Zero-Carbon Future? Nuclears Burning Cash But Worth Billions

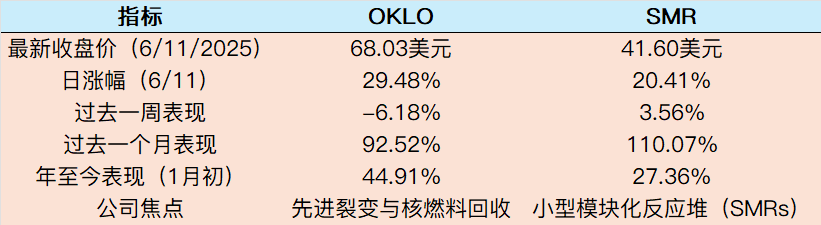

Nuclear sector stocks $Oklo Inc.(OKLO)$ and $NuScale Power(SMR)$ have been very strong in recent weeks, largely driven by recent industry trends.

OKLO (Oklo Inc.).

OKLO is a company focused on developing advanced fission power plant and nuclear fuel recycling technologies, and its stock has been a notable recent performer.On June 11, OKLO closed at $68.03, up 29.48% from the previous trading session's price of $52.58, showing a strong one-day performance.However, the performance for the past week (ending June 11) was -6.18%, which may reflect short-term market volatility.OKLO is up 92.52% over the past month and 44.91% year-to-date (as of early January), indicating a strong long-term trend.Although the company is currently unprofitable and unsold, the potential of its technology (e.g., with the U.S. Department of Defense) has attracted market attention, especially in the context of AI infrastructure needs.

The company, which said it expects the first Aurora commercial small modular reactor to be commissioned in late 2027 or early 2028, has "completed drilling operations for site characterization work" at a site in Idaho, where it is exploring the construction of its first fast-fission nuclear power plant.

That goal will depend on the outcome of Oklo's licensing application with the Nuclear Regulatory Commission, which is scheduled to be filed in the fourth quarter of this year, Jacob DeWitte said on an earnings call, and which covers a reactor design newly expanded to 75 megawatts, which company executives have said better reflects the power needs of potential customers.

SMR (NuScale Power Corporation)

SMR (NuScale Power Corporation) focuses on the development of small modular reactors (SMRs) and has been performing equally well recently.As of June 11, 2025, SMR closed at $41.60, up from $34.57 in the previous trading session, the exact amount of the gain was not directly provided, but the daily range from $35.14 to $41.88 shows a positive trend.It has performed +3.56% over the past week, 110.07% over the past month, and 27.36% year-to-date (as of early January).The company recently received standards approval from the Nuclear Regulatory Commission (NRC) for its VOYGR power plant design and is in discussions with tech giants (e.g., $Amazon.com(AMZN)$ $Microsoft(MSFT)$ ) for a power deal, which has further pushed the stock higher.

Industry Trend Analysis

The nuclear energy industry has shown signs of recovery recently, with key drivers including the following:

AI Data Center Demand: As AI technology grows, the demand for clean, reliable energy in data centers is surging.Tech giants such as Amazon, Microsoft, and Google have shown strong interest in SMRs, and nuclear energy is seen as the "energy backbone" of AI infrastructure, driving market enthusiasm.

Government policy support: In May 2025, President Trump signed an executive order to accelerate the construction of nuclear power plants, aiming to enhance energy security and clean energy supply.This policy is seen as a boon for the industry, providing $50 billion in AI infrastructure support for nuclear energy stocks such as OKLO.

Clean Energy Goal: Nuclear energy is seen as key to achieving the global clean energy goal, with projections that U.S. nuclear energy capacity could triple by 2050.This provides a solid foundation for long-term industry growth.

Stock Positioning and Market Reaction

OKLO: The company's technology focuses on next-generation fission technology and nuclear waste recycling, and the market has been optimistic about its potential in the recent past despite the fact that its application for the Aurora reactor had been rejected by the NRC.OKLO has risen 164% over the past month, largely due to the interest in small nuclear reactors from Amazon, Microsoft, and Google.Recent share price volatility (e.g., 29.48% rise on June 11) may reflect the market's short-term optimism about the company's future prospects.

SMR: NuScale Power's SMR technology is seen as a more cost-effective and flexible nuclear energy solution, and the recent NRC approval of its VOYGR design has further bolstered market confidence.SMR is shown to be up 27.36% year-to-date, reflecting investor expectations of its partnership with the tech giant.

Risks

Despite the positive outlook for the industry, investment risk is currently high, with none of the companies in this category yet generating revenues (0 revenue), in addition to facing policy uncertainties such as delays in regulatory approvals, long project construction cycles and market volatility. the unprofitable status quo at OKLO and execution risks at SMR (e.g., progress in partnering with tech giants) could impact short-term performance.

In the long term, the recovering trend in the nuclear energy sector offers growth potential for both.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Merle Ted·2025-06-12Anyone with experience in nuclear industry know that it is highly doubtful Nuscale is ever profitable. Doesn’t mean its stock won’t go much higher.LikeReport

- Mortimer Arthur·2025-06-12OKLO有什么对你来说足够突出,以至于-140 PE不会让你紧张地拿着它?LikeReport

- Merlin Spear·2025-06-13Why isn't constellation on this list tooLikeReport

- MichaelPerez·2025-06-12Incredible insights! Love your analysis! [Heart]LikeReport

- Merle Ted·2025-06-12OKLO!LikeReport