Big-Tech Weekly | AMZN at Low PE, AI Catalysts Ahead? Intel's Rebound Just Begin!

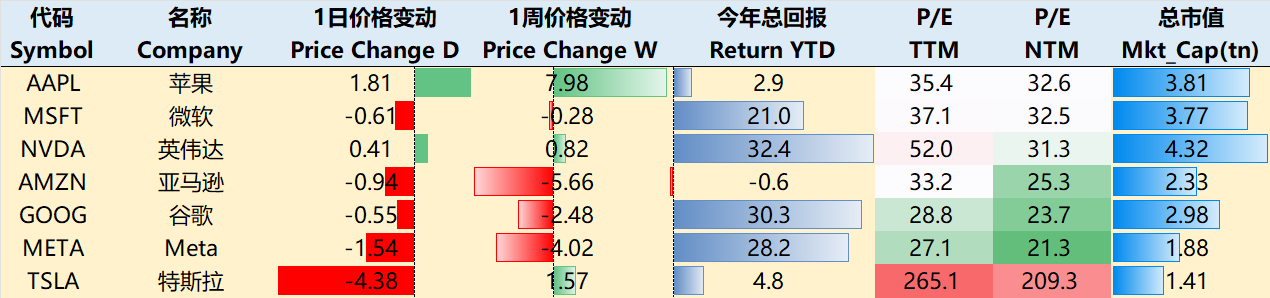

Big-Tech’s Performance

Macro Headlines This Week:

The market is reassessing rate cut expectations. Due to slightly stronger economic data (particularly employment-related indicators), the market has been forced to adjust its expectations for further rate cuts. Some participants are questioning whether the labor market is more resilient than anticipated, leading to a resurgence in the U.S. dollar's strength. The three major indices all hit weekly lows as investors worry that the Federal Reserve might slow the pace of rate cuts. Meanwhile, technical corrections and profit-taking emerged in the market, with U.S. Treasury yields (long-end) rising, putting pressure on high-valuation tech and growth stocks.

Political pressures on central bank independence, potential U.S. government shutdown, and commodity fluctuations remain underlying concerns. Former President Trump's attempt to remove Lisa Cook was halted at the judicial level (preliminary injunction), followed by the release of a joint letter signed by figures including Bernanke and Greenspan. While it appears temporarily contained, the influence of politics on monetary policy remains a key market focus. An accident at Indonesia's Grasberg copper mine caused a supply shock, driving copper prices higher, which often signals market expectations of growth recovery or easing liquidity. Additionally, the U.S. federal fiscal year ends on September 30. If Congress fails to agree on a new appropriations bill or a continuing resolution (CR), it could lead to a partial government shutdown. Key economic data (employment, CPI, PCE, retail sales, etc.) might be delayed due to the shutdown, leaving the Fed and markets "flying blind," making monetary policy adjustments more challenging.

The market is experiencing an "AI hangover," referring to the fatigue following the tech stock rally. The AI hype continued to drive the market this week, but divergence intensified. Investments related to NVDA, INTC, and OpenAI became one of the most significant stimulants for the tech sector, symbolizing capital's confidence in long-term AI infrastructure deployment. However, speculative AI and ancillary tech companies showed clear signs of pullback.

Big Tech also displayed divergence this week, with AAPL performing strongly and turning positive year-to-date, while AMZN dipped underwater.

As of the close on September 25, over the past week: $Apple(AAPL)$ +7.98%, $Microsoft(MSFT)$ -0.28%, $NVIDIA(NVDA)$ +0.82%, $Amazon.com(AMZN)$ -5.66%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -2.48%, $Meta Platforms, Inc.(META)$ -4.02%, $Tesla Motors(TSLA)$ +1.57%.

Big-Tech’s Key Strategy

Does AWS Really Have a Chance to Reverse Its "Current Undervaluation" in the AI Wave?

From a cloud market perspective, if the market continues to premium AI benefits toward Azure, then AWS could become the next "undervalued rebound" target. In the medium to long term, if AWS can firmly capture the growth in demand for large model training and inference computing power, it has potential for an undervaluation reversal.

AWS Current Status: Strong Base, Slowing Growth + High CapEx Pressure

AWS Q2 revenue was $30.9 billion, up 17.5%. If annualized at this pace, cloud business annualized revenue would be around $123 billion, representing a 19% year-over-year increase from 2024's $107.6 billion.

Accompanying the ongoing large-scale CapEx spending is pressure on profit margins, with Q2 AWS operating margin dropping to about 32.9% (influenced by depreciation, data center investments, and stock-based compensation). Power, chips, server components, and other resources remain its current "bottleneck" constraints.

Where Are the Opportunities?

From an industry trend perspective, demand for training and inference computing power is rapidly expanding, with clients like OpenAI and Anthropic becoming "heavyweight buyers." However, based on publicly available information, through Q2 2025, OpenAI's cloud spending is "entirely" on Azure (per SemiAnalysis), which is a core argument for why Azure receives a premium due to its tie-in with OpenAI.

One of AWS's counterattack paths lies in its bet on Anthropic, with agreements to use its proprietary AI chips (Trainium/Inferentia) as the preferred infrastructure for training and inference platforms. If Anthropic becomes the next large-scale AI client, its computing power procurement from AWS could boost AWS's revenue share in the AI space. Additionally, AWS is advancing products like Bedrock, AgentCore, and Kiro in its AI toolchain, integrating with the broader AI application ecosystem. In the future, during the AI inference phase, it could get closer to user business environments, capturing the "user-proximate inference" dividend.

Q3 Outlook: Current market consensus for AWS revenue is around $32-33 billion, with year-over-year growth of 16-20%. AI deals (such as expanded partnerships with Anthropic and custom silicon deployments) are accelerating but not yet fully monetized. This is evident from Q2 AWS backlog growth of 25% to $195 billion, indicating strong future demand, especially for generative AI services like Bedrock. Market expectations align with company guidance, anticipating AWS acceleration to over 20% growth by year-end, but investors have not fully priced this in yet. If AWS margins rebound to 35%, it would significantly boost EPS.

Additionally, e-commerce as Amazon's foundational business showed resilience in Q2, with North American sales up 12% and operating margins at 8.1%, benefiting from streamlined logistics and Prime enhancements, surpassing pre-pandemic levels. International operations turned profitable, driven by growth in emerging markets like India and Brazil. Q3 expectations are for overall retail to contribute to total revenue growth of 11.7% to $177.4 billion.

Risk Points:

Exclusive Contracts for Large Client Purchases: Clients like OpenAI may enter exclusive or quasi-exclusive agreements with cloud providers (especially for training), potentially marginalizing AWS even if it competes on infrastructure and performance.

Discounts Eroding Gross Margins: To win large clients, cloud providers may offer significant discounts or revenue shares, which could compress per-unit profit margins. In other words, revenue growth may not necessarily translate to profit growth.

Uncertainty in Project Implementation and Capacity Release.

Competitors' First-Mover Advantages and Partner Lock-Ins: Azure currently has a deep tie-in with OpenAI; Google also has competitive edges in TPUs and inference. If AWS fails to capture key clients or falls into a "second-mover" position, its AI elasticity opportunities will be compressed.

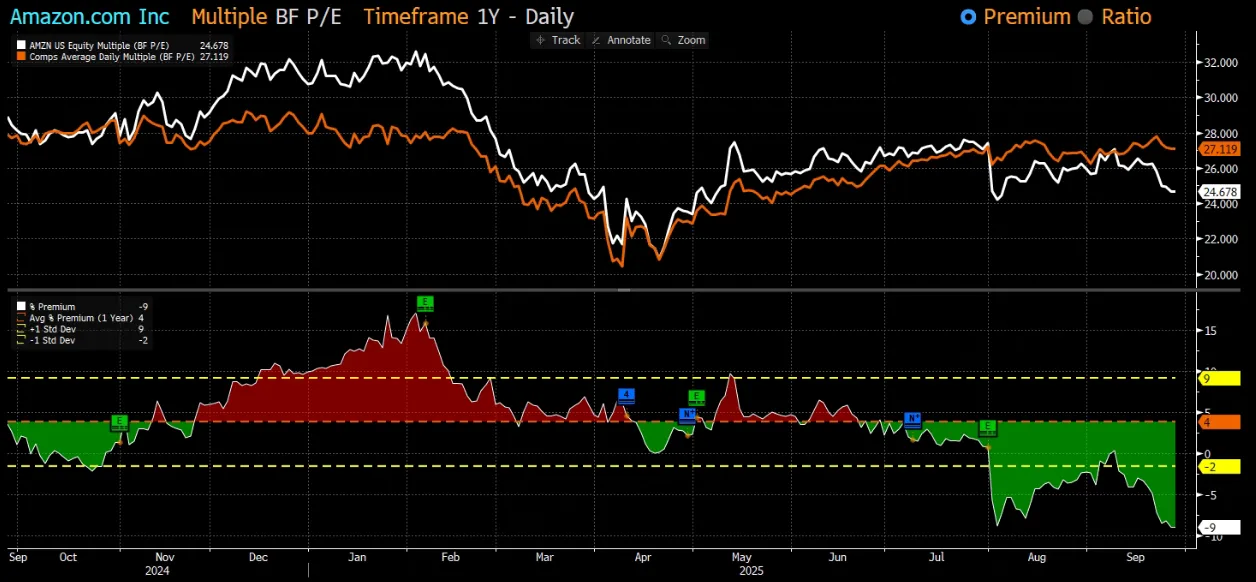

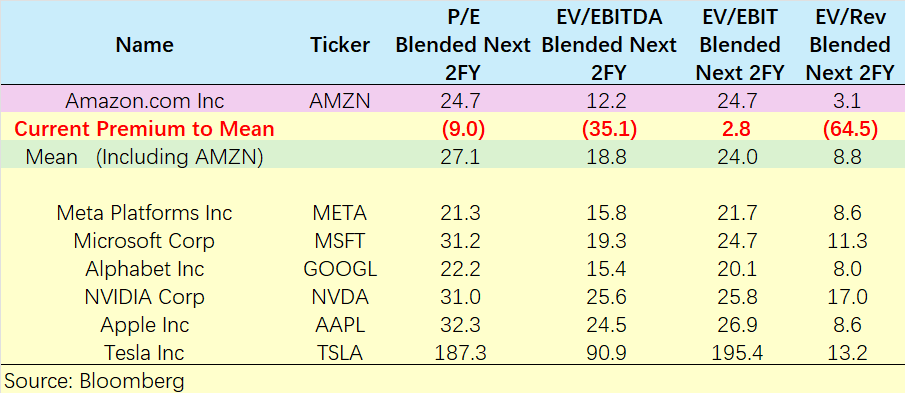

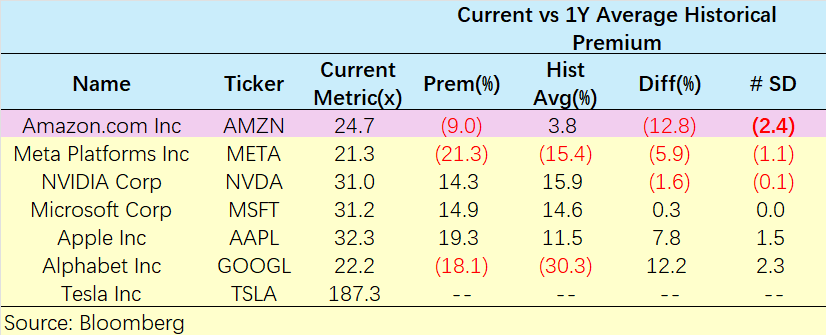

From a valuation perspective, AMZN's current TTM P/E is 33.2x, which is quite low historically. It is also the only one among the Mag7 where the P/E (based on average EPS over the next two years) is below the one-year average minus one standard deviation.

The main factor influencing future EPS changes is still CapEx depreciation and amortization, which will affect all Mag7 companies.

Big Tech Options Strategies

This Week's Focus: Is Intel's Turnaround Officially Underway?

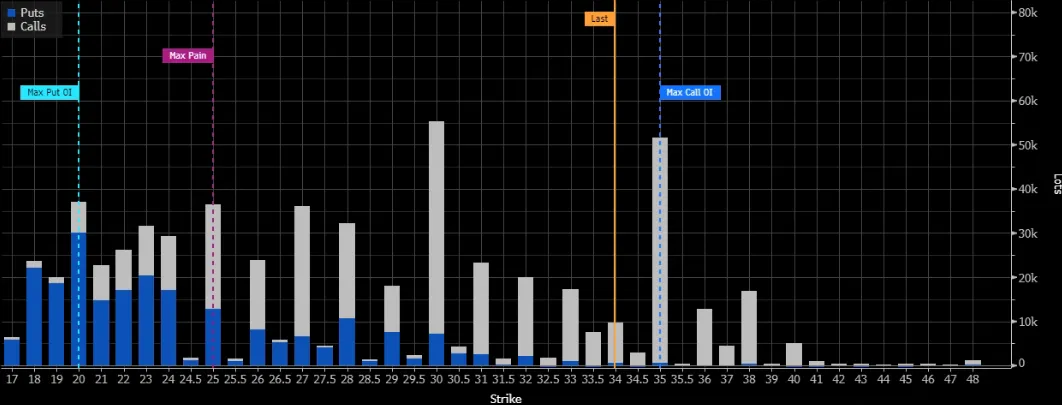

$Intel(INTC)$ stock performed strongly this week, entirely driven by positive news. Intel approached Apple for collaboration, similar to last week's $5 billion investment from Nvidia, pushing the stock up 6% on Wednesday and surging 8.87% on Thursday. The Nvidia partnership's lingering effects affirm Intel's foundry capabilities, especially amid surging AI demand. Government support through the CHIPS Act in the form of equity investments, combined with strong bullish signals in the options market—such as heavy buying of November $35 calls and implied volatility rising to 60.44%—further bolstered sentiment. Additionally, Intel's collaboration with Trust Stamp on an AI briefing and Micron's demand recovery provided indirect benefits.

The latest Trump chip tariff plan amplifies the impact, requiring chip companies to produce in the U.S. an equivalent amount to imports (1:1 ratio) or face tariff penalties. As a domestic manufacturer, Intel's foundry advantages stand out, potentially boosting capacity utilization, reducing tariff risks, and strengthening its position as the "American chip champion."

From an options perspective, beyond some "keen-sensed" large orders that positioned early on $35 calls, INTC's price is currently above the midpoint of its price range, and this holds for options orders from the last week of September through November. While expirations this week could result in over 340,000 shares becoming in-the-money—several times the previous amount—after recent volume increases, it only accounts for 0.18% of daily trading volume, with minimal impact. Therefore, more large orders are still expected to flow in.

Big Tech Portfolio

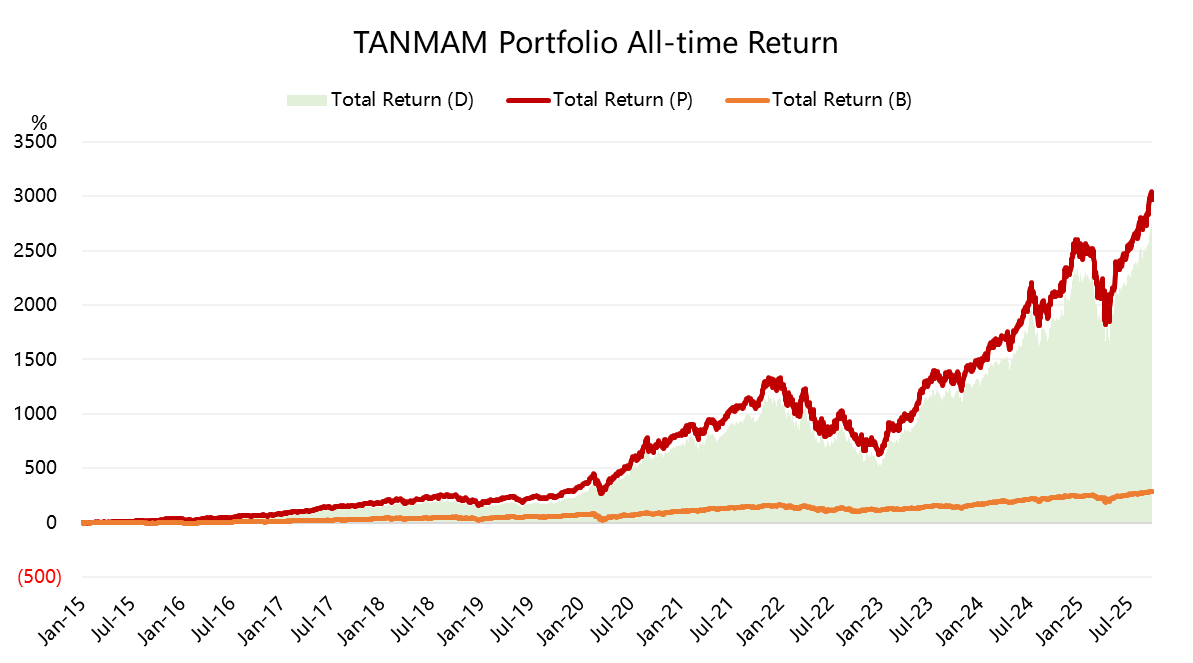

The Magnificent Seven form an investment portfolio ("TANMAMG" portfolio), equally weighted and rebalanced quarterly. Backtest results since 2015 show it far outperforming the $S&P 500(.SPX)$ , with total returns of 2971.89% compared to $SPDR S&P 500 ETF Trust(SPY)$ 284.95%, delivering an excess return of 2686.93%, and still at high levels.

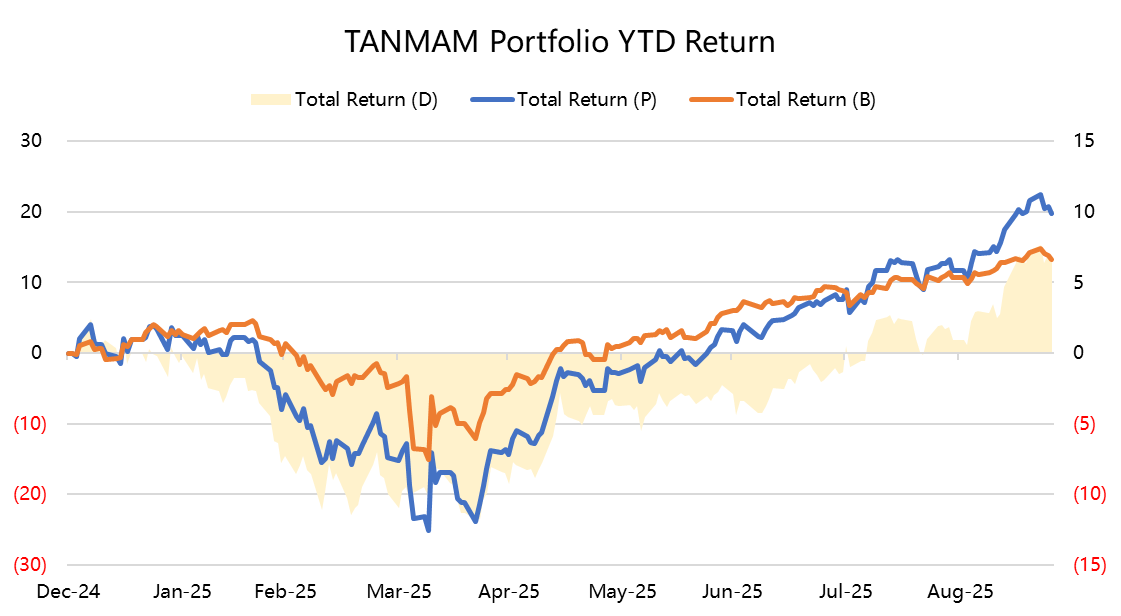

Year-to-date, Big Tech returns have hit new highs at 19.73%, surpassing SPY's 13.26%.

$Invesco QQQ(QQQ)$ $NASDAQ(.IXIC)$ $ProShares UltraPro QQQ(TQQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$ $Cboe Volatility Index(VIX)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Mortimer Arthur·2025-09-29Get ready for another Great week! More good news coming s o o n !!!LikeReport

- Yaomao·2025-09-26Great insights on the tech trends! [Heart]1Report

- Valerie Archibald·2025-09-29bunch of good news. intc could fly!LikeReport

- Brando741319·2025-09-27Good1Report