not overly bearish, so selling puts to follow the trend remains the optimal strategy.

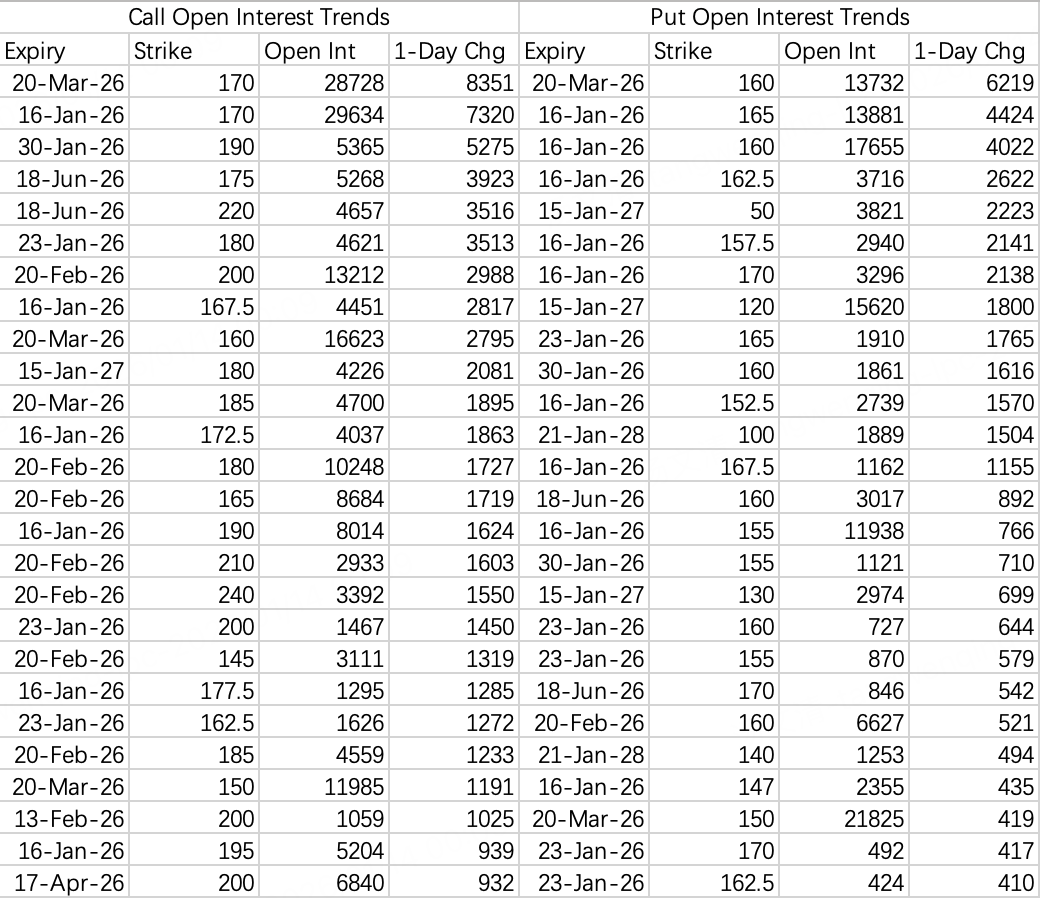

$BABA$

The initial target is still 170. After 170, the next target is 200. For a more conservative approach, consider selling the 160 put $BABA 20260123 160.0 PUT$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Juju710·01-14GoodLikeReport