Why Coca-Cola earnings more iconic tthan Feds minutes?

$Coca-Cola(KO)$ released Q2 earnings before Tuesday open. As the best representative of consumer staples, it means a lot.

From Q2 earnings, Coca-Cola is convinced no longer an ordinary consumer product. For most consumers, it is a necessary like daily necessities, te Demand elasticity of necessities is quite low, that is, people are extremely insensitive to price changes. An 10% (probably a few cents) price raise will not change any demands.

Although Coca-Cola is bearing inflation like others (such as $Wal-Mart(WMT)$ ), it can easily raise its price with sales volume still strong.

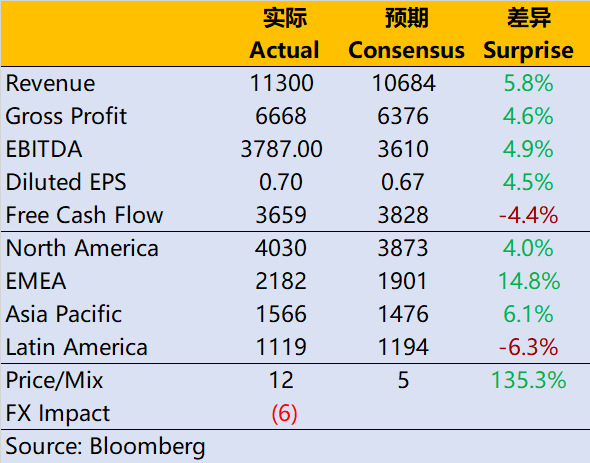

For Q2, price/mix metric jumped 12%, with an 11.9% jump in revenue pushed $730M above expectations, bolstered by an 8% jump in case volume.

At the same time, profit indicators are also higher than expected. Although the gross profit margin decreased from 61.4% in the same period last year to 59% due to more expensive raw materials (such as bottles), it was also slightly higher than the market expectation. The diluted EPS is 0.7 USD, which is higher than the market expectation consensus of 0.64 USD.

It is worth mentioning that Coca-Cola's withdrawl from the Russian market in March. Although there may be some finishing work to be done in Q2, it is obvious that the overall sales impact is not great.

Geographically,The income growth rate of Europe, Africa and the Middle East was 8.1%, ranking second among the four major regions, and beat market estimates. However, the company expects the impact on EPS to be about 0.03 US dollars.

The biggest impact on Coca-Cola should be the forex, which gives Q2 a -6% headwind. But more importantly, the company is still very optimistic about the performance in the second half of the year, so it raised the annual performance guidelines, and the growth rate of organic income was raised from 7-8% to 12-13%, and the growth rate of EPS was also raised to 5-6%.

In a word, Coca-Cola's users are too sticky, almost becoming a necessity, and its price elasticity is very low.

Of course, although inflation is high in the United States at present, the overall salary level is still not low, which is why consumer goods can still maintain strong purchasing power. If Coca-Cola's performance has declined, it may be that the recession has really started.

Are you sensitive to the price of Coke(Single choice)

Are you sensitive to the price of Coke(Single choice)Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

番木瓜

对于那些TLDR

以下是要点

1.可口可乐是经济衰退的证据

2.即使价格上涨,喝可乐的人也不太可能改变品牌,这被称为非弹性需求

3.具有极强的粉丝忠诚度--高黏性因子

好

Good news

[Smug] [Smug] [Glance] [Helpless] [Helpless]