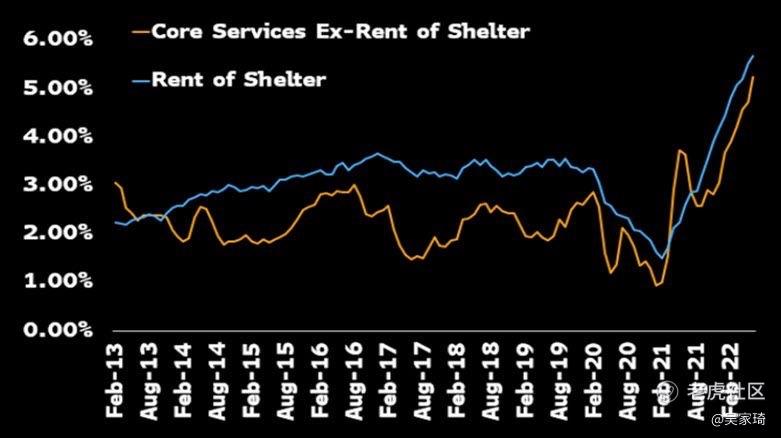

The price gains may be persistently higher than the market and economics community at large expect. If we're right, then this means the market is probably under pricing how high fedpolicy will develop, with a fed funds terminal rate needing to be higher than it priced - Anna Wong and the Bloomberg Economics team now forecast a 5% terminal rate.

If we do get to 5% then the two-year note is very mispriced. Even if the terminal rate doesn't get to the BE level, we are sympatric and think a 4.25% terminal rate more likely, which still suggests more bear flattening of the yieldcurve could be coming.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- bulldozer·2022-07-21let's see tonight!3Report

- MinkyHuat·2022-07-20Hopefully rises more3Report

- PandoraHaggai·2022-07-23Your post is very informative.LikeReport

- Zen0321·2022-08-20👍LikeReport

- gstrader·2022-07-22nice2Report

- leejk·2022-07-22Thanks1Report

- TradingWithJ·2022-07-22Ok1Report

- Lotus123·2022-07-22hmm2Report

- Gambang·2022-07-22ok1Report

- Keith Yeow·2022-07-22GreatLikeReport

- jnjn·2022-07-22aLikeReport

- Bluemountain·2022-07-20👍1Report

- kiskish·2022-07-20great2Report

- schatzy·2022-07-20[Thinking]LikeReport

- bossbaby·2022-07-20好的LikeReport

- tigee·2022-07-20kLikeReport

- 股市专家·2022-07-20NiceLikeReport

- GreenMan123·2022-07-20ok1Report

- RKT·2022-07-20OkLikeReport

- Alan1985·2022-07-20Jia youLikeReport