Triple Witching? More Like Minor Triple Witch

$SPY$

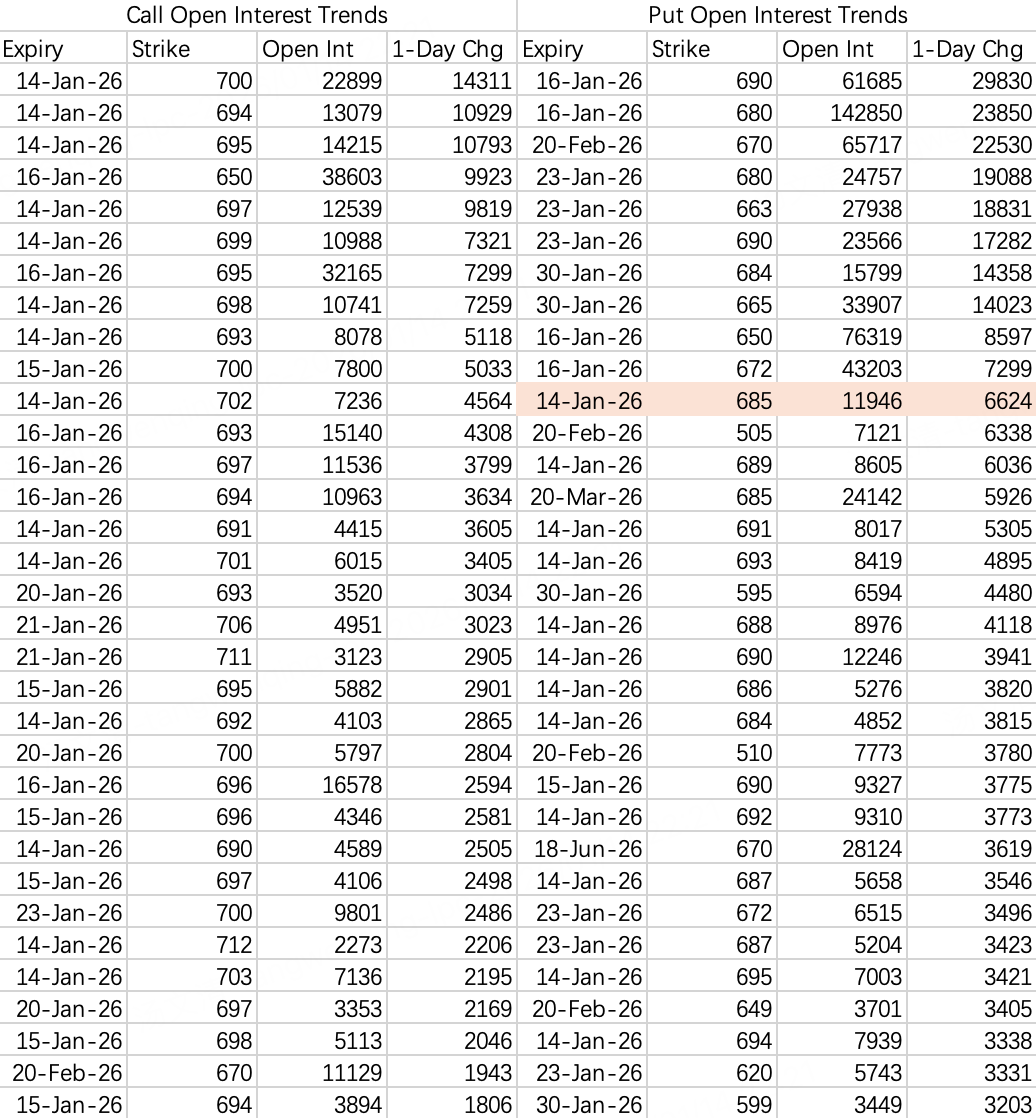

Pressure on the broad market remains significant ahead of the January 16th monthly options expiration, exerting a dampening effect across various sectors. Overall, the outlook remains bullish after this week. However, this week SPY is likely to pull back towards 680, probably closing within the 680-690 range.

Notably, during Tuesday's session, someone opened a large position buying 20,000 contracts of the January 23rd expiry VXX 30.5 call $VXX 20260123 30.5 CALL$ , with a notional value of approximately $700,000. The timing of the order was exceptionally precise.

$NVDA$

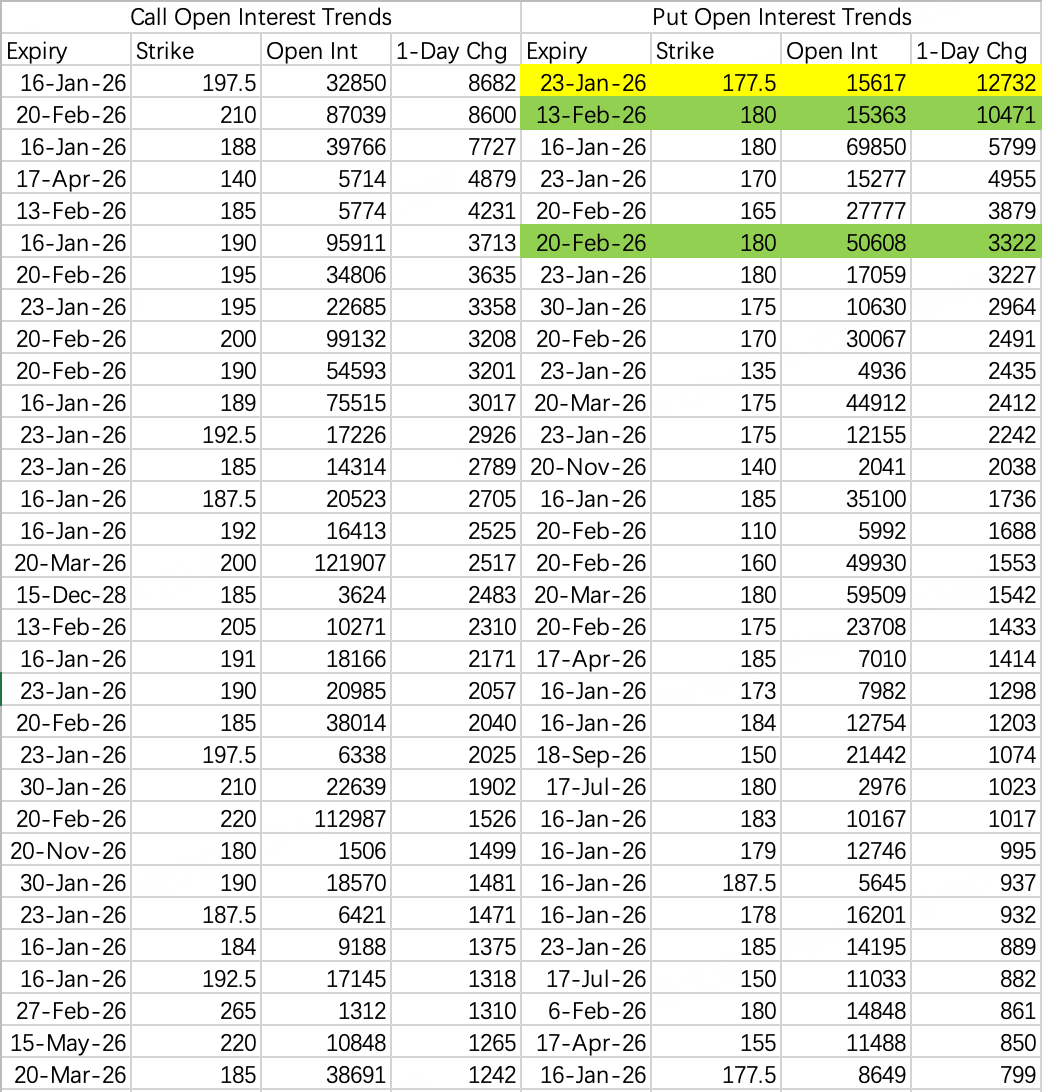

I'm now convinced that the volatility during the January monthly options expiration week is more unpredictable than during a regular triple witching week. After failing to break 190 during Tuesday's session, the price pulled back. A sizable bearish order was placed, buying the January 23rd expiry 177.5 put $NVDA 20260123 177.5 PUT$ . It's advisable to watch the timing of its closure.

Overall, based on put option activity, 180 remains a fiercely defended level.

$TSLA$

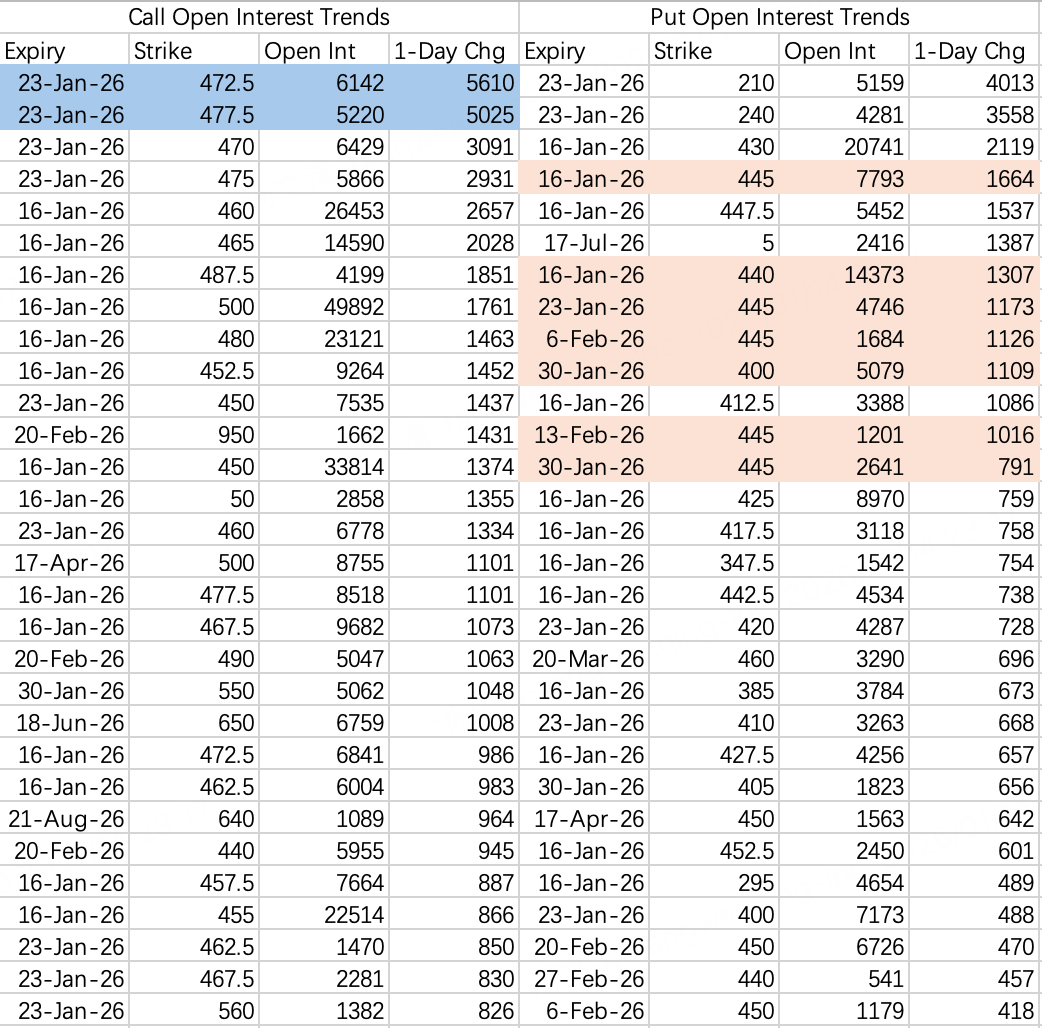

Currently, it appears Tesla will staunchly defend the 440-445 range over the next couple of months. Consider selling puts on dips: $TSLA 20260116 425.0 PUT$

$INTC$

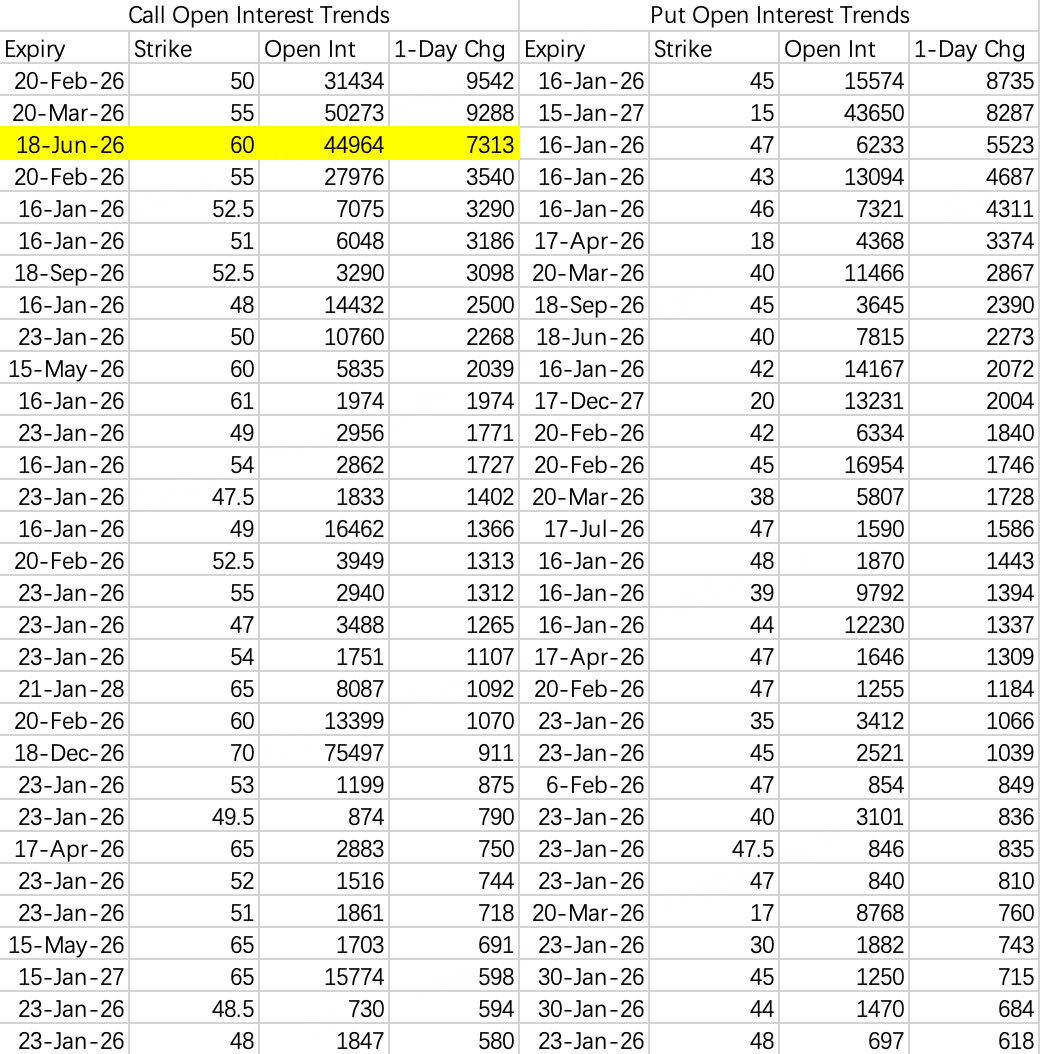

The large order for the $INTC 20260618 60.0 CALL$ saw an additional 7,313 contracts opened at Tuesday's open, with the majority of the trades being buys.

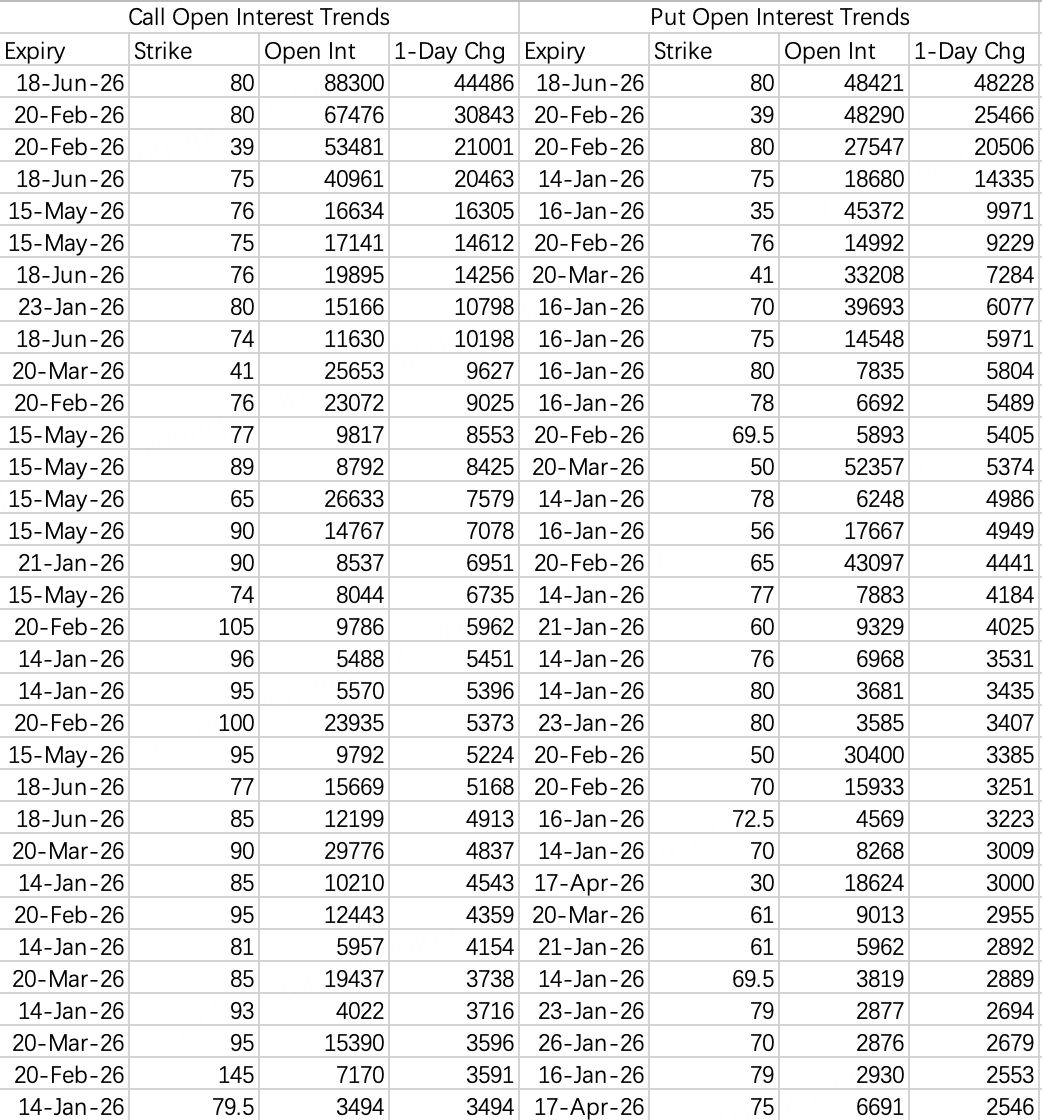

$SLV$

Difficult to assess. The stock price is far ahead of the option positioning. Currently, 80 appears to be the new anchoring point, with significant straddle positions opened at this level.

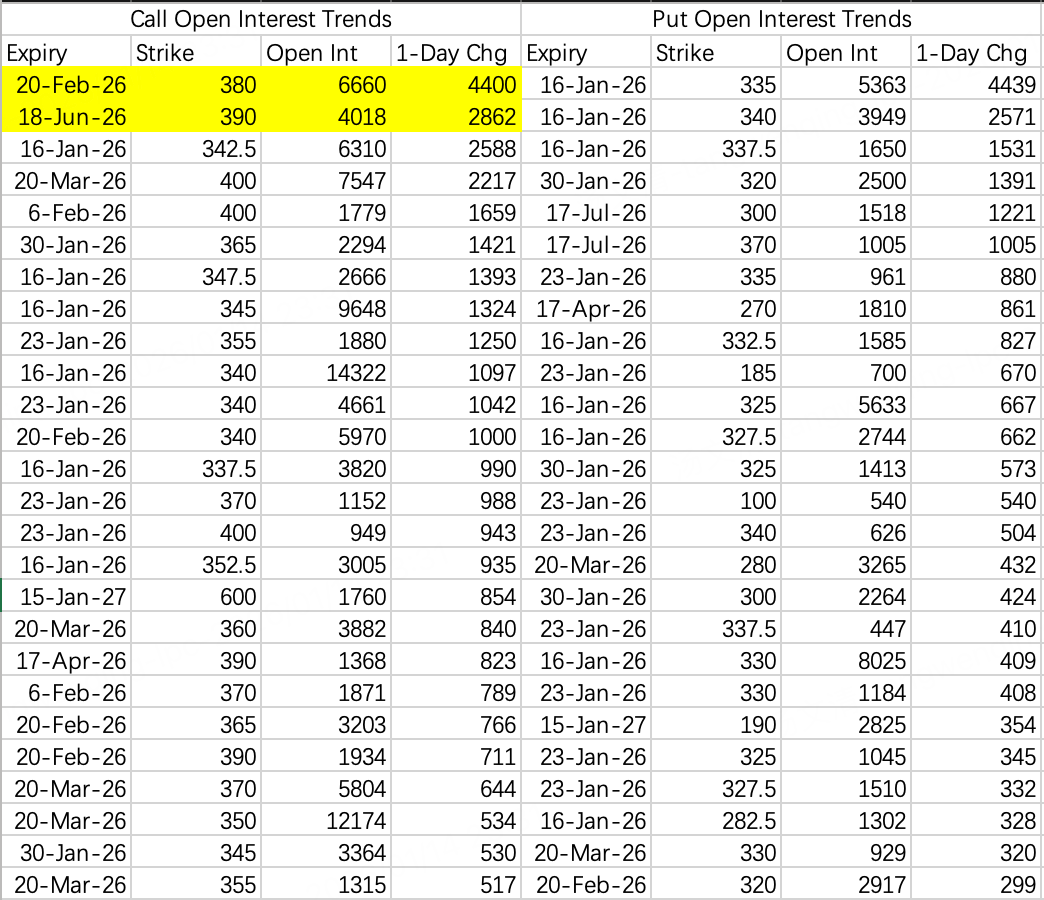

$GOOG$ $GOOGL$

One of the strongest performers in the current market, very suitable for selling puts. Consider a strike price below 320: $GOOGL 20260123 320.0 PUT$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

很棒的文章,你愿意分享吗?